– Options for Volatility Traders Expand with VIX Weeklys

– Croatian Kuna Pairs to be Discontinued

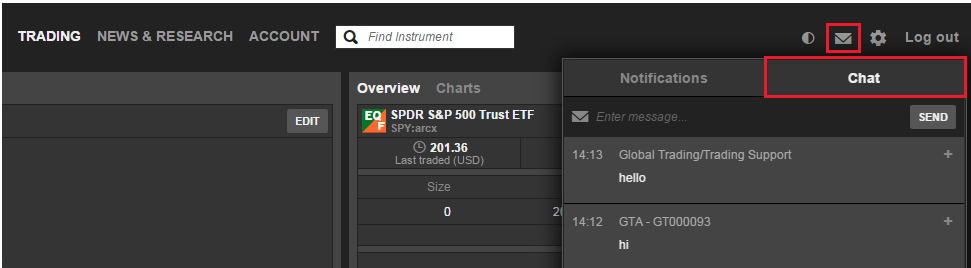

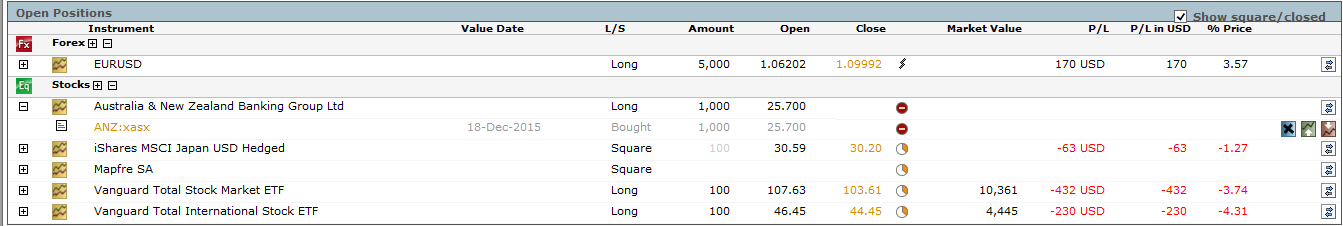

– Enhancements to Instrument Overview in GTS

– Movable Trade Tickets in GTS

– Improvements to Charts in GTS

– Listed Options Supported in GTS Pro Watchlists

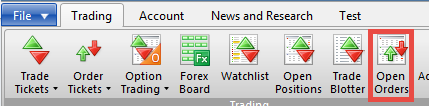

– Open Orders to be Renamed to Orders in GTS Pro

– Technical Analysis Tool to be Discontinued in GTS Pro

– Market Data Changes

Products

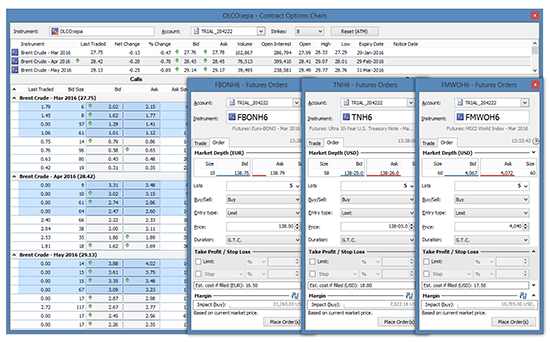

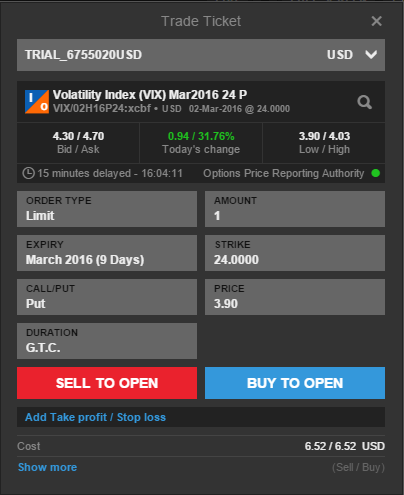

Options for Volatility Traders Expand with VIX Weeklys

Weekly options on VIX have been added to our product offering, so clients can trade volatility on the short term instead of only monthly or longer dated options.

New VIX Weeklys can be traded from the Contract Options Chain in GTS Pro and from Trade and Order tickets in all platforms.

New weekly expirations are listed on Thursdays (excluding holidays) and expire on Wednesdays but have a Last Trading day on the business day before. CBOE may list up to six consecutive weekly expirations for VIX options.

Because of this short-term maturity and the accelerated time decay, most traders prefer to sell Weeklys rather than buy them. Covered calls and naked puts are examples of some selling strategies that attract investors to these listings. Spreads are also frequently used with the instrument, especially credit spreads as well as calendar and diagonal spreads.

