Published: August 06, 2021

Relevant Strategies

- International Balanced

- International Growth

- Natural Resources

- Gold and Precious Metals

- Peter Schiff

Our Commentary

Financial markets buffeted by cross currents

July witnessed a variety of cross currents at play in the financial markets. They are the following:

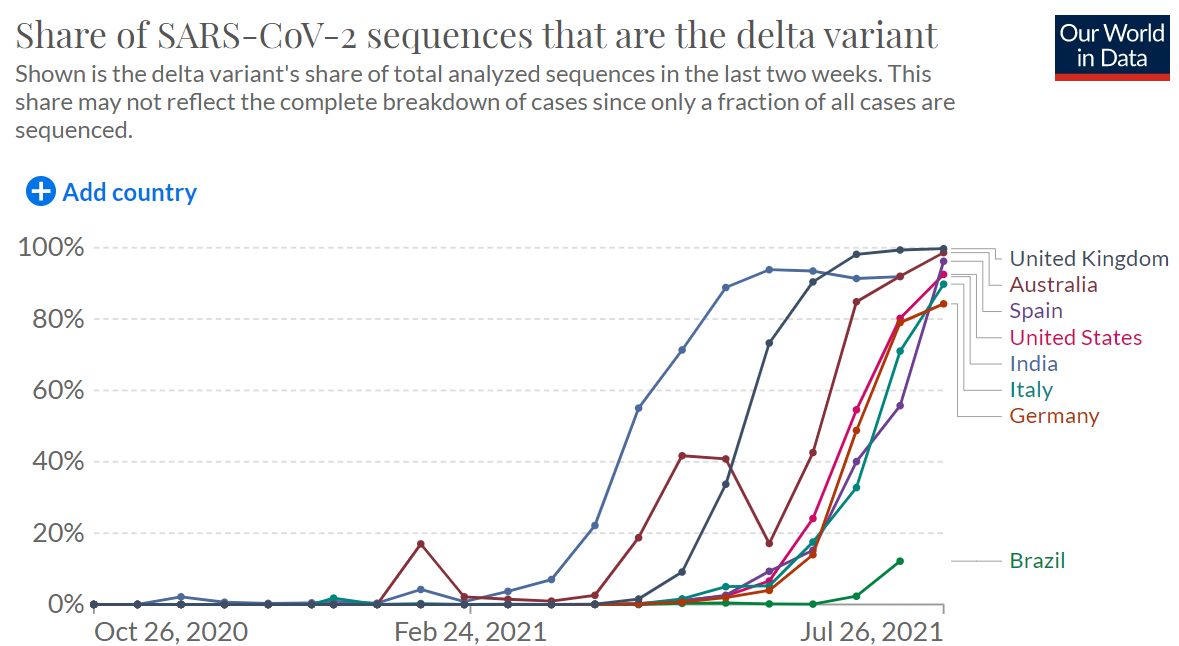

- The spread of the more highly contagious Delta Variant and potential economic impact due to measures that may be needed to prevent its further spread.

- Worries that the global economy may have reached peak economic performance which may lead to plateau or slip from now.

- The ongoing debate about inflation, with more support for it likely to be transitory than turning into 1970’s high inflation.

- Supply shortages, which saw the prices of commodities and other items rise as demand continued to outpace supply and delivery of goods remained slow.

- Tense US-China relation, which was viewed as likely to translate into even further decoupling with huge ramifications for the global economy.

