During Easter, markets and exchanges around the world are closed at certain times. Global Trading’s operating hours over this period are given below. Please note that even during these hours some markets and exchanges may not be available.

FX and Metals Schedule*

| DATE | FX | FX METALS |

|---|---|---|

| Good Friday | Closed | Closed |

*May be subject to change, depending on liquidity providers and venues.

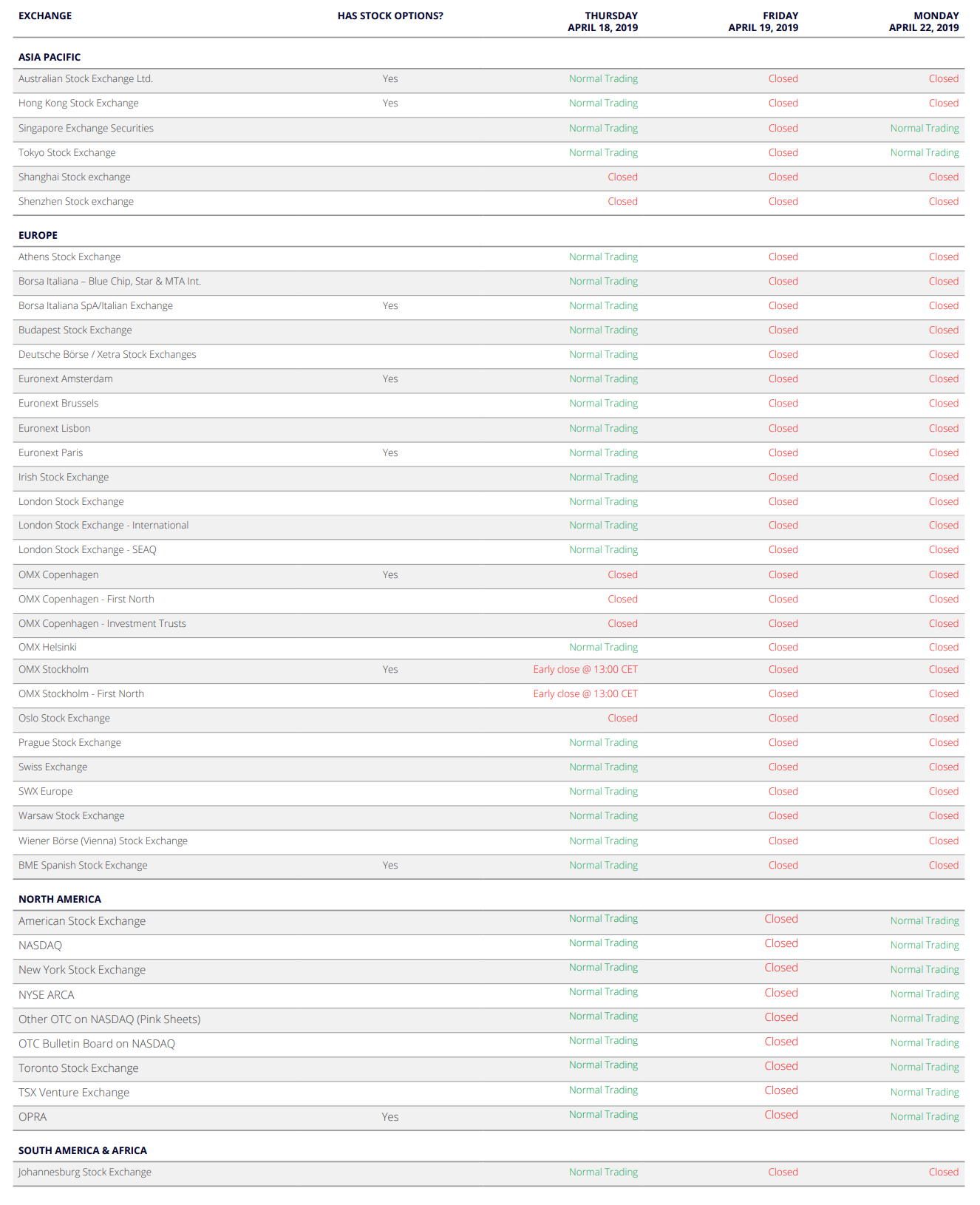

Stocks and Stock Options

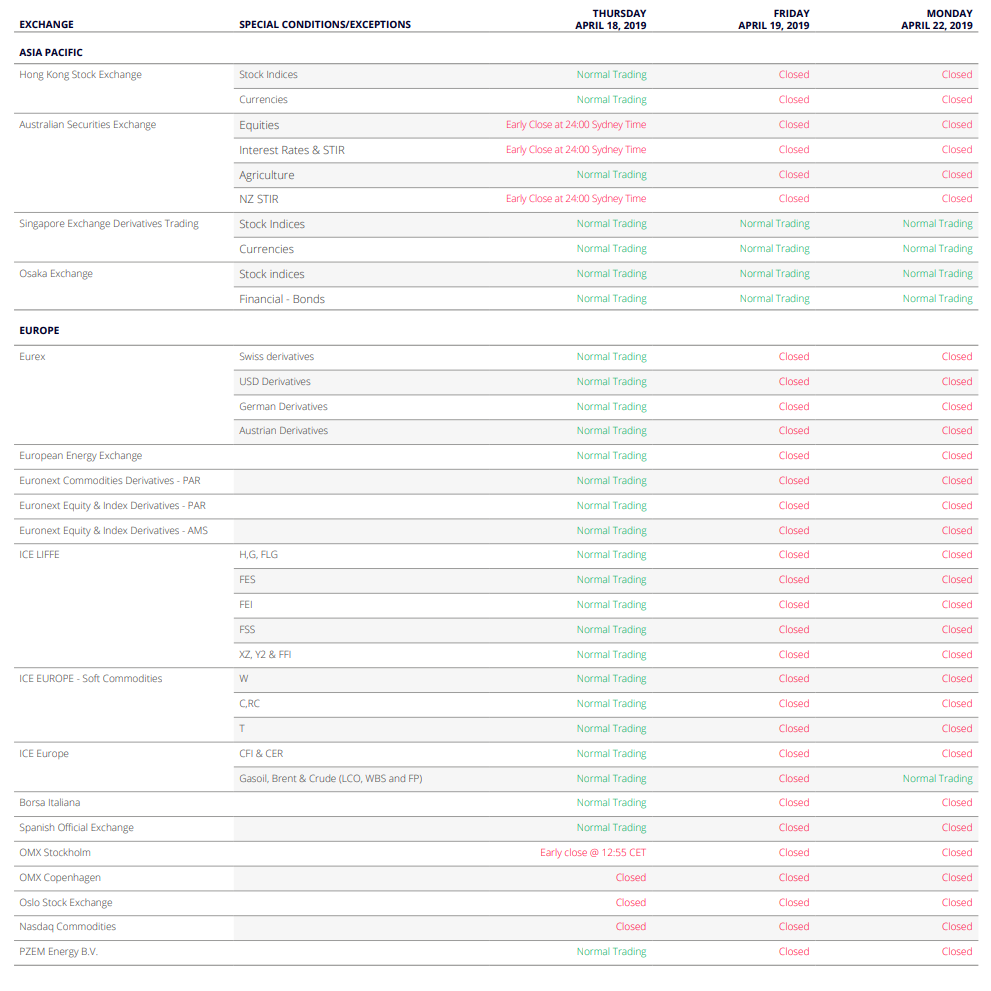

Futures and Options

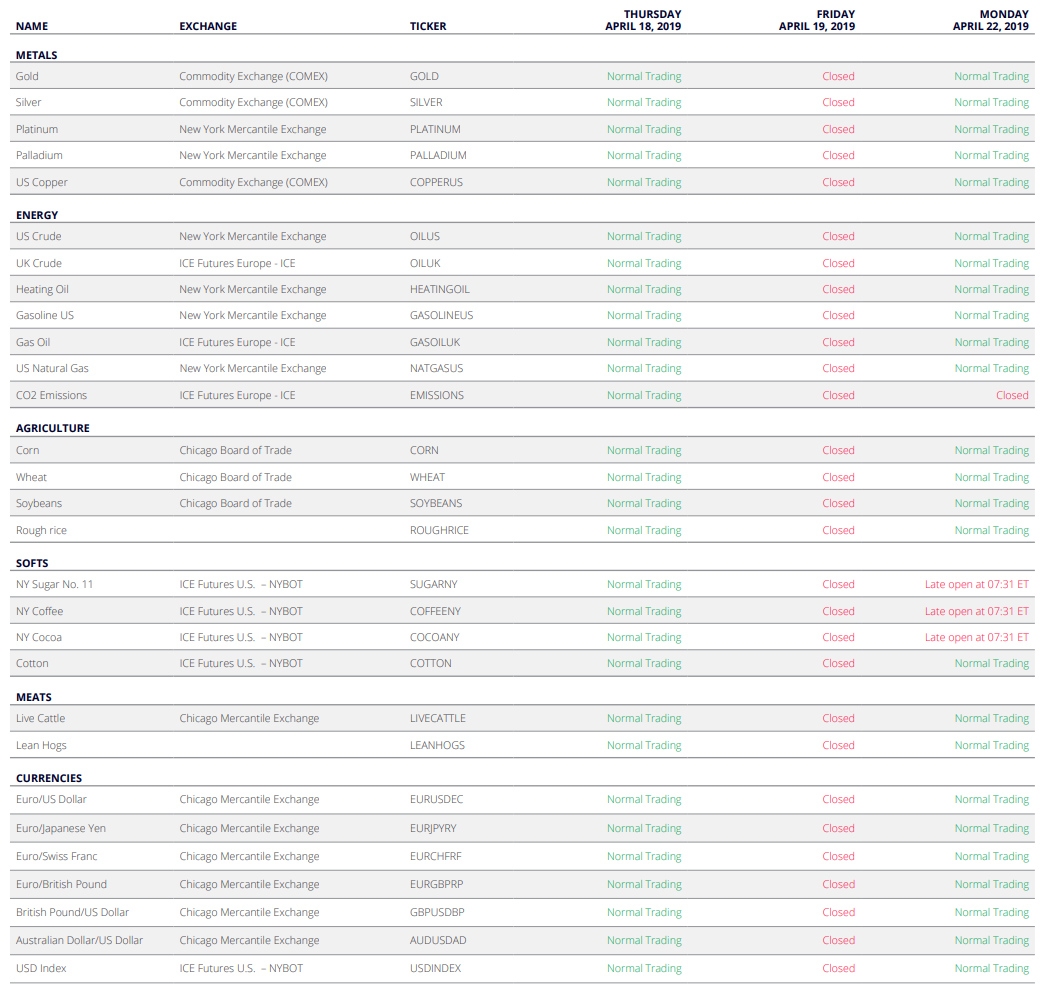