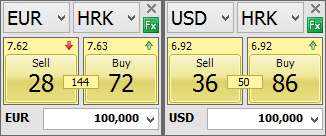

Croatian Kuna Pairs to be Discontinued

The Croatian Kuna will no longer be available for trading on Global TradeStation due to illiquidity in the market. The affected pairs are EURHRK and USDHRK and the change is effective immediately.

Platform Enhancements

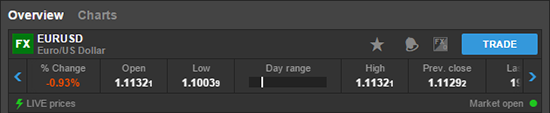

Enhancements to Instrument Overview in GTS

The instrument Overview module in GTS has been extended to display additional data for instruments across all asset classes. Resize the module or navigate through the blue arrows on the far ends to see more relevant instrument data.

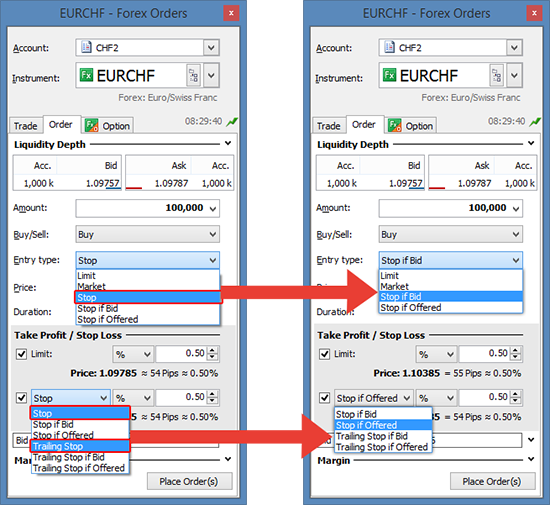

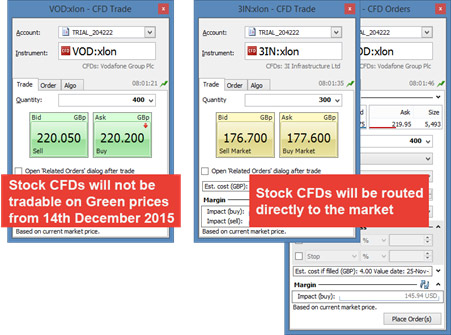

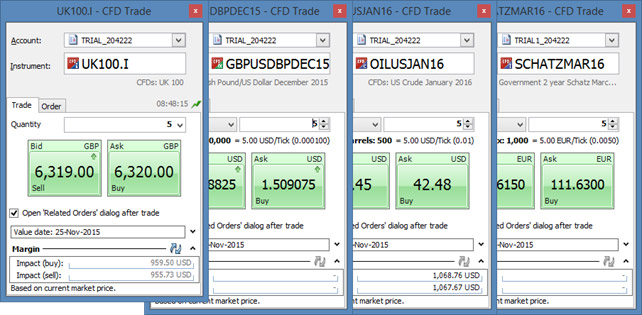

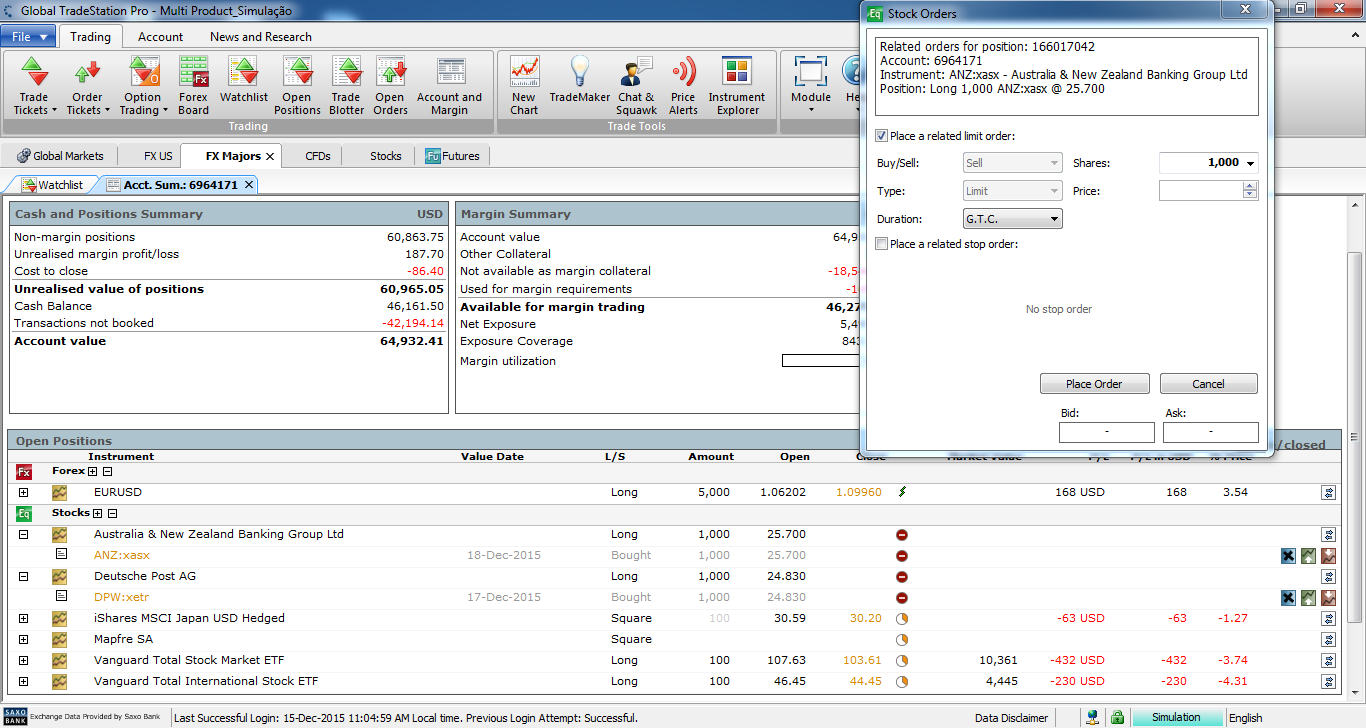

Movable Trade Tickets in GTS

The trade ticket in GTS can now be moved around the screen, enabling users to view data underneath the ticket. Once the ticket has been dismissed, it will once again appear as a centered popup the next time it is triggered.