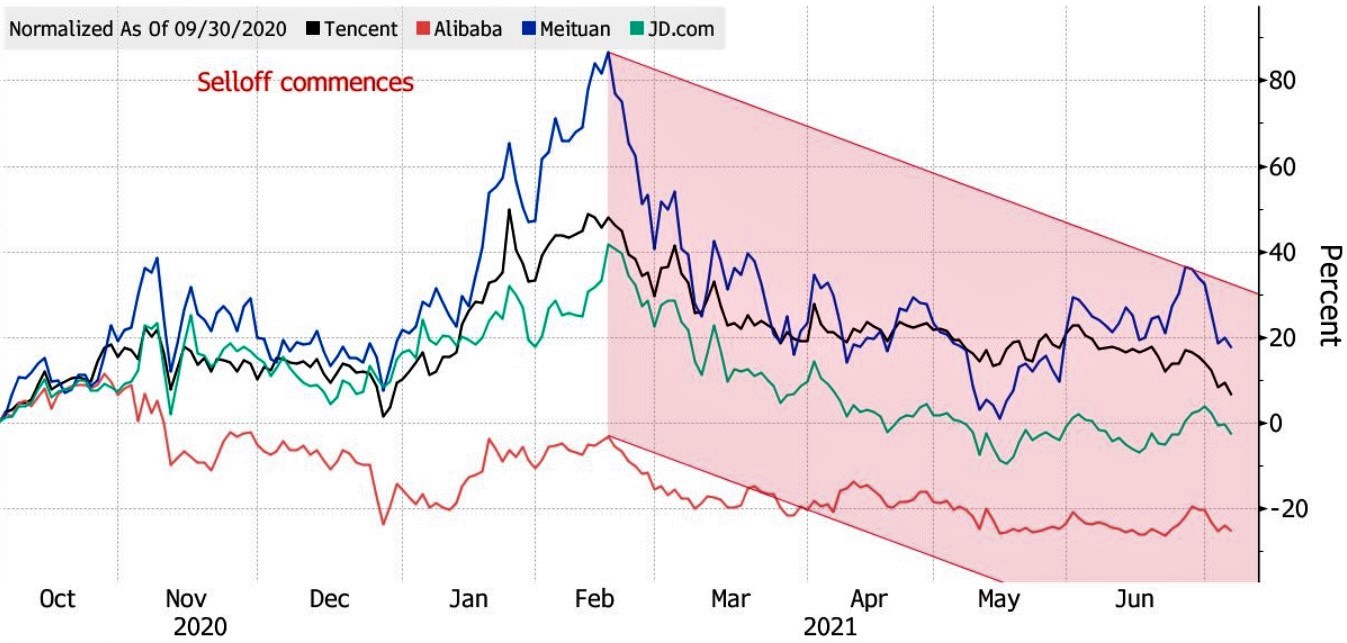

- China causing havoc in the tech sector and broader stock markets by coming down hard on promising Chinese tech companies due to what it defines as data privacy issues.

Surprisingly, investors seem to shrug off these concerns and the US stock market made further progress with the broad-based S&P 500 rising 2.4% during July, ahead of the Dow Jones Industrial Average’s 1.3% gain.

Across the Atlantic Ocean, the main European and UK indices saw little changes but like all the major US indices have provided double-digit gains year-to-date. Meanwhile, Japan’s Nikkei slipped 5%, reducing the index’s year-to-date gains to 0.2%.

Delta Variant and the global economy

In the UK, the nervously anticipated Freedom Day on 19 July went ahead despite the rise in delta variant-related infections. Prime Minister Boris Johnson defined the opening as a move away from legal restrictions to personal responsibility.

So far, the reopening has had a favorable, but relatively muted, impact on the economy, with less movement and activity than expected – probably a result of cautious attitudes as a result of the rise in infections. Towards the end of July infections began to ease off, which bodes well for the world’s economy to shift towards more normal activities.

