Published: April 11, 2022

Relevant Strategies

- International Balanced

- International Growth

- Natural Resources

- Gold and Precious Metals

- Peter Schiff

Our Commentary

Market overview

Although stock markets improved during March, most remain lower year-to-date with some European markets and global growth sectors registering double-digit percentage declines. The only major developed stock market to be in the black year-to-date is the FTSE 100 which is registering a 2.9% increase. In contrast, the UK mid-cap index is 9.4% lower and the MSCI Europe (Ex UK) index has declined by 7.8%, having been particularly affected by the war and the impact of reduced access to energy supplies.

Despite the increasingly confrontational political rhetoric into the new year, only a minority of investors really believed a Russian invasion of Ukraine was imminent and the shock move raised the specter of World War III, a worst-case scenario that is not yet out of the question. In recent days, stock markets have found new optimism in any signs that talks between the two countries may result in a ceasefire. News that Russia would “retreat” from armed conflict in Kyiv and focus on the eastern territories saw stock markets rally into the final days of the quarter.

Commodities soar

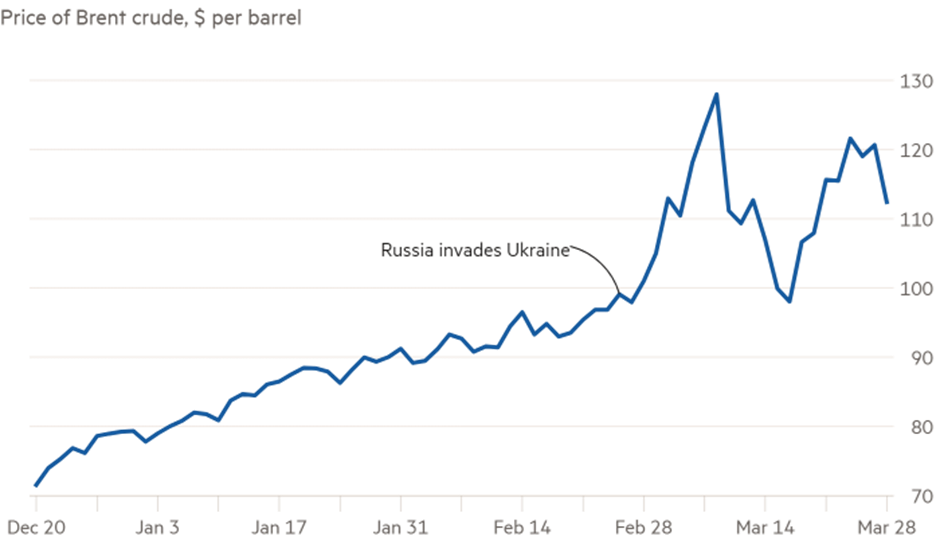

In response to the Ukraine crisis, commodity prices have soared, with oil reaching $130 a barrel and prompting predictions it could reach as high as $200. Natural gas also rose further as the world came to grips with just how dependent Europe is on the gas supplied by Russia, as evidenced by the fact that the stringent and far-reaching sanctions imposed on Russia excluded energy commodities.

The biggest surprise was the surge in nickel prices to $100,000 a ton and a halt in trading due to the unprecedented short squeeze, highlighting the dislocations that can occur when geopolitical shocks emerge.

The war has also wrought havoc in the grain and fertilizer markets that could have long-standing impacts, including dire food shortages in low-income countries. Already producers are raising prices or seeking to reduce their use of these inputs in response to the restricted supply and steep price increases. Reductions in fertilizer usage in the upcoming planting seasons could see yields decline and so the vicious cycle of scarcity could intensify.

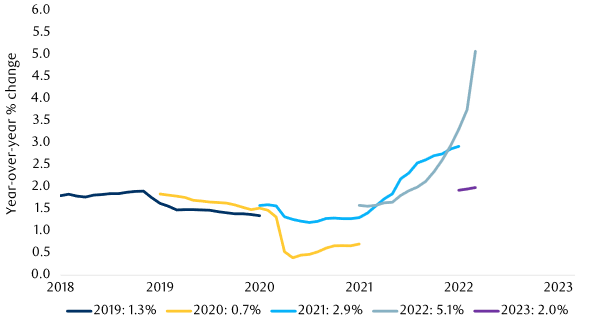

The war on inflation

In the last commentary, inflation is one of the main concerns derived from the Conflict’s escalation. Overshadowed by inflation fears, food and energy price now likely to spiral off already 40-year US inflation highs. The graph below highlights how economists are ratcheting up their inflation forecasts for the OECD countries – to 5.1% currently from the 1.5% expected this year when economists made their predictions in early 2021.

