New E-mini Russell 2000 Contract Options on CME

On 10 July 2017, the world’s largest derivatives marketplace, the CME Group, launched futures and options on the Russell 2000® Index. This Russell index offers access to US domestic companies with market capitalization of between 50M-10B.

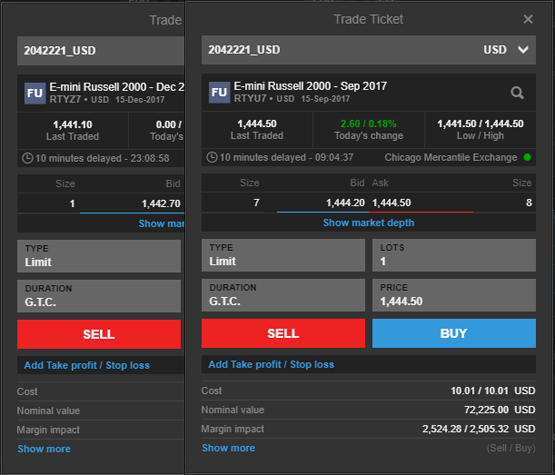

The respective futures and options have traded on the ICE exchange since 2007 but are now returning to CME. The futures will be listed with quarterly contracts, and the September (RTYU7) and December (RTYZ7) ones are already available on GTS.

Introducing RANsquawk news feed

You can look forward to even more real-time FX news on the trading platforms, thanks to our latest agreement with FX news provider RANsquawk offering a filtered scrolling headline feed that comprises market relevant news, flow and commentary.

RANsquawk offers comprehensive text headlines for macro events in FX space. This service covers all G20 economic releases, central bank speakers and FX news for major currency pairs and crosses: EURUSD, USDJPY, USDCHF and GBPUSD.

Other currencies covered include AUD, NZD, CNY, NOK, SEK, INR, KRW, TRY, RUB, BRL and any currency in focus and affecting the wider market.

RANsquawk covers sovereign order flow, option barriers and expiries. Key levels in focus by FX desks are also included in the coverage of important European bond auctions and yield movement.