CFDs on Futures

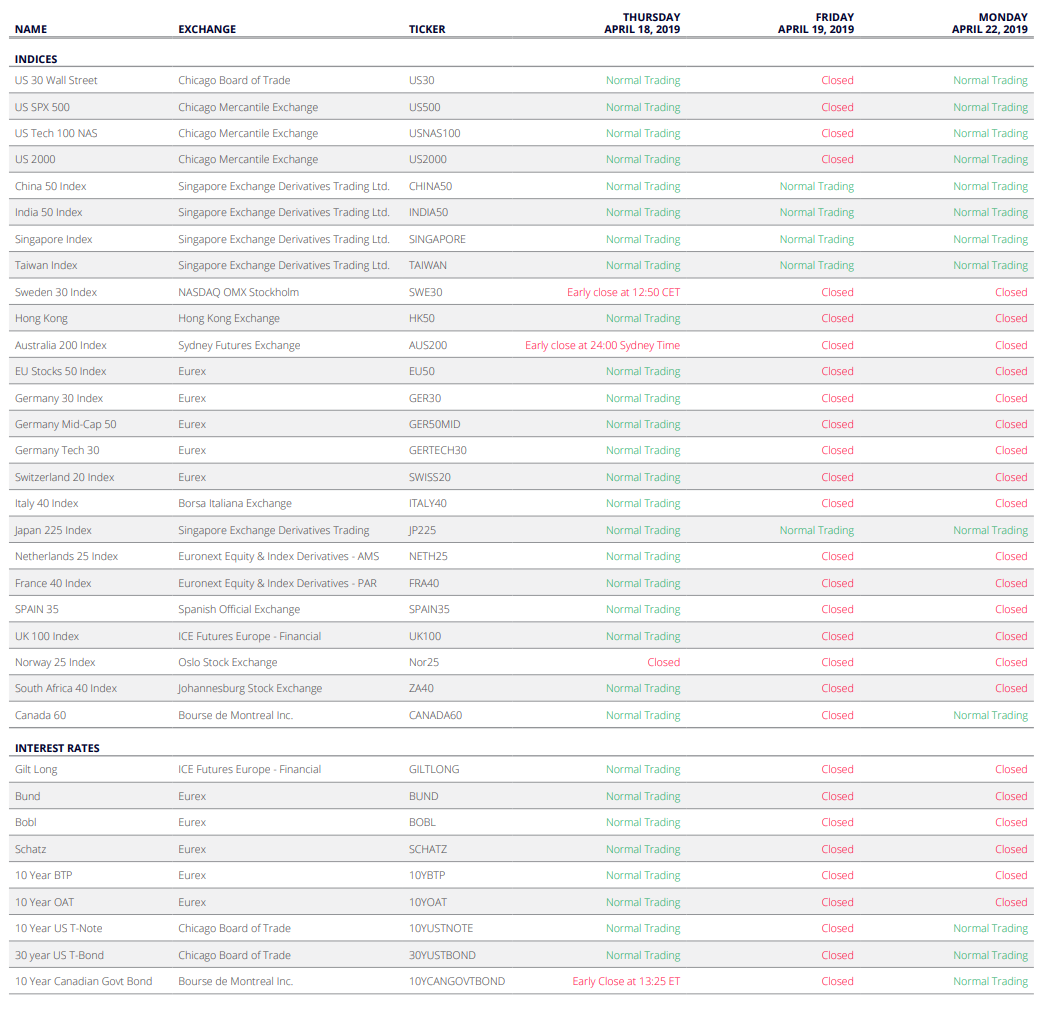

CFD Index Tracker

April 2019 New Products & Platform Updates

Product Updates & Enhancements

New product overview in GTS and GTS Pro

In April, we will be launching a major upgrade to the Product Overview pages in GTS and these pages will be made available in GTS Pro.

The overview pages will continue to offer an in-depth overview of the instrument selected in the watchlist, positions list, order list or through the global search function in the platform.

Summary

