Published: May 8, 2020

Relevant Strategies

- Moderate

- International Balanced

- International Growth

- Gold & Precious Metals

- Natural Resources

- Peter Schiff

Our Commentary

An increasing number of countries worldwide are poised to set their economies’ wheels turning again in May as COVID-19 infections level off.

Equity investors are acting as if the worst is over, and the extent of the stimulus has buoyed their optimism.

The US S&P 500 index has returned to the levels of autumn 2019 and the price-to-earnings ratio for 2020 has rocketed back up to 21, significantly above its five- and 10-year averages of 16.7 and 15 times.

The robust policy response by the US government and the central bank means the US economy is likely to show some uptick from here.

We believe the extended S&P 500 valuations are fueled by stimulus.

During April, governments and central banks upped the ante in their economic support, further extending stimulus measures to unprecedented levels.

Against a backdrop of around $85 trillion global output, the US federal government alone passed a $2 trillion stimulus bill and is looking to further expand support for small businesses and individuals. Alongside this, the US Federal Reserve put in measures that will see $2 trillion finding its way into credit markets.

The EU endorsed a short-term government rescue package worth more than $500 billion.

Japan, battling a second round of infections having emerged from the shutdown prematurely, announced a fiscal package worth close to $1 trillion.

The IMF has warned that the world could be facing its worst economic downturn since the global depression. In addition to reducing its global growth projections substantially to -3% this year (a figure even it admits could be optimistic), the Fund also focused on the considerable financial support that emerging markets may need to avert a full-scale economic disaster.

However, we are concerned that markets are factoring in a short-lived recession and a steep, quick recovery.

If the current slowdown fails to reverse significantly into the second half of this year, the impairment to the corporate sector could herald a further decline of at least 40% in the S&P 500 from current levels.

Recent unemployment, growth, retail and housing statistics in the US are highlighting the extent of the economic damage inflicted on the economy there.

US GDP fell by 4.8% in the first quarter. The bigger than expected decline is worrying because the economy was operating at pre-coronavirus levels for about 80% of that period. Risks that second quarter GDP declines will significantly exceed 30% projections are high.

There is a strong and geared—albeit lagged—correlation between US production and profits. Year-on-year US production declines are likely to exceed the 15% falls seen during the global financial crisis and this could mean US corporate earnings are halved.

The extraordinary circumstances have been further highlighted by the collapse in the price of oil. Ahead of expiry, the May WTI contract traded negatively for the first time in history, as low as -$37.63 per barrel.

With countries preparing for a carefully staged exit from shutdowns, the manufacturing and construction sectors may recover reasonably quickly.

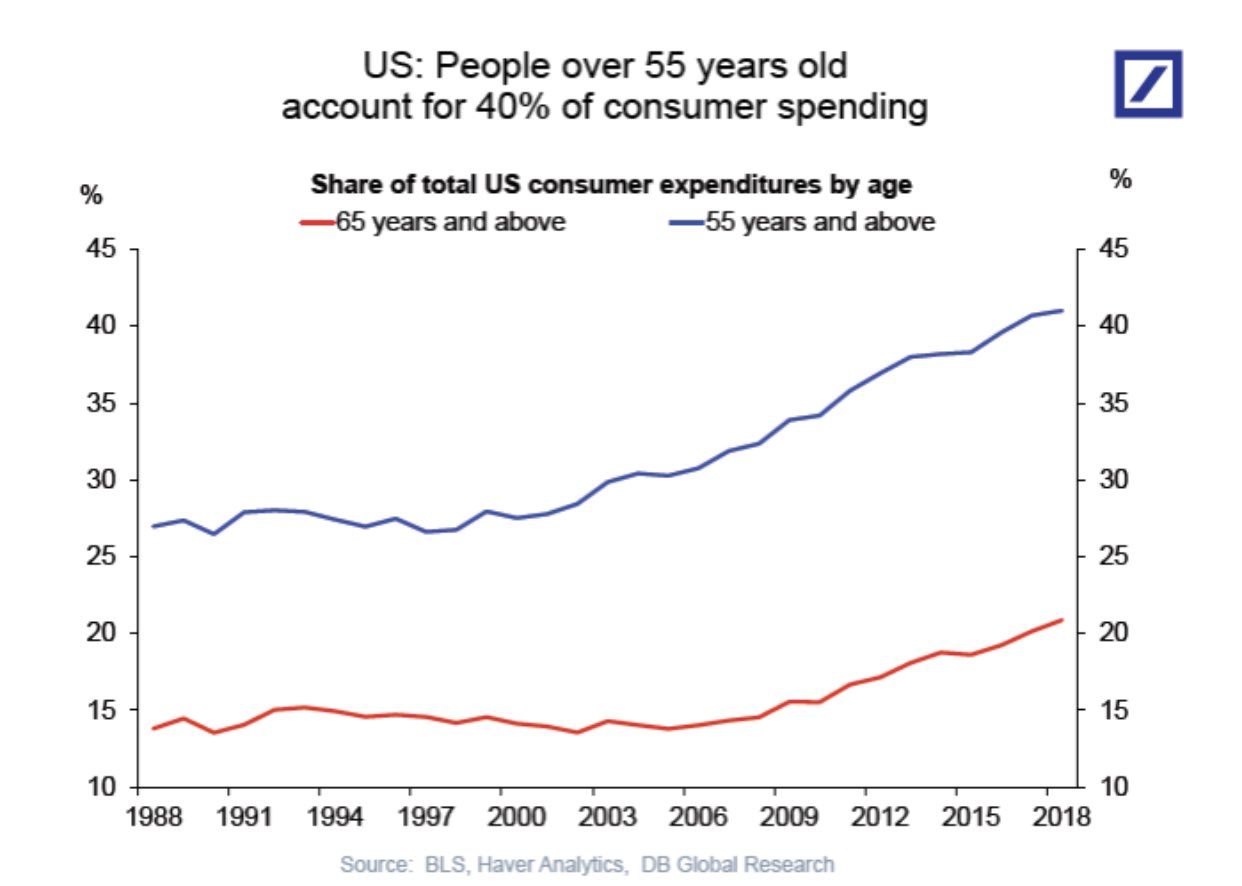

However, consumers, who will still be maintaining social distancing for some time to come, may not provide the spending boost required to get the retail and entertainment sectors going as fast as equity markets hope.

The uncertainties and risks that lie ahead in a recovery based on trial and error will make the path difficult to predict.

For now, the US Central Bank’s position of ‘whatever it takes’ to prevent a credit crunch has left many investors assuming a floor to both economic decline and stock market performance.

In whose interest would it be to see a greater collapse? At some point, focus will switch to the impact of governments gradually removing support and the longer-term consequences of the pandemic and recent interventions.

Portfolio Actions

We are currently maintaining a comfortable degree of cash in all portfolios.

We are also shifting equity investment to growth sectors, which are less impacted by the pandemic and whose valuations benefit from lower interest rates.

There will undoubtedly be companies such as those involved in health care and certain technologies (cyber security, cloud infrastructure, smart cities, etc.) that will prosper regardless, or even because of, developments this year and these are areas we are focused on.

Regards,

Euro Pacific Advisors Management Team