Product Updates

News Offering Update

Termination of Dow Jones news feed

As of July 2016, the Dow Jones news feed will be removed from the GTS platform.

Introducing NewsEdge

NewsEdge is a new offering on GTS that gathers news from numerous providers.

In addition to Macro and Corporate coverage, which is available in the platform immediately, NewsEdge also provides product-specific news feeds.

All subscriptions are free and the offering includes:

- NewsEdge Macro

- NewsEdge Corporate

- NewsEdge Forex

- NewsEdge Commodities

- NewsEdge Futures

- NewsEdge Bonds

- NewsEdge Central Banks

- 11 regional news streams with local coverage in local languages

Find subscriptions in the trading platform under Account > Subscriptions > News services.

Ruble (RUB) Options & Forwards and Extension of Trading Times

FX Options and Forwards are now available for USDRUB and EURRUB on live (green) prices.

Trading in RUB FX crosses has also been extended from 16.00 GMT to 19.00 GMT.

Platform Enhancements

New Chart Features

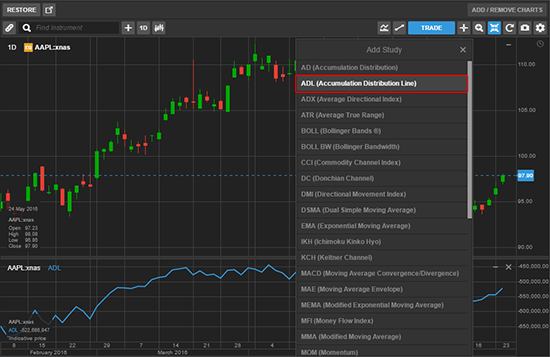

Accumulation Distribution Line (ADL) Study

The Accumulation Distribution Line (ADL) developed by Marc Chaikin is now available from the Studies menu.

Chaikin ADL is a volume-based indicator designed to measure the cumulative flow of money into and out of a security, essentially measuring the buy and sell pressure and confirming the strength of a trend.

The ADL indicates both bullish and bearish signals and relies on divergence and confirmation:

- a bullish signal is when the price is in a downtrend and the ADL is moving up.

- A bearish signal is when the price is in an uptrend and the ADL is moving down.

This study relies on trade volume so it is only available on exchange-traded products and is not available on OTC products such as FX.

Triple Exponentially Smoothed Moving Average (TRIX) Study

Triple Exponentially Smoothed Moving Average (TRIX) is a momentum oscillator developed by Jack Hutson and shows the % change in a triple-exponentially-smoothed moving average. It filters out insignificant prices and if you add a normal exponentially moving average to the TRIX study panel it works in a similar way to MACD. However, since it is triple-smoothed it is more smoothed than MACD.

Similarly to MACD, the lines fluctuate around 0 (zero) and when adding an EMA you look for divergence where the signal line crosses over for buy/sell and zero crossover line.

Money Flow Index (MFI) Study

Money Flow Index (MFI) is an oscillatior developed by Avrum Suodack and Gene Quong, which uses both volume and price to measure buy and sell pressure on a security. The output value ranges from 0 to 100 and works like an RSI – MFI is also known as volume-weighted RSI.

Investors are looking for divergence – when the MFI moves in the opposite direction of the price.

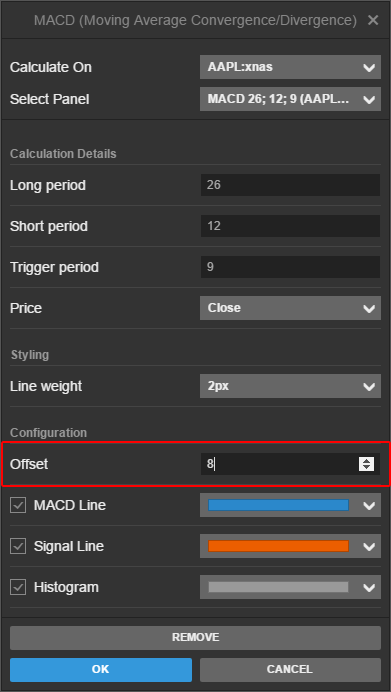

Study Offsets

A new Offset feature is now available from the configuration dialog for studies where you can move a study left into the past or right into the future by up to -100 to 100 periods. The underlying calculation does not change this feature, only moves the study left or right on the chart.

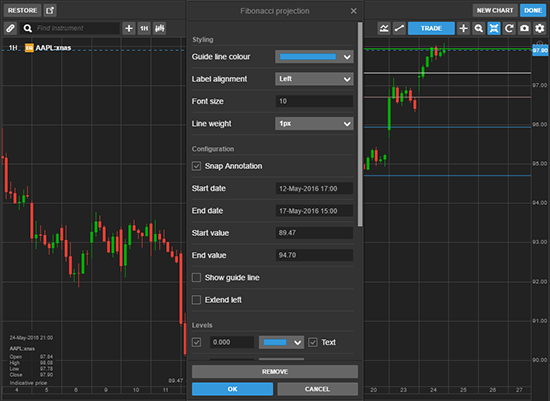

Fibonacci Projection annotation

A new Fibonacci Projection annotation is now available from the annotation menu in the chart.

Previously this was available through the Fibonacci Extension annotation by placing the two last placements at the same level, but it can now be added more efficiently in two clicks.