The Summary tab will continue to offer market overview for the instrument and can include:

- -market depth (for exchange traded instruments)

- -a simple range chart showing price movements for a selected period

- -Trade Signals (from Autochartist)

- -news

More sections with more information are planned in the near future.

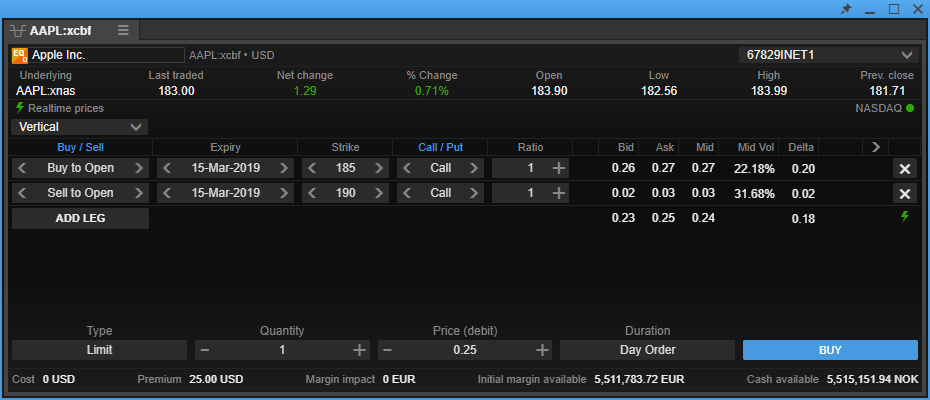

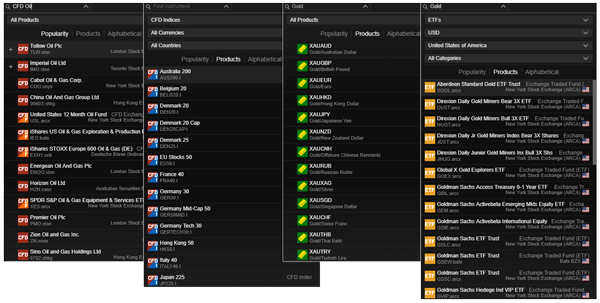

Combination orders for Exchange Traded Options in GTS and GTS Pro

In April, we will launch an Option Strategies trade ticket in the GTS desktop and GTS PRO platforms offering multi-leg exchange-traded option trades.