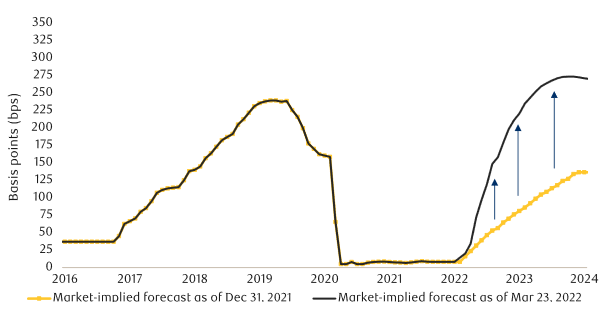

The sharp turnaround from what the Fed expected to be transitory inflation last year to the potential for a return to 1970s inflation highs has resulted in far more hawkish central bank stances in the first quarter of this year. The Fed’s March meeting saw interest rate projections catch up with the more hawkish expectations of the market. The graph below shows a significant shift upwards in the implied Fed funds rate as measured in 12-month future contracts, with consensus expectations now for at least six rate hikes this year and three next. The prospect of a couple of outsized 50-basis point increases is now being factored in, with US central bank messaging paving the way for one at the next meeting.

Such an aggressive response to inflation pressures arising out of the pandemic – and now accentuated by the war – has also raised growing concerns that rate hikes will stall the world economy or even drive certain regions into recession, reintroducing the stagflation that haunted the world in the 1970s.

These fears increased in the final week of the quarter as the two-to-10-year area of the US yield curve inverted. History indicates such an inversion (i.e. longer dated yields being lower than shorter dated) is a harbinger of recession. However, opinion is divided on whether this will prove the case on this occasion and how long after the inversion a recession may occur, with many economists saying it could be as much as 18 months to two years ahead. Some economists also suggest that, given the historic levels of monetary accommodation and liquidity introduced into the financial markets, the relationship between an inverted yield curve and economic recession is less reliable than it once was.

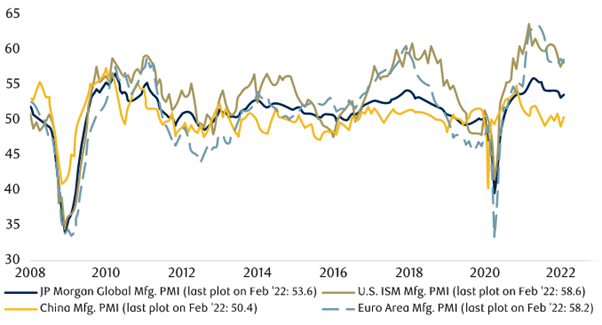

No matter the outcome, the central banks still face the unenviable position of having to prevent expectations of higher prices from setting in while avoiding an economic meltdown. For now, all indications are that the developed economies, particularly the US, are as robust as they were coming into 2022. The latest purchasing manager indices, as shown in the graph below, show that only China’s PMI fell below the 50 level into contraction territory. The US and Europe manufacturing PMIs remain well above that level.

China’s challenges

After leading the world out of the initial phase of the pandemic, China now faces a host of challenges which have seen its economy and stock market performance diverge from the rest of the world. The Chinese government’s focus has been on trying to repair the damage it did to investor certainty after clamping down on tech and online education companies last year. This comes at a time when it is up against a resurgence of Covid infections. Nonetheless, the government is still confident that it will achieve the above 5.5% growth target (see graph below) that it set for the country and, after providing stimulus to the market, has shown an intention to do what it needs to do to get there.

Outlook

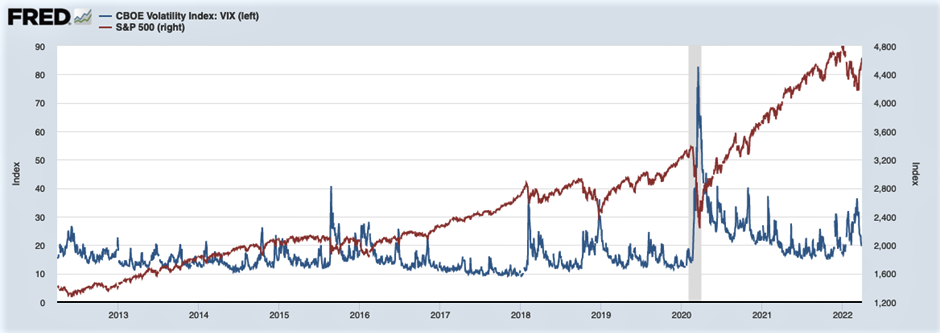

The Russia/Ukraine geopolitical shock has brought increased uncertainty to stock markets. However, history has shown the dangers of making negative long-term judgements based on short-term concerns. The graph below shows how the US stock market at least has continued to climb notwithstanding the extremely volatile conditions at times since 2013.

Stock markets recover and rally after macro-economic or geopolitical shocks, and it is during these periods that the best investment opportunities often arise.

US consensus earnings expectations for the S&P500 have moderated from their exceptional levels last year, but they remain positive, as shown in the graph below. This plots the month-by-month progression of S&P 500 earnings estimates, which have been moving sideways for the past few months. While the war in Europe continues to devastate the lives of millions, there are nonetheless many companies across the world for which the financial impact is minimal and many others that offer the potential for a significant rebound following indiscriminate selling.

The portfolios’ March performance is as followed:

| Fund Name | Performance |

|---|---|

| International Balanced | 1.51% |

| International Growth | 2.36% |

| Natural Resources | 8.16% |

| Gold & Precious Metals | 7.21% |

Regards,

Euro Pacific Advisors Management Team