Product Updates

Holiday Trading Schedule

During the Christmas and New Years period, markets and exchanges around the world will be operating under modified schedules. Please bear in mind that exchanges may be closed and thus unavailable for trading. More information will follow.

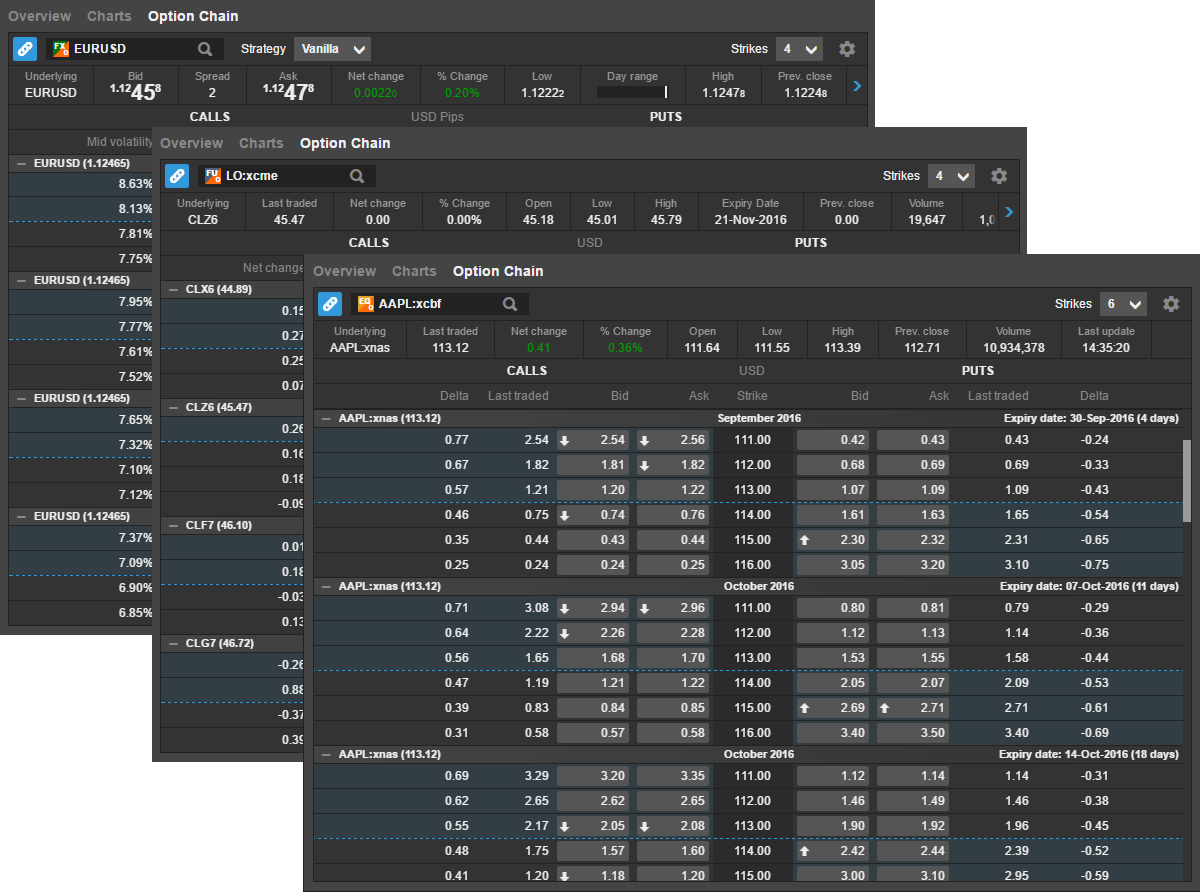

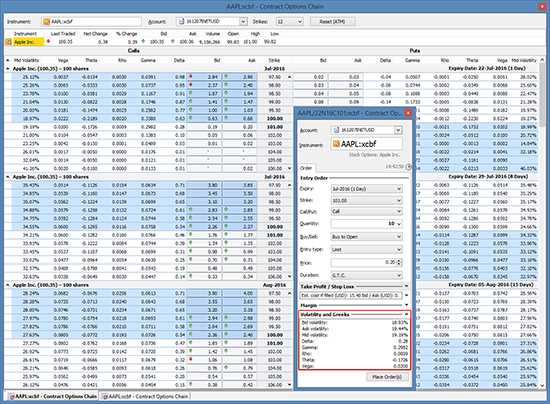

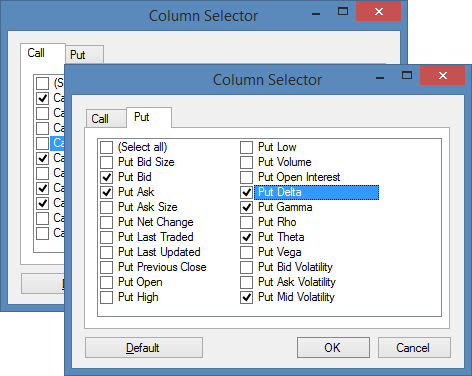

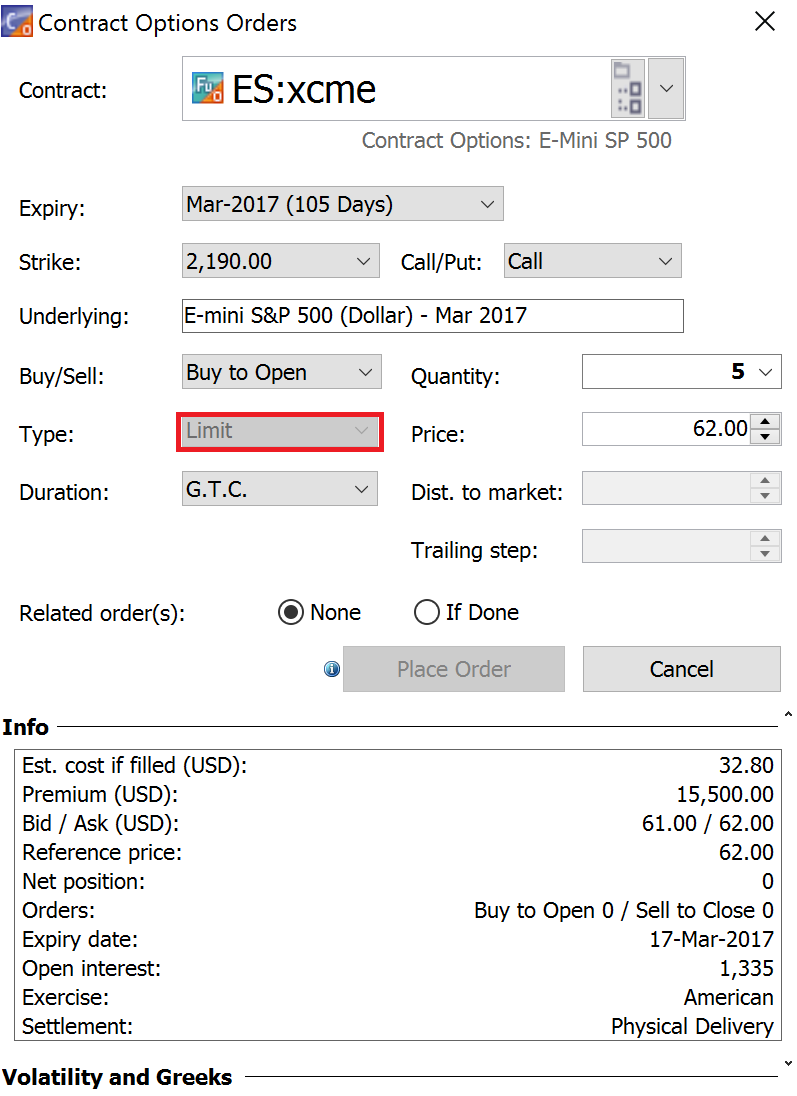

Removal of Market Orders for ETOs

Market orders on Exchange-Traded Options (ETOs) have now been removed in the trading platforms.