The new Option Strategies module:

- -offers a choice of common option strategies

- -supports custom strategies with up to 4 legs

- -will be launched from the option chain

- -will initially support US listed options

- -supports configurable columns for Greeks and market data

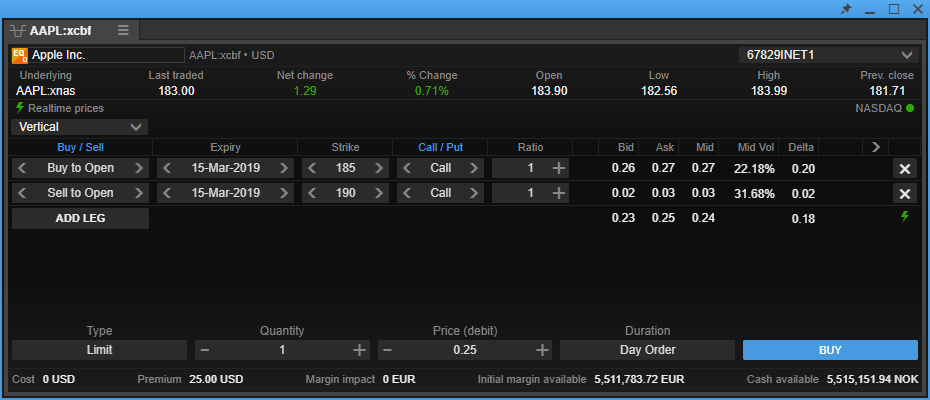

New Net FX Exposures module in GTS Pro – from April

In April, we will be launching a new FX Exposures module in TraderPRO which will give a detailed breakdown of your net FX exposures by currency.