Snap Annotation option

Previously, snap for annotation was only available in the configuration settings, controlling snap on all annotations. You can now also select / de-select snap on each individual annotation in the annotation configuration settings.

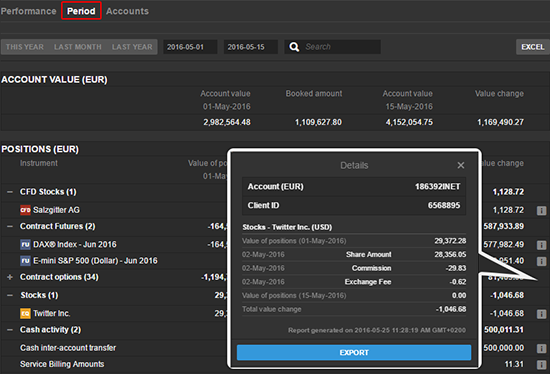

New Periodic Overview Report

Now available on GTS, the new Period Overview report shows account value development itemized as profit and loss per traded instrument and cash bookings, and allows analysis of broader, long-term trading trends.

The Period Overview report will be available in the Account section of the GTS platform and will show the development of a selected account or across all accounts.

The info icon (i) on each post gives access to full details of the post including:

- the value of the position at the start and end of the period

- a summary of all individual bookings for the instrument throughout the period

Excel Export

The extended Excel function allows you to export each booking in the period showing the value at the start and end of the period and offers granularity and flexibility of the data.

The report can also be exported as PDF.

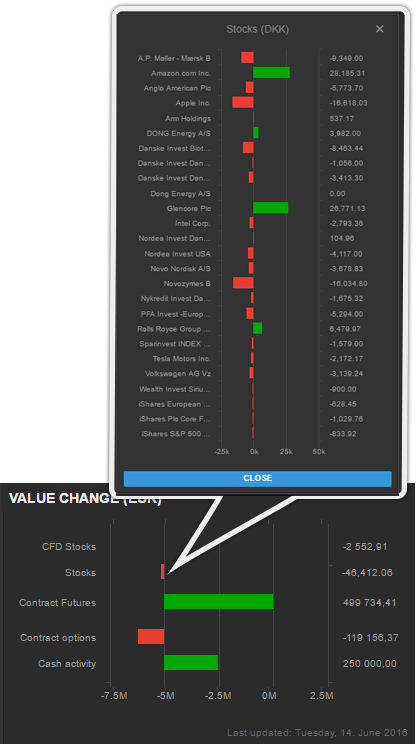

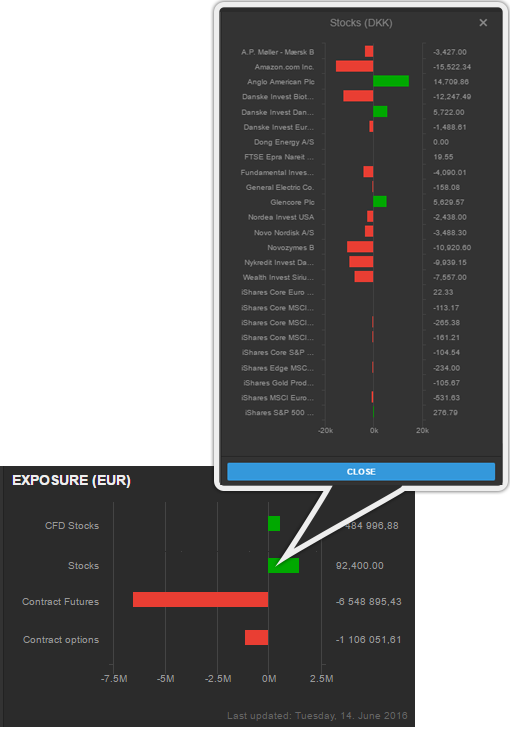

New Exposure Bar and Value Change Charts

The Performance report in the Account Overview now contains new Exposure and Value Change bar charts, which provide a breakdown of exposure and value change in each asset class for the selected period, and make it possible to drill-down into the exposure and change in underlying securities.

For the account, or all accounts, selected in the account drop-down, the exposure bar chart shows exposure per asset class at the end of the selected period.

Short positions are shown as red negative values and long positions will be seen as green positive values.

Margin Products

For margin products like CFDs, Futures and FX, the exposure is equal to the value of the underlying positions.

Cash Positions

For cash products like Stocks and Bonds, the exposure is equal to the market value of the position.

Options Premiums

For Options, the exposure is equal to the premium which can be both positive if long and negative if short.

All values are converted into the currency of the selected account.

Exposure to underlying securities

The Exposure Chart also makes it possible to drill-down into the underlying securities by clicking on the bar for each asset class, which shows holdings at the end of the last trading day in the selected period.

Value Change Chart

The Value Change chart shows the contribution to the account value for each asset class for the selected period and gives an overview of the same data shown in the period report.

Positive contributions are shown in green and negative contributions in red.

All values are converted into the currency of the selected account.

Cash activity

Cash activity is also itemised with its own bar and shows the net cash activity in the selected period. This can include cash transfers, interest and subscription fees.

Underlying Security Contributions

The Value Change chart also makes it possible to drill-down into the contributions from underlying securities by clicking on the bar for each asset class.

This shows the contribution for each security for the selected period and NOT over the full lifetime of the position.