Generally, market orders are subject to immediate execution, but can sometimes be delayed due to high-volume, fast markets or very low liquidity. When a market order is entered on Options, traders cannot control the price at which this order is executed. One way to minimize the risk of trades being executed at a price significantly different from the last trade/quote is to enter a limit order.

GTS-Web support of IE 10 discontinued by the end of 2016

GTS will no longer be supported through the Internet Explorer 10 browser from January 2017. Internet Explorer 11 will continue to be supported for the foreseeable future.

Platform Enhancements

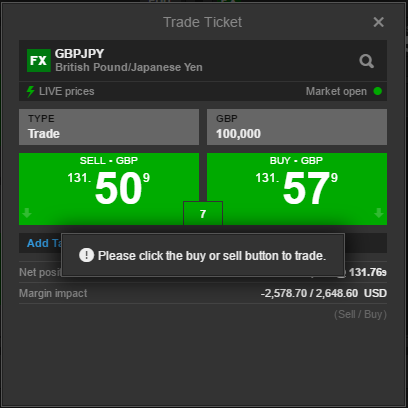

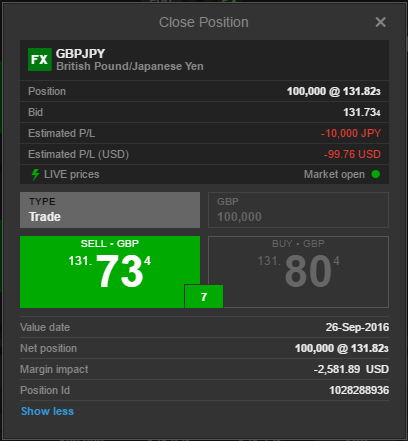

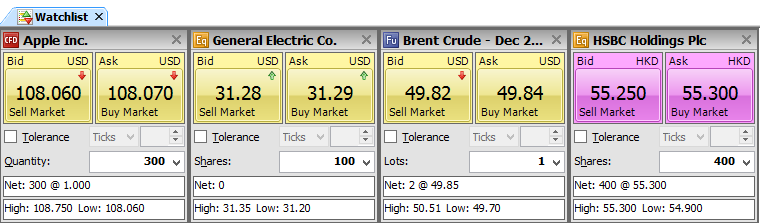

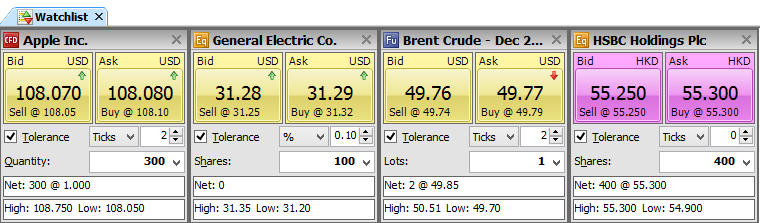

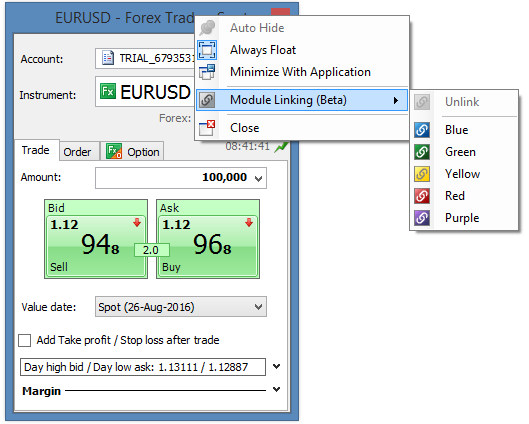

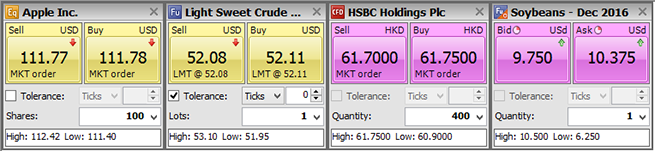

Trade Button Colors in GTS Pro

Trade button colors for Stocks, Stock CFDs, Futures and ETOs

In GTS Pro, the trade buttons for Stocks, Stock CFDs, Futures and ETOs have been modified to indicate market status:

- Yellow – live prices and market is open

- Purple – delayed prices or market is closed

Trade buttons for these instruments are now aligned with the new Order Driven Execution FX/CFD color conventions and the GTS platform as follows:

- Red/Blue – live prices and market is open

- Grey – delayed prices or market is closed

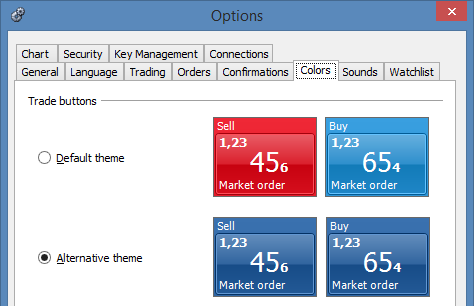

A more neutral blue trade button color is also available as an alternative to the bright red/blue colors in GTS Pro. The trade buttons colors will be red/blue by default, but you can switch to the alternative colors from Options -> Colors.

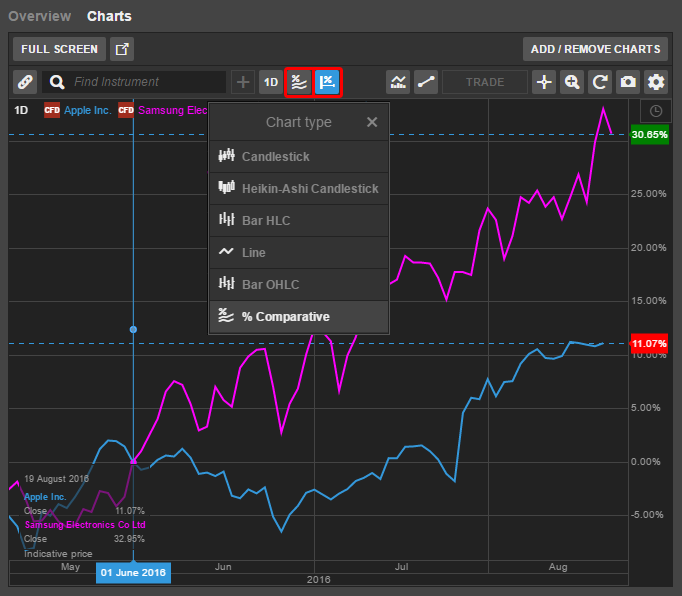

New Chart Features

Logarithmic Charts

Logarithmic charts are now available in GTS, on both Live and Simulation.

Normal charts use a linear price scale where prices are plotted equally on the y-axis. Logarithmic charts, on the other hand, plot prices so that there is an equal % change between two prices levels.

For example: on a linear chart, a $5 price distance from $20 to $25 is the same distance as from $30 to $35. When plotted on a logarithmic chart, however, the distance will be shorter, as a change from 20 to 25 represents a 25% increase, whereas from 30 to 35 is an increase of only 16.67%.

Logarithmic charts can be useful when analyzing price movements with large ranges, where the data is skewed towards the large values.

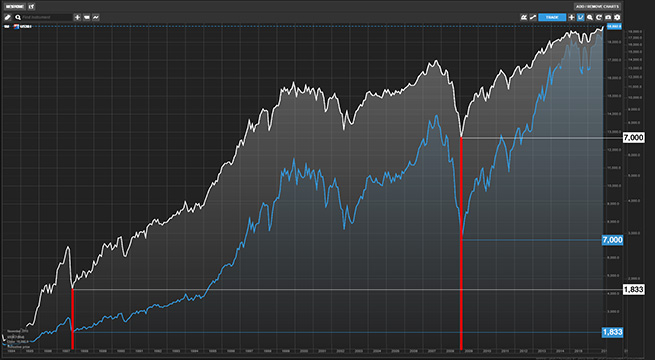

In this chart of the Dow Jones Industrial Index since 1984, the blue chart is plotted on a linear axis, and the white chart is plotted on a logarithmic price axis.