The FX Exposures module will be available from the TraderPRO Menu as a module that you can dock in your workspace.

FX Exposures shows a breakdown of net position by currency for a selected account or group of accounts.

The columns show your net FX exposures:

- -by currency

- -in your account currency a

- -in USD

Customizable columns offer sorting by currency, exposure in account currency or exposure in USD. Exposures can be itemized by trade, P/L and cash components of the exposure.

The FX Exposure module also displays your exposure limit for each exposure currency the % utilization, and your total FX Net Open Position (NOP) exposure limits.

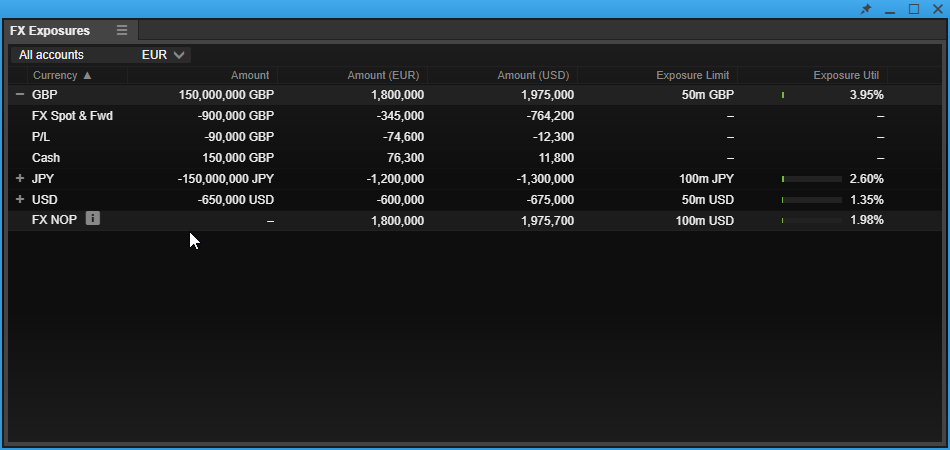

Advanced search – available from April

From April, an enhancement to the search will be available allowing you to refine searches by for example product, currency, country and sector and will allow you to sort results by product, popularity or alphabetically.

The down arrow on search fields will give access to the Advanced search options which allow you to filter results by:

- -Product (FX, FX Options, CFD indices, CFD Stocks etc.)

- -Currency (USD, EUR, GBP, etc.)

- -FX category (Majors, Minors, Exotics)

- -Country (for exchange listed products, Mutual Funds and Bonds)

- -Sector (for stocks, futures and CFDs)

- -Type (bonds, mutual funds, ETFs)

Results can further be sorted by:

- -Popularity (default option)

- -Product

- -Alphabetically

New chart feature

2- and 3-minute chart intervals are now available on charts in the TraderGO and TraderPRO platforms.

These can be added to the Period selector in charts by clicking the Customize link in the selector.

Operational Changes

Equity Research services discontinued

As previously announced, Equity Research will be discontinued in April 2019 and the Equity Research and Stock Screeners will be removed from all platforms.

Please contact [email protected] if you have further questions about these changes.

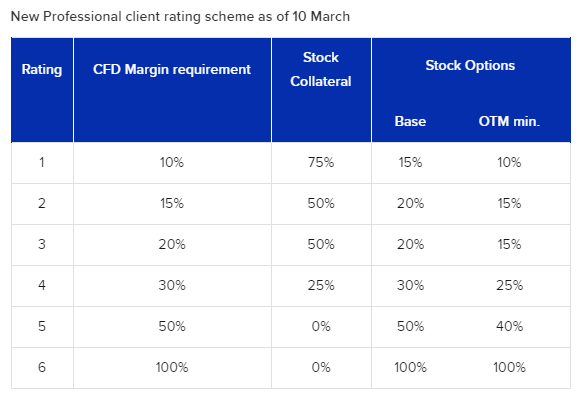

New equity risk rating model

EFFECTIVE: Sun, 10 March 2019 at 12:00 GMT

We are implementing a new equity risk rating model on the March 10th. These changes will impact single stock CFDs and short stock option position margin requirements, and where applicable, the collateral for cash shares/ETF positions.

You should be able to see all the scheduled changes and how they could impact current positions in the platform’s ‘Margin Monitor’ tool. The tool can be accessed via the ‘Info’ icon, under ‘Account Summary’.

Clients that could have been exposed to a large margin usage swing have been contacted individually.

