Published: August 26, 2020

Relevant Strategies

- Moderate

- International Balanced

- International Growth

- Gold & Precious Metals

- Natural Resources

- Peter Schiff

Our Commentary

July continued to see a growing divergence between stock markets, buoyed by technology stocks and many economies stalling in the face of renewed flare-ups of infection.

The US Federal Reserve delivered a gloomy assessment of current economic conditions and the risks that lie ahead for the global economy. To counteract the most severe downturn “in our lifetime”, it left the doors open to using any tools at its disposal to support the US economy “until it is confident the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals.”

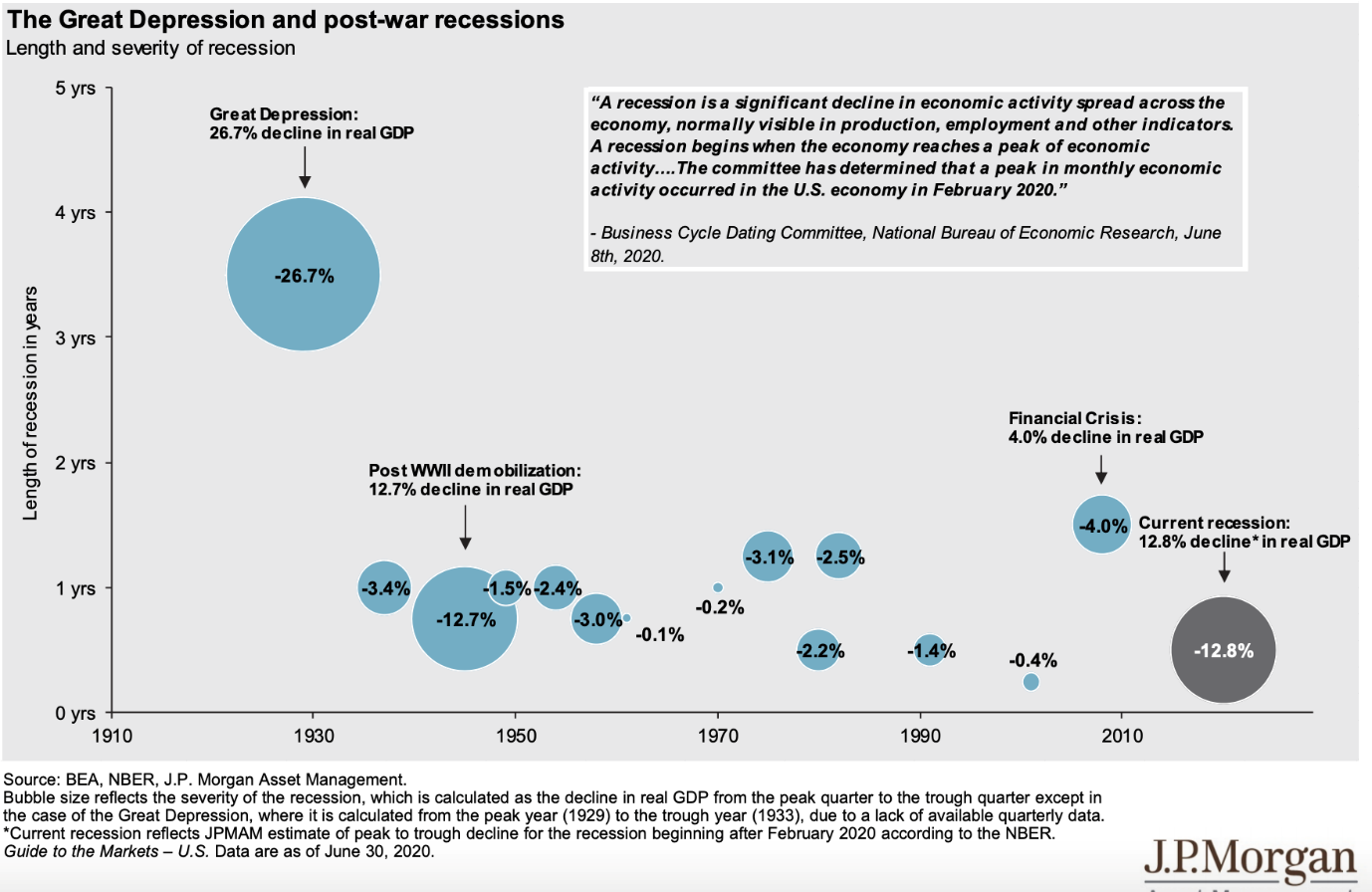

The diagram produced by J.P. Morgan below puts the recession into context.