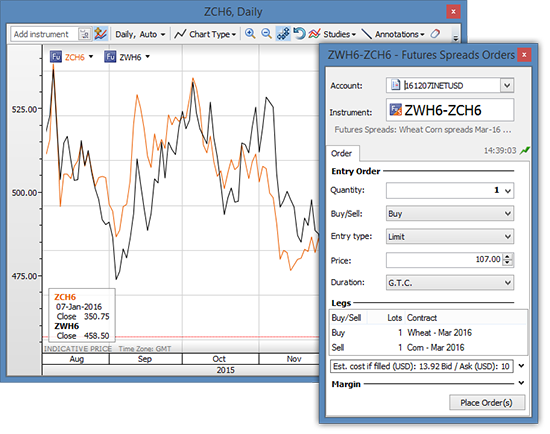

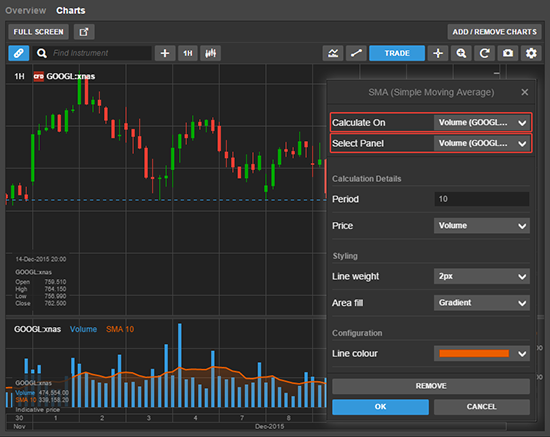

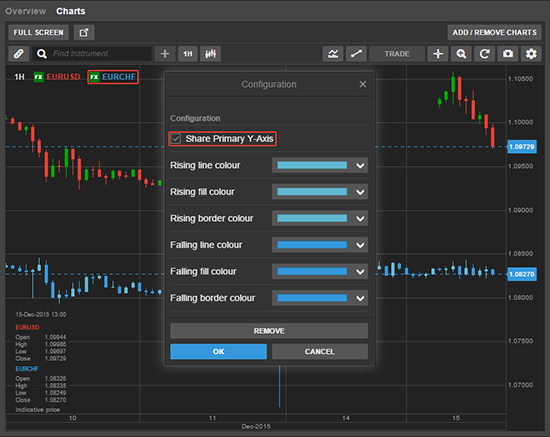

Improvements to Charts in GTS

New Price Channel Study

Price Channels are lines set above and below the price of an instrument. The upper channel is set at the x-period high and the lower channel is set at the x-period low. For a 10-day Price Channel, the upper channel would equal the 10-day high and the lower channel would equal the 10-day low. Price Channels can be used to identify support and resistance and break out Price Channels can also be used to identify overbought or oversold levels within a bigger downtrend or uptrend.

Annotations

The order of the Annotations has been changed from alphabetic to a more intuitive order starting with Lines, then Fibonacci, Figures, Measure tools, and Texts.

A new annotation has also been added to the Annotation Menu – Infinite trendline.