If you have any questions, please send us an email at [email protected]

February 2019 New Products & Platform Updates

Product Updates & Enhancements

FX trailing stop order handling

From 19 December 2018 we have implemented a small but significant change to the way that we handle FX trailing stop orders.

- -Trailing stop if offered orders to sell will now follow the bid price (previously they followed the offer). They will continue to be triggered on the offer price.

- -Trailing stop if bid orders to buy, will now follow the offer price (previously they followed the bid). They will continue to be triggered on the bid price.

Previously, where a trailing stop if offered order to sell followed the offer price, spread widening would result in the stop order being dragged higher by a temporary spike. When the spread returned to normal levels, the stop order would then be triggered resulting in unexpected trailing stop behaviour.

We have therefore made this small change to protect clients from unexpected order fills as result of spread widening around market volatility or market opening e.g. Sunday open.

New chart features

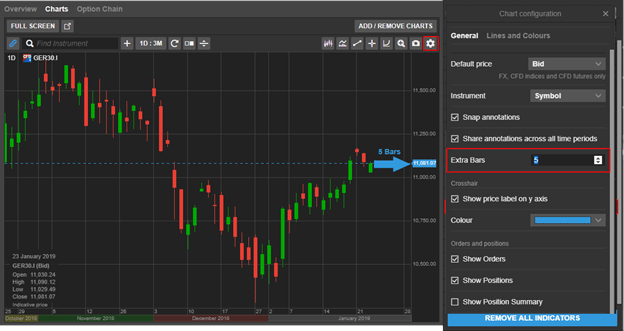

Extra bars

Extra Bars is a useful new feature that allows you to create space between last updated bar or candle and the y-axis, adding space for projecting annotations into the future.

You can add space from chart configuration menu available from the right-click menu (desktop) or the chat settings icon.

Annotation persistence across chart windows

Chart annotations are now remembered for each instrument and will be available whenever you open a new chart for the instrument.

If you have several instances of a chart open for the same instrument, the most recent changes to the chart annotations will be used.

Time range persistence when zooming

If you zoom or pan in the chart, the chart now persists the time range if you close and reopen the platform, detach the chart or select another instrument. If I pan the chart to show a time range of 2016 – 2017 for example, opening a new instrument in the chart will show the time range 2016 – 2017.

Click on the Reset icon ![]() to quickly reset to the time range selected.

to quickly reset to the time range selected.

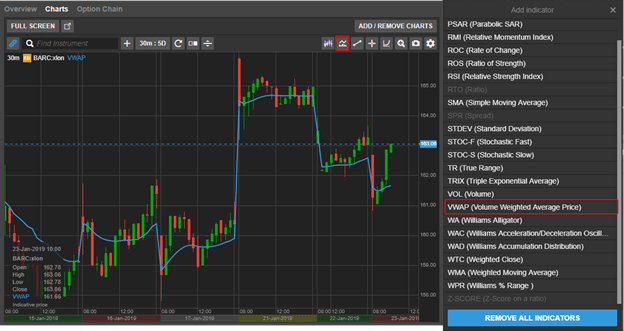

Improved Volume Weighted Average Price (VWAP) indicator (9th February)

The calculation behind the Volume Weighted Average Price (VWAP) indicator will be improved to more accurately display the average weighted price by volume – the value of all trades in a trading session divided by trading volume.

VWAP is similar to a moving average with a lagging indicator used on intraday time periods only. Contrary to the moving average, VWAP accumulates volume throughout the trading session.

VWAP can be used to compare the current price to the VWAP value to determine the general direction for the instrument – if current price is below the VWAP line prices are falling, if above prices are rising.

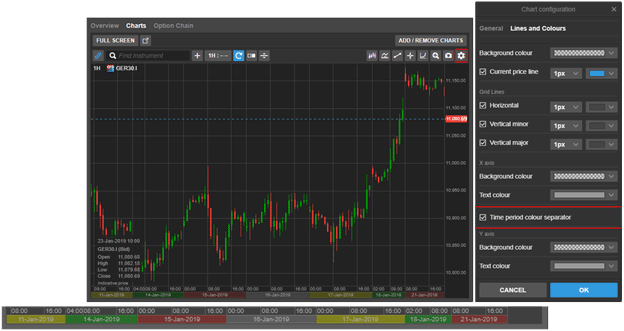

X-axis time period colour separator (9th February)

To improve the readability you will be able to add colours to the x-axis to make it easier to quickly identify different trading periods.

