Net Free Equity (NFE) is:

- The cash balance of your main trading account

- Plus/minus any unrealised profits or losses from open CFDs, FX Forwards and Futures on your main trading account

- Plus the market value of any FX Options on your main trading account

- Minus any margin required for financing open positions on your main trading account and sub-accounts

Cash collateral for NFE margin financing may differ from the trading margin requirement.

Interest is calculated daily and settled monthly – within seven business days after the end of each calendar month.

How do I monitor my Net Free Equity?

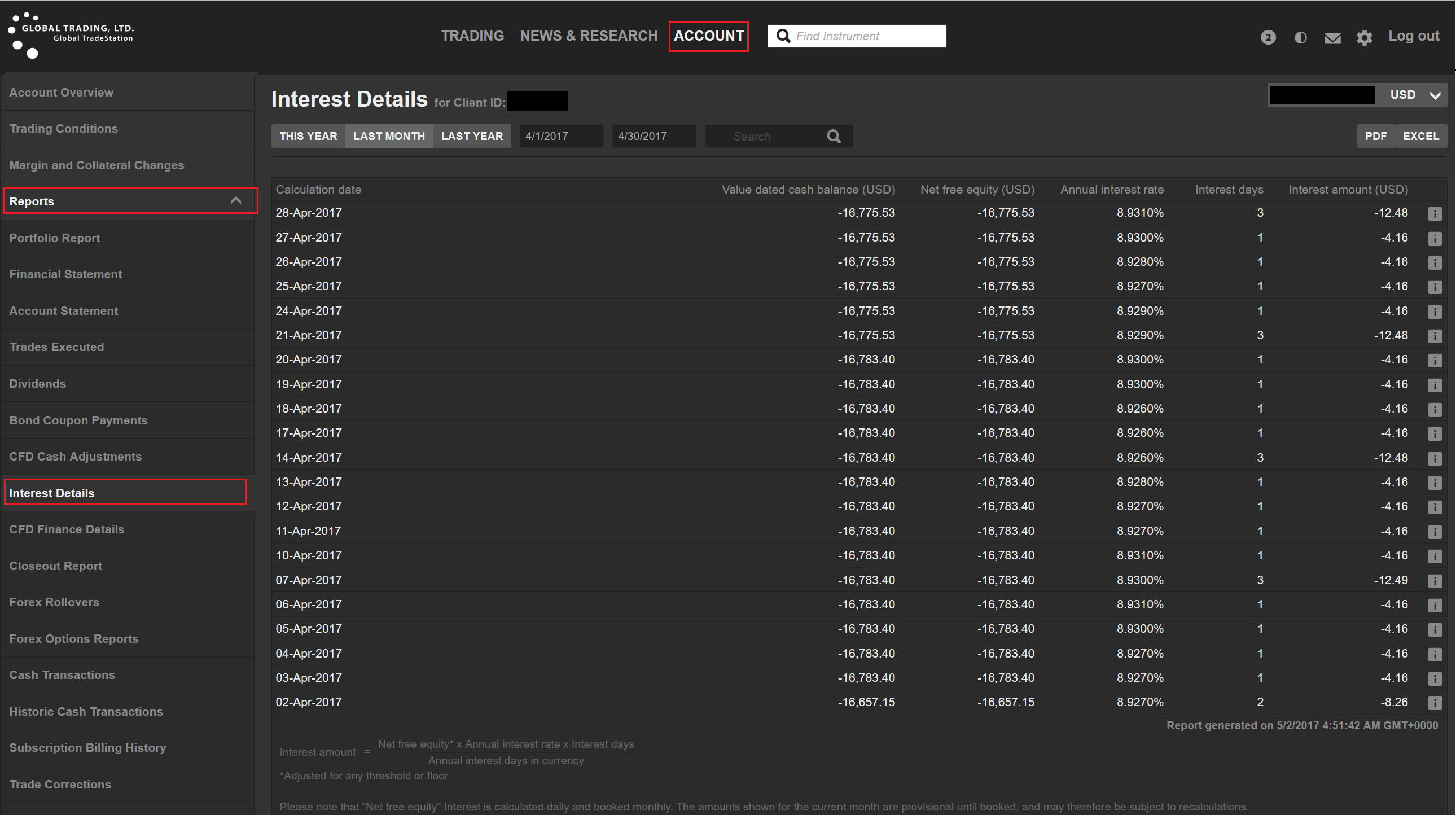

You can view the Net Free Equity in the “Interest Details” report of the “Account” tab of GTS.

How do I resolve my negative Net Free Equity?

If you have a negative Net Free Equity balance, you will accrue “overdraft” interest on your account. To avoid paying interest, please hold sufficient cash collateral. This can be done several ways:

- Deposit cash from your bank account using your Transfers > Between Own Accounts function.

- Sell shares or close a position.

- If you have multiple sub-accounts, often negative Net Free Equity is the result of trading with the wrong sub-account—the sub-account that doesn’t have sufficient cash. If this is the case, move funds from the “positive” sub-account to the “negative” sub-account by making two transfers. First from the brokerage sub-account to your bank account, and then once the funds have settled, a second transfer from your bank account back to your brokerage account’s correct sub-account.

For further assistance please send a message inside your brokerage platform or email [email protected]