Published: May 11, 2021

Relevant Strategies

- International Balanced

- International Growth

- Natural Resources

- Gold and Precious Metals

- Peter Schiff

Our Commentary

April summary

As vaccine rollouts move forward at a promising pace in Europe and the US, and economies open up, optimism is translating into increased forecasts for 2021 economic growth. Meanwhile, the US Central Bank maintains that it is in no hurry to withdraw monetary stimulus. Consequently, many major equity indices have climbed to all-time highs and safe-haven assets such as treasuries and gold have stabilised after the steep declines of Q1.

The FTSE 100, undeterred by a large financial sector and lingering worries about Brexit, has surpassed the level at which it began last year. It is also worth noting that markets greeted the 18.3% rise in first quarter Chinese GDP with nothing more than a shrug. Coming in May, the base effects from a summer in lockdown are bound to be spectacular for equity outperformance.

Earnings season update

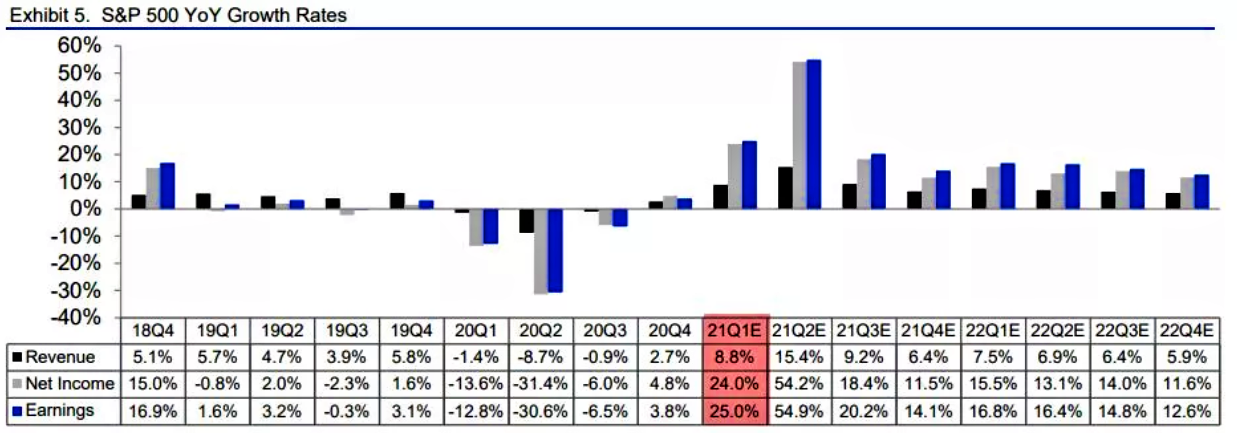

Most companies that have reported on the first quarter have announced their earnings per share (EPS) far above estimates – a performance attributed to both better-than-expected business performance and last year’s low EPS estimate as a result of the onset of the COVID-19 pandemic.

84% of the US companies reporting by the third week of April have beat EPS estimates. The average upside surprise was 24% – significantly above the five-year average of 7%.

Meanwhile, the majority of European companies have also reported earnings above market expectations and better sales growth than consensus estimates. Earnings surprises were delivered across various industries, with financials, consumer discretionary, materials and healthcare reporting the highest earnings growth. The industrial and energy sectors were the only ones to report year-on-year earnings declines.

It’s important to note that after three successive quarters of companies outperforming estimates, the surprise element and consequent positive impact on share prices has also diminished. In many cases, companies reporting earnings in line with expectations are now being penalized by the market. So, we remain cautious about investing in overvalued and low-quality stocks.

What’s next for equities?

Elevating market expectation

Companies will need to continue along their current upward trajectories for increasingly optimistic analyst expectations to be met. Concerns about overvaluations and stock markets moving into bubble territory have raised the risks of an adverse event having an outsized impact on investor sentiment and global stock markets. As a result, management of volatility in investment portfolios remains as important as ever.

A stimulus-driven bull market?

If we consider the almost unimaginable size of the US stimulus package so far, the $2 trillion in unspent household savings and the additional $1.9 trillion stimulus to come, a period of roaring 20’s type-economy would seem a racing certainty. Much of the stimulus is targeted at the consumer and the lower-paid and is effectively “helicopter money” putting dollars directly into the bank accounts and pockets of individuals. As such, it is unlikely to be spent on property or the stock market which is where so much cheap money ended up during the recovery from the Great Financial Crisis in 2008.

The Fed & inflation

If stock markets were looking for an excuse to take profits, one would have thought that the prospect of an inflationary scare pushing up bond yields would provide it.

To note the recent rise in bond yields is probably an acknowledgement that there are going to be some shockingly large economic numbers coming down the road which, under any other circumstances in almost any period in history, would greatly effect equities. After a surprising move to the upside in February and March which caught bouts of stock sell-offs, 10-year US treasury rate has stabilized for now.

It is the reaction of the Fed in response to a big headline inflation figure that is really what has been bugging bond investors rather than the stock market. Fed Chairman Jerome Powell, appears to be reassuringly relaxed about the coming boom and willing to tolerate a spike well above the 2% target rate if the evidence suggests it is no more than a passing moment of economic giddiness. If the Fed can look through an inflationary boom, so can investors. As proof, major US stock markets have all touched or surpassed their February levels, shrugging off any inflation fears.