Go add colours to the time period under Chart Configuration > Lines and Colours the check the Time period colour separator checkbox

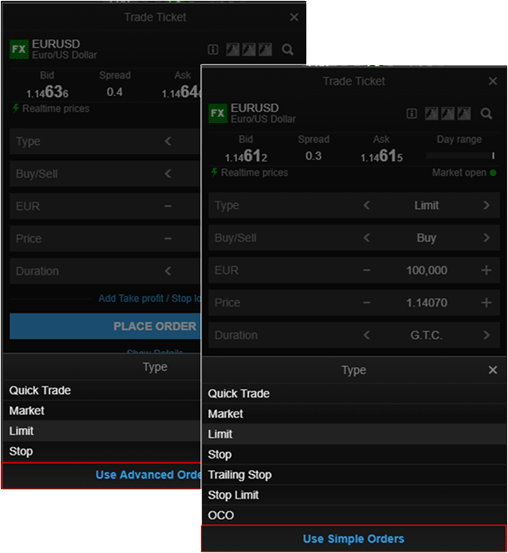

Simple order types in GTS Web

From February, an option will be available in the Trade Ticket when placing orders, allowing you to simplify the order types, hiding complex order types and limiting the list to Market, Limit and Stop orders used by most clients.

Design updates

A number of design updates to GTS Mobile will be released in the coming months. In close contact with clients, we have been making a number of usability improvements to the mobile trader. Most notably we will increase the font sizes and certain navigation buttons and icons to improve legibility and navigation.

Font sizes will also be increased on GTS Mobile on the desktop.

A number of enhancements will soon be released in the GTS Pro platform allowing traders to more efficiently navigate the platform using the keyboard.

FX stop order simplification

From February 2019, FX stop orders will be simplified where Stop if Bid and Stop if Offered will be labelled Stop orders throughout the platform in trade confirmations and order and position lists. Similarly, Trailing stop if Bid and Trailing Stop if Offered orders will be labelled Trailing Stop orders.

These orders will continue to be placed and triggered in the same way.

Operational Changes

Mandatory event notifications and corporate actions on Bonds

To provide better service clients, we are happy to announce that from 4th February 2019:

Notifications on mandatory corporate events

Corporate Action Notifications will be provided on mandatory events for Stocks, Bonds and Mutual Funds.

Clients can access this information under Account > Other > Corporate Action Mandatory Events. Events will be shown until their Ex date/effective date + 30 days.

Equity Research services discontinued

Equity Research available through the platforms will be discontinued in April 2019.

We are working on a replacement for this service which will be available before the Equity Research is retired.

Spot metal XPDUSD to be discontinued

Due to a deterioration in the underlying liquidity available in XPDUSD, we are no longer able to support trading in Palladium/USD.

From Monday 21 January 2019 clients are no longer be able to open new positions in XPDUSD and by Friday 15 February 2019 all existing positions must be closed. After this date, we will close all open positions and cancel any open orders on your behalf.

Please note that should you wish to gain exposure to Palladium, we continue to offer trading of Palladium CFDs and Palladium (PA) Futures.

Please contact [email protected] if you have further questions about these changes.

New standard margin rates as of 21 November 2018

Dear client,

On Wednesday 21 of November 2018 at 08:00 GMT we will be implementing new standard margin rates for FX and CFDs. These margin rates will remain in effect until further notice.

These margin rates will remain in effect until further notice, as we continue to monitor the geopolitical and market situation closely.

What will the margin rates be?

The following tables gives you an overview of the affected instruments on your account.

FX

| FX | Current minimum margin | Minimum margin from 21 November |

|---|---|---|

| SEK | 2.5% | 3.0% |

| RUB | 7% | 7.5% |

CFDs

| Index Tracker CFDs | Current minimum margin | Minimum margin from 21 November |

|---|---|---|

| EU Stocks 50 | 3% | 4% |

| Swiss 20 | 3% | 4% |

| France 40 | 3% | 4% |

| Netherlands 25 | 3% | 4% |

| Germany 30 | 3% | 4% |

Commodity CFDs

| Commodity CFDs CFDs | Current minimum margin | Minimum margin from 21 November |

|---|---|---|

| NY Cocoa | 5% | 8% |

| Cotton | 4% | 5% |

| Soybeans | 4% | 5% |

| Silver | 8% | 5% |

| Gasoline US | 8% | 5% |

| UK Gas Oil | 8% | 5% |

| Heating Oil | 8% | 5% |

You can check the upcoming changes to margin rates and collateral requirements for your respective margin profile in the trading platform under ‘Account – Margin and Collateral’.