Contracting economies, weakening forecasts

The US economy shrunk by 9.5% in the second quarter (annualised -32.9%) and personal spending was particularly hard hit, declining 34.5%, its steepest contraction since the 1940s. Meanwhile, the Eurozone’s economy contracted 12.1% in the second quarter – the most significant quarterly decline on record.

On a more positive note, PMI data moved past 50 for the first time since COVID-19 appeared in the US and Europe. This suggests expansion, although Goldman Sachs’ Current Activity Index pegs the recent economic slowdown in July at -3.8% versus a positive 0.5% the month before.

The path of the virus remains the dominant driver of near-term growth. As infections continue to spread, forecasts are weakening. Early in July, Goldman Sachs reduced its US GDP estimate for 2020 to -4.6% versus -4.2% previously, based on a 25% rebound in the third quarter, also lower than its previous 33% figure.

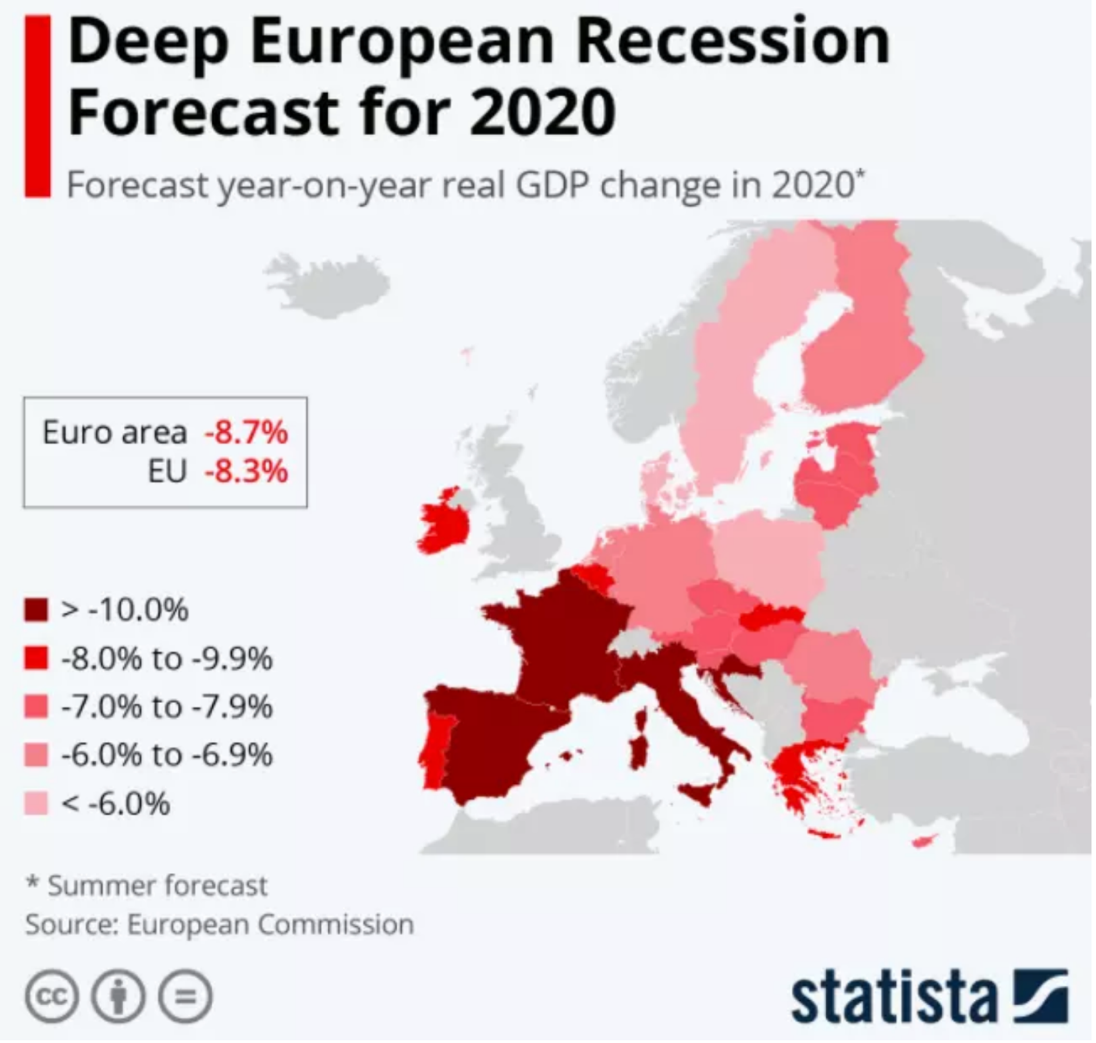

Meanwhile, the European Commission put forward a GDP Summer Forecast contraction of 8.3% for 2020, a steeper decline than its previous expectation of a 7.4% decrease in economic growth this year.

