Published: February 05, 2021

Relevant Strategies

- International Balanced

- International Growth

- Natural Resources

- Gold & Precious Metals

- Peter Schiff

Our Commentary

Market Overview

The past year has brought not only huge market swings between risk-on and risk-off phases but also a staggering divergence of returns between regions and investment styles. In equities, much of this can be explained by sector performance.

The outlook for inflation is not yet strong enough for the sector rotation of November and December to have continued at the same rate in January but many investors are expecting the recent recovery of cyclical/value shares (consumer cyclicals, energy, industrials, and financials) to continue and the valuation gap to close.

Last year, it was a COVID-19-determined market, with sectors that benefited from the pandemic doing well and those that did not having a torrid year. The best performing sectors included tech shares, consumer defensives, basic materials, freight and logistics and homeware. The worst performers were oil and gas, financial services (banks), retail estate and airlines.

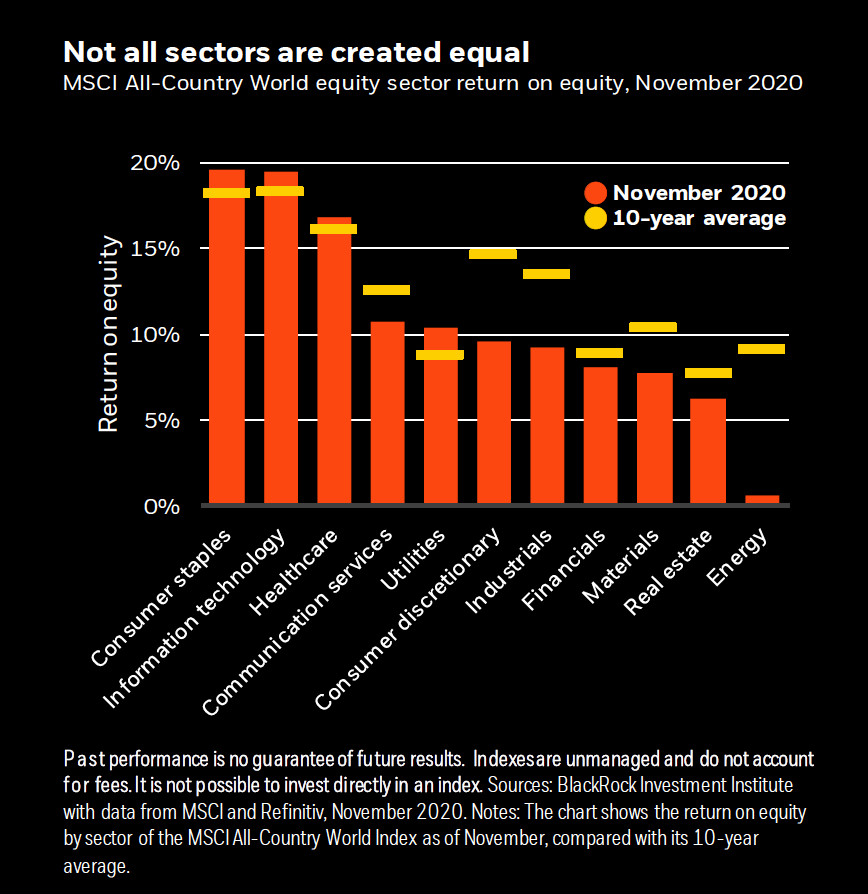

The graph below captures the state of play in the sectors towards the end of last year:

Sector divergence remains in focus

As vaccines are being distributed, we are optimistic to see how the sectors will perform this year.

In its 2021 Global Outlook, Blackrock has divided companies into three categories based on its bottom-up analysis:

- Those in trouble that may fall further

- Those that that are hurt but should recover

- Those that are strong and could get stronger

The report sees airlines in the first bucket because business travelers account for a disproportionate share of profits and expects that companies will wish to continue benefiting from the cost savings made by holding events virtually.

Housing, materials, and autos fall into its middle bucket as the interest rate-sensitive parts of the US economy are already recovering strongly.

Meanwhile, the tech sector is in the third category as it leverages accelerated trends, offers scarce growth amid rock-bottom yields, and boasts high profit margins.

In the next paragraph, we will see how this sector divergence affects stock indices and their valuation.

Impact on indices

For the S&P500 index metrics such as price-to-sales and price-to-earnings are often quoted as evidence of overvaluation, but it is important to consider the impact of the high weighting now attributed to mega-cap tech stocks.

These stocks are generally more highly-rated, at least partly justified by high earnings and cash flow, so as the share prices have rallied it is only natural that the P/E and P/S ratios of the S&P 500 have risen.

The table below generated by Deutsch Bank shows sectoral PE ratios and demonstrates how shifts in sector performance can move index-level valuations. It is worth noting a theoretical scenario where the ratios applied to an index could rise without it being the case for any individual sector, purely due to sector performance divergence.