Lastly, a willingness to keep rates low by central banks in the US and UK would add even more tailwinds for equities to outperform in May and onwards.

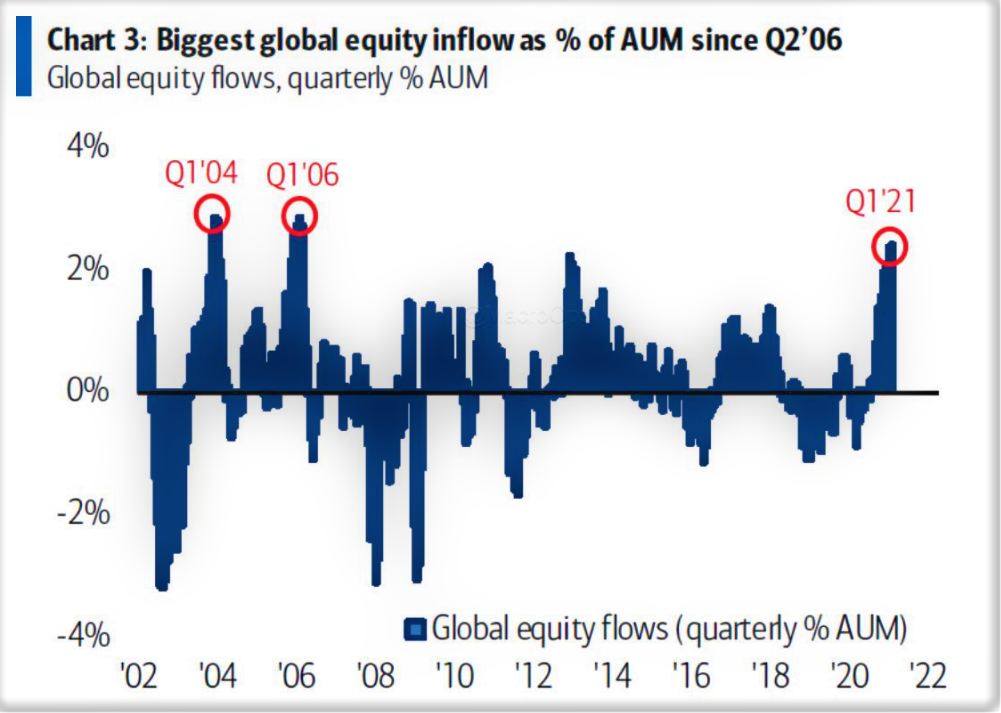

Source: BofA Global Investment Strategy, EPFR Global

Biden’s tax hike

The impact of the proposed US corporate tax increase is certainly a concern for some investors but we think a stable and predictable stance from the central banks may promote a longer-term commitment to equities from investors along with a renewed focus on the long-term compounding benefits of dividends in a low interest rate environment.

In the UK for example, the ongoing resumption of normal dividend payments, across companies of all sizes, will make them more attractive – particularly to foreign investors who may have been absent for a few years due to Brexit uncertainty.

Nevertheless, we will continue monitoring this event to remain cautious about its potential long-term impacts on our equity holdings. Any reactions of the market due to this new tax plan may affect our portfolios’ performance in the short-term but the long-term impacts should be limited due to our diversification.

Portfolio Actions

International Balanced & Growth Fund

Sell iShares Gold Producers (IAUP) and replace with WisdomTree Enhanced Commodities (WCOA)

This new ETF provides exposure to a broad basket of commodities including precious metals, industrial metals, energy and soft commodities such as cocoa, sugar and cotton. It uses an optimization strategy to enhance the return when rolling futures contracts.

The inclusion of industrial metals and energy makes the holding more sensitive than the precious Metals Basket to the benefits of the economic recovery and, in particular, may show a greater positive response to inflationary pressure.

A resurgence in infrastructure spending will increase the demand for many commodities over coming years but a dearth of investment in raw materials extraction is likely to see supply remain tight. Furthermore, production yields on several agricultural commodities have been falling while consumption has risen. Recent weather patterns may provide further tailwind for agricultural commodities. The safe haven attributes of gold have diminished since the US election and the rollout of vaccines, while the gold price continues to respond negatively to steepening of the US bond yield curve. Although the new holding does retain an element of gold exposure, it is reduced.

Traditionally, commodity benchmarks have been limited to the extent that they have adopted a pre-defined schedule to manage the rolling of futures contracts, failing to account for particular seasonality and suffering significant negative carry returns associated with the front end of commodity futures curves when markets are in contango. They have also missed out on potential positive carry in backwardated markets. In the Wisdom Tree Enhanced Commodity UCITS, the optimised methodology has led to commodity carry being a primary source of alpha in comparison to the traditional approach.

Note that we retain our exposure in gold miners through L&G Gold Mining (AUCO).

Add iShares Euro STOXX SmallCap (DJSC)

The purchase will provide our portfolios with exposure to small-cap Eurozone equities, which are set to benefit from the consumer boom as the vaccination rollout gathers pace and the economic recovery in Europe continues to accelerate. To add, The Euro area’s business activity indicators (PMI) improvement for a second month while low interest rate expectation serve as tailwinds for small businesses in the area to outperform in the upcoming quarters.

Regards,

Euro Pacific Advisors Management Team