Notice that the 40% market drop in 1987 looks smaller on the linear chart, and much larger on the log chart. Similarly, the market crash during the financial crisis in October 2009 doesn’t look as impressive on the log chart compared to the 1987 crash. Also, some of the major market movements in the 1970s are barely recognizable on the linear chart but stand out on the log chart.

To switch to a log chart

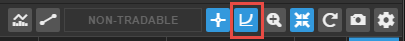

To switch to a logarithmic price scale, click the log chart icon in the chart toolbar.

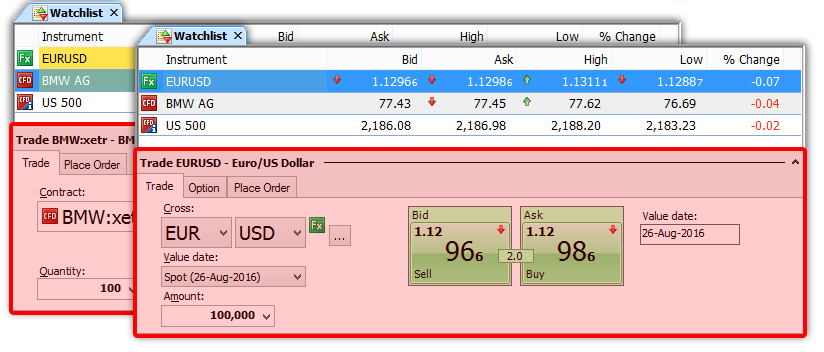

FX chart Mid-price option

A new Mid-price option is now available on FX charts in GTS.

By default, the FX charts use the Bid Price but traders could also use the Ask price under the chart settings. Now, the Mid-price between the Bid and Ask is also available from the chart settings.

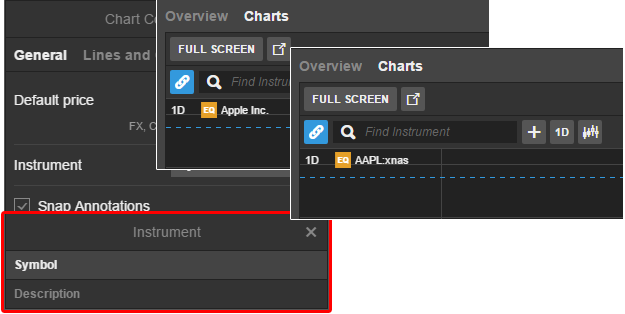

To use the Mid-price for an FX chart:

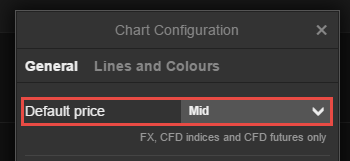

- Go to the chart configuration menu.

- Select Mid from the Default price dropdown menu.

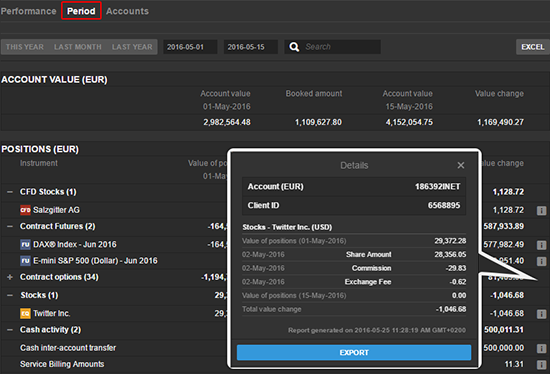

New PDF Portfolio Reports in GTS

Our new PDF Portfolio Reports allow traders to download a consolidated report of a portfolio’s performance for a specific period.

To generate a PDF Portfolio Report

The PDF Portfolio Report can be generated under Accounts > Reports in the GTS web-based platform.

To generate a report:

- Select an account (or all accounts).

- Specify a date range.

- When the report has been generated, click the download button to download the PDF.