Table of Contents

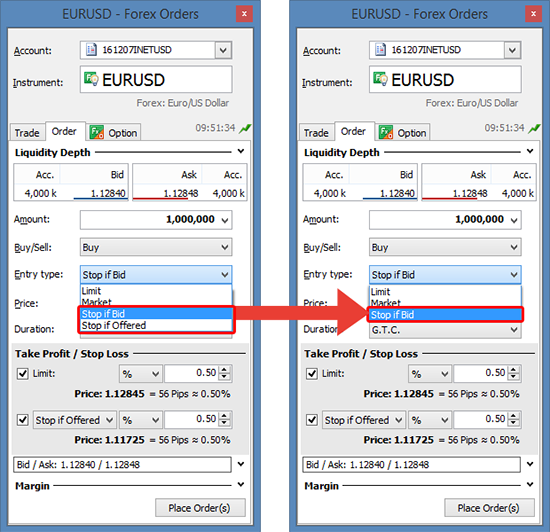

Simplified FX Stop Orders

FX Stop orders have been simplified in the GTS Pro, where ‘Stop if Bid’ sell and ‘Stop if Offered’ buy orders will be removed and replaced with a single ‘Stop’ order that will automatically trigger on the appropriate side.

Existing Stop if Bid and Stop if Offered orders will not be immediately affected, but on Saturday June 11th they will be converted to the new stop order convention:

- Stop if Bid sell orders will be converted to Stop if Offer

- Stop if Offer buy orders will be converted to Stop If Bid

Note that the client order level will stay the same.

Triggering Stop Orders

Stop orders will be triggered using institutional practices where:

- Buy orders will be triggered on the Bid price

- Sell orders will be triggered on the Offer price

To some clients this may seem counter-intuitive, but it has long been the convention in institutional trading as it eliminates spread effects from strategies where trades can be prematurely triggered from a sudden widening of the Bid/Ask spread during volatile market conditions.

This convention is already used in the GTS platform.

Stop Order Fills

When Stop orders are triggered, they become market orders and filled at the best available price in the market at the time:

- Buy orders will be filled on the Offer price

- Sell orders will be filled on the Bid price

It is important to understand that triggering an order on the opposite side of the spread is not slippage; it is a way for clients to trade at a price only when there are other legitimate buyers or sellers active in the market as a way to avoid triggering due to temporary spread widening. Spot orders always become market orders when triggered and are filled at the market price, however market spreads are not something in a broker’s control.

New Market Overview in GTS

The News & Research section of GTS will now include a comprehensive overview of global equity markets including:

- Indices

- Gainers and Losers

- News

- Calendar Events

- Overview Chart

Indices Overview

Indices display the last traded value and intraday percentage.

Selecting an index from the list selects the overview chart, gainers and losers, news and calendar events from the exchange mapped to the index.

Gainers / Losers

The Gainers / Losers displays the 20 highest and 20 lowest performing stocks from the exchange mapped to that index. Note that Gainers / Losers is based on the entire exchange mapped to the index, not just the index constituents.

Context Menu

Click on an instrument in the Gainers or Losers to access a context menu to trade, open Equity Research (if subscribed), add a price alert or open the Overview for the instrument.

Overview Chart

The Overview chart offers a 24-hour (fixed) view of index, additional price information and performance data for 1W, 1M, 3M, 6M, 1Y, 2Y, 5Y.

Where available, the selected index can be traded by clicking on the product icon to open a trade ticket.

Price alerts can also be added for a select instrument.

News

News displays filtered news for the selected index based on the news subscriptions available.

Calendar Events

Calendar events displays upcoming events related to the selected index for the next five calendar days. Each event has a countdown associated with the expected release of actuals being published. Once countdown is reached, the counter will disappear as actuals are published.

Other New Features in GTS

Other new features in GTS include:

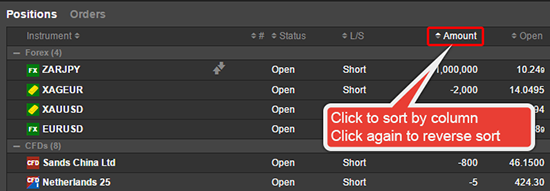

Sorting on columns

You can now sort by most columns on the Watchlist, Positions List and Orders List by clicking on the column header. This will order (or reverse order) the table based on the column content but maintain product groups.

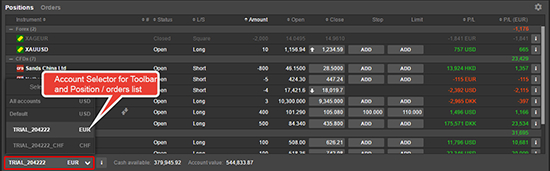

Account filter removed in the Positions and Orders Lists

The Positions List and Orders List are now filtered for the Account selected in the Account Selector in the Account Toolbar:

Additional Time Zones

A number of new time zones are now available in the GTS platform.

Improvements to Order Management

Manage your Orders from the Open Positions list

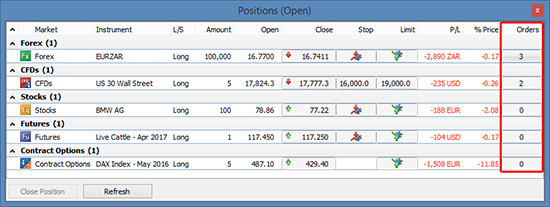

A new column called Orders is now available in the Open Positions list in GTS Pro.

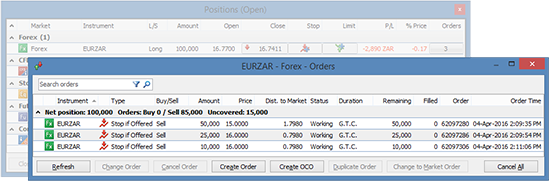

The button shows the number of orders for the instrument on the same account. Click the Order button to open the list of orders where you can edit, cancel or create new orders for the instrument:

The overview shows the:

- Net position

- Total Amount of Buy and Sell orders

- Uncovered amount showing the difference between the Net position and the Order amount. For example, if you have a long EURUSD position for 1M and a sell order to close 250,000, the Uncovered would be 750,000

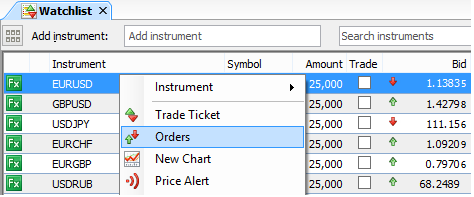

Access from the Watchlist, Chart, Instrument Explorer, Trade Tickets

Filtered Orders can also be accessed from the right-click context menu for an instrument from the Watchlist, Chart, Instrument Explorer, Trade Tickets, etc.

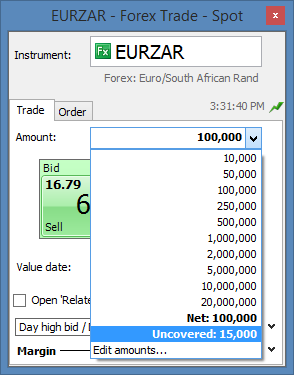

Uncovered Amount in the Trade ticket

The Uncovered amount for an instrument – the difference between the Net position and the Order amount – is now available from the Amount selector for the instrument in the Trade Ticket.