Collapse of Panels and Main Window

Panels and the main window in charts can now be collapsed. Just click – next to the X in the top right corner of a panel and it will collapse. To expand it again, click +.

Movable Configuration Settings for Studies and Annotations

Similar to trade tickets, the configuration dialogue for both studies and annotations can now be moved around the screen.

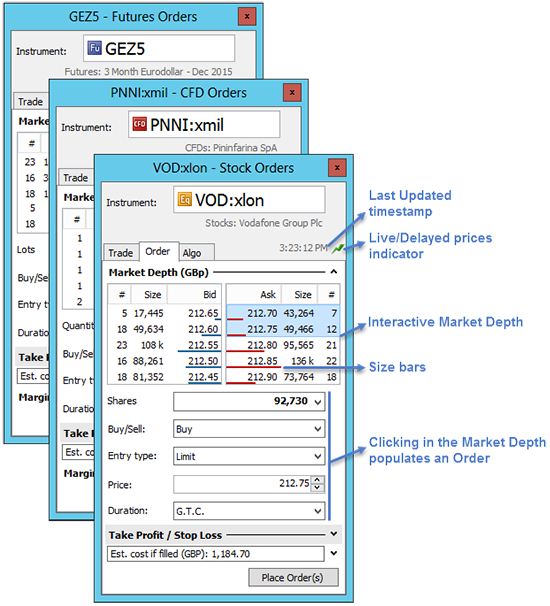

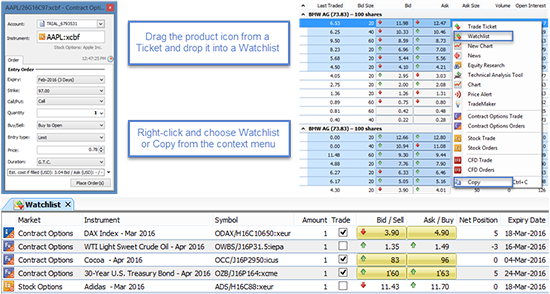

Listed Options Supported in GTS Pro Watchlists

Contract Options and Stock Options can now be added to a Watchlist in GTS Pro. This is done through drag-and-drop or right click -> Watchlist or Copy from Contract Options Chain, Trade Ticket, Order Ticket, Positions, Orders and other applicable modules.

This improvement will be rolled out with the next GTS Pro update on 8 March 2016.

Open Orders to be Renamed to Orders in GTS Pro

The Open Orders module in GTS Pro will be renamed to Orders in March 2016. The change will be applied to all languages supported in GTS Pro.

Technical Analysis Tool to be Discontinued in GTS Pro

The Technical Analysis Tool found in the News and Research toolbar in GTS Pro will be discontinued from 30 April 2016.

We are working on a new and improved solution TBA.

Operations

Market Data Changes

Real-time market data subscription for Xetra Stars instruments required

As of 1 April 2016, real-time market data for Xetra Stars instruments require a separate subscription:

| Deutsche Börse Xetra Stars | Private Users | Professional Users |

|---|---|---|

| Real-time Level 1 | 6.00 EUR/Month | 16.90 EUR/Month |

| Real-time Level 2 | 9.00 EUR/Month | 26.00 EUR/Month |

Real-time market data subscriptions for ICE instruments

Please be advised that real-time market data for ICE instruments require the respective subscriptions.

| ICE Futures Europe Commodities | Private Users | Professional Users |

|---|---|---|

| Real-time Level 1 | 110 USD/Month | 110 USD/Month |

| Real-time Level 2 | 110 USD/Month | 110 USD/Month |

| ICE Futures Europe Financials | Private Users | Professional Users |

|---|---|---|

| Real-time Level 1 | 110 USD/Month | 110 USD/Month |

| Real-time Level 2 | 110 USD/Month | 110 USD/Month |

| ICE Futures US (NYBOT) | Private Users | Professional Users |

|---|---|---|

| Real-time Level 1 | 110 USD/Month | 110 USD/Month |

| Real-time Level 2 | 110 USD/Month | 110 USD/Month |

London listed ETF instruments moving from London Stock Exchange to London Stock Exchange (ETFs)

London listed ETF instruments currently offered on the LSE_SETS – London Stock Exchange will be migrated to LSE_ETF – London Stock Exchange (ETFs). The change to LSE_ETF – London Stock Exchange (ETFs) is effective as of 1 April 2016.

Real-time market data subscriptions are not affected by this change. Data for those instruments will remain available under the London Stock Exchange subscription.

| London Stock Exchange | Professional Users | Retail Users |

|---|---|---|

| Real-time Level 1 | 41.90 GBP/Month | 4.10 GBP/Month |

| Real-time Level 2 | 165.05 GBP/Month | 6.00 GBP/Month |