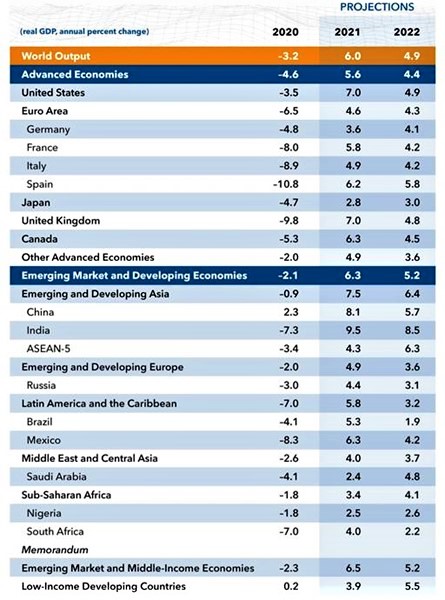

With the COVID-resurgence-fear simmered in the background, the latest World Economic Outlook, released by the IMF, has highlighted the still growing divergence between advanced and emerging market economies with the latter expected to outperform until 2022.

At a global scale, the IMF projection maintained its forecast 6% growth rate for the world, while upping the rate of growth expected from advanced economies and reducing it for emerging markets, particularly emerging Asia. The change seemed to be influenced by rates of vaccinations as having a big impact on the different macro-economic experiences across the world.

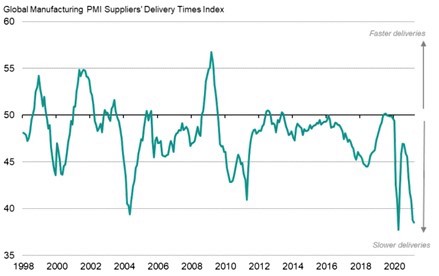

In the US, GDP growth came in at 6.5% for the second quarter – two percentage points lower than economists’ projections but seen as a solid performance for the world’s largest economy. The shortfall was ascribed to the clogged supply chains that are slowing down inventory rebuilding as we are seeing one of the lowest Global PMI Suppliers’ Delivery Times Index reading in 21 years.

As an indication of the buoyant demand that is resulting in supply constraints, consumer spending soared for the second quarter, with spending on goods up 11.6% and services, including restaurants and airfares, 12% higher.

On the other hand, spending levels are being underpinned by the trillions of federal rescue money that has been introduced into the US economy.

Chinese stock market woes

The CSI300 Index continued to suffer from the surprising clampdown on technology companies, with the Chinese government citing data privacy concerns. Sentiment was also hit by the announcement of a complete regulatory overview of the $100 billion online education industry, one of the favorite sectors among foreign investors.

As a result, Tencent saw its share price sell off by 9% in its worst day in a decade, erasing $100 billion from the company’s market capitalization. Other notable company hurt in the sell-off was Meituan, a food delivery firm, which lost 18% in one day. Alibaba and JD’s stock price were no exception to the market trend either.

The Chinese government has also announced that she is exploring various measures to contain the rapid expansion in these technology companies, including anti-monopoly investigations, new laws, and direct communications with top executives. While these measures and what they entails are unknown, the uncertainty it creates will keep investors away from the market in the short-term.

Outlook

Despite fears of a new wave caused by the highly infectious COVID-19 Delta Variant, we foresee the global economies continue its track to recovery with growth divergence skewing towards the emerging markets in the next year.

While Chinese stocks experienced a beat down in the last months, the Chinese government’s surprising and far-reaching shifts in market regulation has highlighted that they were more concerned about managing the capital markets than scaring off foreign investors.

Historically, the Chinese tech sector has suffered from sharp reversals in the past and it has recovered strongly. Furthermore, their valuations are no higher than those of US counterparts despite growth trends and prospects remaining stronger while anticipation of monetary easing in China is growing. This is supportive of equities in the long-term.

Portfolio Actions

We want to maintain our portfolio’s current composition but be very responsive to critical changes in the market. Hence, we are tactically holding less than 10% of the portfolios’ weight in cash while refraining from adding new investment ideas to the portfolios.

The portfolios’ July performance is as followed:

| Fund Name | Performance |

|---|---|

| International Balanced | +0.64% |

| International Growth | +0.29% |

| Natural Resources | +0.16% |

| Gold & Precious Metals | +1.09% |

Regards,

Euro Pacific Advisors Management Team