| Index | 1-year Return | 3-year Return | General Estimated Next Year P/E (as of 28/01/2021)* | General Estimated Next Year P/E (as of 29/01/2018) |

|---|---|---|---|---|

| S&P 500 Index | 15.6% | 31.8% | 19.4 | 16.9 |

| S&P 500 Consumer Discretionary Sector | 35.5%s | 53.9% | 27.5 | 19.4 |

| S&P 500 Consumer Staples Sector | 3.2% | 11.2% | 19.1 | 18.2 |

| S&P 500 Energy Sector | -26.9% | -46.5% | 16.0 | 20.4 |

| S&P 500 Financials Sector | -2.2% | -2.1% | 12.2 | 13.1 |

| S&P 500 Healthcare Sector | 13.6% | 27.6% | 15.4 | 16.1 |

| S&P 500 Industrials Sector | 5.3% | 7.9% | 18.5 | 17.1 |

| S&P 500 Information Technology Sector | 36.6% | 93.1% | 25.0 | 17.9 |

| S&P 500 Materials Sector | 22.3% | 13.0% | 18.5 | 16.6 |

| S&P 500 Real Estate Sector | -6.7% | 16.2% | 43.0 | 34.6 |

| S&P 500 Telecommunications Sector | 7.2% | 45.2% | 25.2 | 19.3 |

| S&P 500 Utilities Sector | -8.6% | 22.6% | 16.9 | 15.7 |

*based on earnings estimates for 2022

Understanding the misunderstanding about the current valuation of index, we will continue to adopt the wait-and see stance in the short and medium-term for our holdings of index ETFs. Until the sector performance begins to shift, which will affect the indices valuation, we will keep monitoring and wait for the right time to adjust their weightings in our International Growth and International Balanced Fund.

A new battleground between the US and China

This year, another key driver of financial markets is expected to be the relationship between the US and China. Although Joe Biden is likely to take a less confrontational approach than his predecessor, both countries are likely to seek self-sufficiency in critical industries.

We continue to ensure that strategies contain diversified exposure to both poles of growth. As China opens its capital markets to global investors, the spotlight may switch from the bilateral trade deficit to climate and human rights. As this trend is playing out slowly, we are also beginning to steadily reflect this shift in our exposure to China.

Global growth recovery?

The pandemic continues to wreak havoc in many parts of the world and expectations of short-term economic performance have weakened. Furthermore, vaccines now appear not quite the silver bullet hoped for when it comes to opening up the global economy while supply constrains rollouts and the effectiveness against virus mutations remains uncertain.

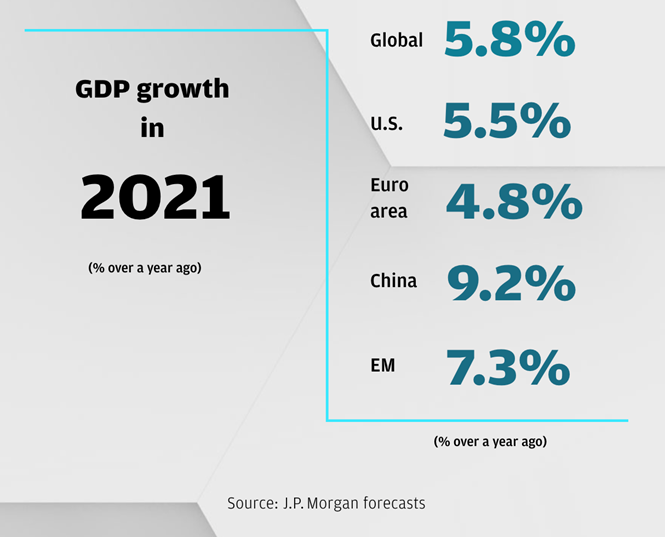

Many commentators, including JP Morgan, still expect strong, back-end-loaded global growth this year and tailwinds continuing to underpin stock markets in a yield-starved world. Nonetheless, we remain risk-conscious and prepared for all eventualities.

The rise of TaaS

In recent news, Amazon is reported to order 100,000 electric vans last year. While this is good news for the electric vehicle market, there is a much larger trend simmering behind the lime lights of Tesla (NASDAQ:TSLA) and NIO (NYSE:NIO) .

According to FN Media Group, the Transportation-as-a-Service (or “TaaS”) industry is expected to reach a market valuation of $8 trillion , of which includes ride sharing in personal and freight transport, food and drone delivery and distribution market.

In the next decade, we believe the sharing “gig” economy, along with autonomous vehicles, electric vehicles (EVs), ESG investing and connectivity will be the future as the world is moving away from buying and owning gasoline vehicles largely due to rapid urbanization, increasingly gridlocked roads, ever-rising CO2 levels and the fact that we are using our cars at a falling rate, according to FN Media Group’s report. More importantly, the TaaS industry is where all four macrotrends will intersect.

Portfolio Actions

Sector Rebalancing

We continue to adopt our cautious stance and refrained from rotating the sectors because there are still gaps between the sectors’ performance and their valuation.

Additionally, sector rotation may not happen until the next quarter when the US vaccination program begins to bear fruits and its positive effects on the economy begins to kick in with rising inflation. Only time will tell.

Transportation-as-a-Service

In terms of our call on TaaS’ emergence, we are slowly building our positions in relevant industries and sectors. For example, within our investment in USA ESG ETF and the US market ETFs, there are holdings in Uber and Dominoes, both of which are members of TaaS.

Environmental, Social, and Corporate Governance

To note, our ESG investments, both US and Global, also have exposure to other aspects of the supply chain of TaaS-related companies. Holdings include Albemarle (NYSE: ALB), FMC Corporation (NYSE:FMC) and Livent (NYSE:LTHM) of which belong to the EV supply chain and their use through the gig economy and connectivity. There is also exposure to Tesla rather than Rivian, which is still private.

In the last six to twelve months, we have slowly increased our ESG exposure because we feel these are areas that will take on greater significance for investors and companies alike with the integration of greener and socially responsible values a key driver in decision making and development.

Furthermore, as more candidates begin to meet our ESG criteria, they may be added to the equity portfolios over time. This steady process will also contribute to our exposure to TaaS in the long-term.

Regards

Euro Pacific Advisors Management Team