China bucks global downward trend

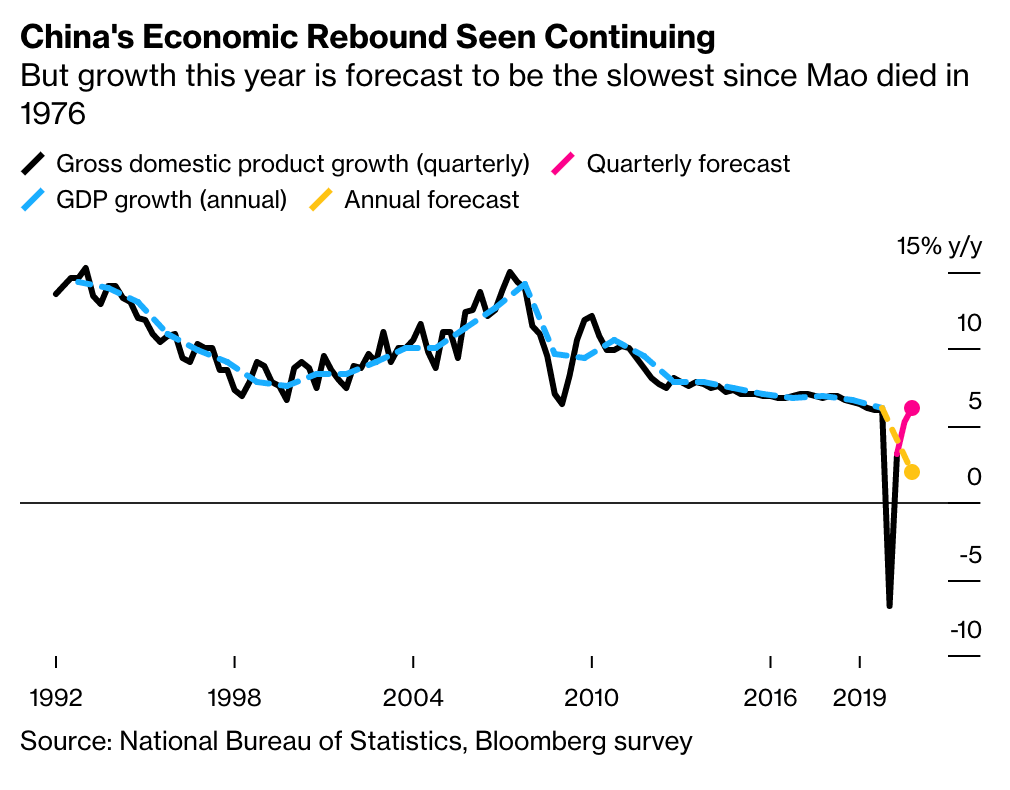

The outlook for China looks more positive and authorities have acted quickly to prevent infection flare-ups spreading further. Economists expect the Chinese economy to grow by 2% this year, the slowest growth since 1976 (see the graph below), but still one of the few countries in the world likely to put in a positive performance for the year.

The stock market is not the economy

By the end of July, the S&P 500 had managed to get back into positive territory year-to-date, reminding us that the stock market is not the economy. Most companies in the S&P 500 reported earnings above analyst expectations, with particularly strong figures from the large technology companies.

Apple’s quarterly revenues were significantly above analyst forecasts, with sales of iPhones, iPads and Mac computers surging. Revenues for the period were $59.7 billion, an 11% increase on a year ago. Facebook’s second-quarter sales also exceeded the most optimistic analysts’ estimates, with almost 3 billion monthly active users during the period.

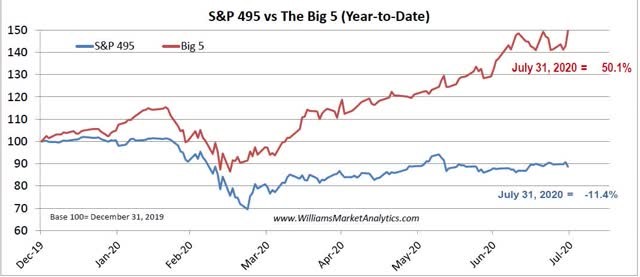

The value of Amazon, Apple, Facebook, Google owner Alphabet and Microsoft has increased 50% since the beginning of 2020. In comparison, the other 495 companies in the S&P500 Index remain down at -11.4% (see graph below from Williams Markets Analytics).

At the other end of the spectrum, Expedia, the online travel giant, reported an 82% decline in revenue in the second quarter with total gross bookings declining $2.71 billion (90% down on the previous year).

Portfolio Actions

We are currently maintaining a comfortable degree of cash in all portfolios.

Regards,

Euro Pacific Advisors Management Team