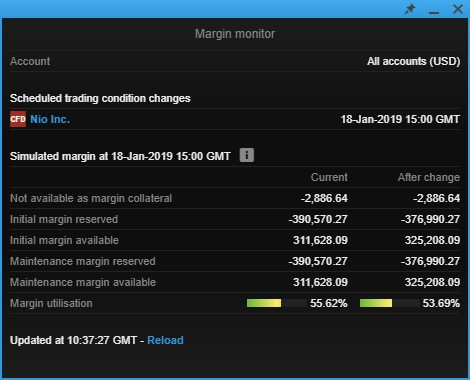

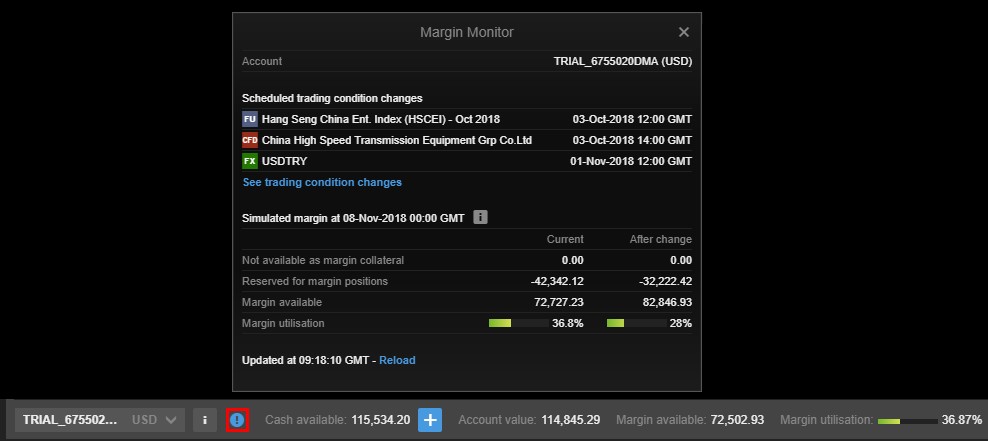

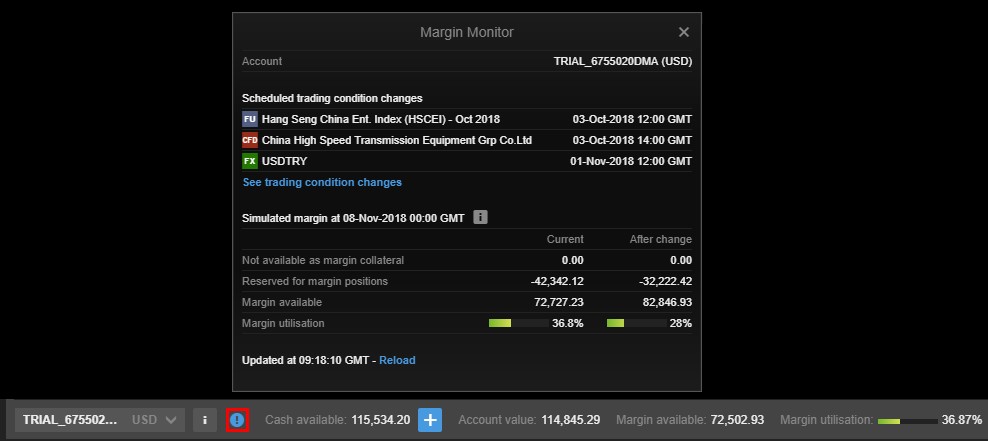

Margin Monitor Feature

Since Monday 22 October, the new ‘Margin Monitor’ feature is be available in GTS Web and GTS Pro, to complement the existing Margin and Collateral changes module. This provides an overview of the positions that are affected by margin changes, and shows the current and the simulated margin after all changes have been applied.

Access to the Margin Monitor

The Margin Monitor will be available through an icon on the Account Toolbar (on the Account Summary in GTS Pro). The Margin Monitor is also available in My Account.

How does this impact your trading?

If you have open positions in any of the affected markets, please ensure that you monitor your positions carefully and maintain sufficient funds in your account to meet the increased margin requirements during this period of turmoil.

We recommend you keep the following in mind, especially when trading during periods of potential market volatility:

- Consider placing relevant resting orders in advance. Market liquidity may vary substantially, and trade/quote requests may be unavailable at times as existing resting orders and new market orders are filled as priority

- Market orders are not guaranteed to be filled at any specific price – they will be filled “at best” according to available market price when processed

- Stop Loss orders are converted to Market orders once triggered, so are not guaranteed to be filled at your stop order level – gaps in available liquidity can result in significant slippage on Stop orders

- Using Stop Limit type orders (rather than Stop Market) can be very beneficial as they allow the client to specify the worst acceptable immediate fill rate after triggering, and they will rest in the order book if not able to be filled immediately

- Buying options (i.e. puts to protect long positions and calls to protect short positions) could be a hedging vehicle suitable for market uncertainty since they offer protection at the fixed Strike price, rather than Stop orders where fills on gapped prices can occur

If you have any questions, please contact [email protected].

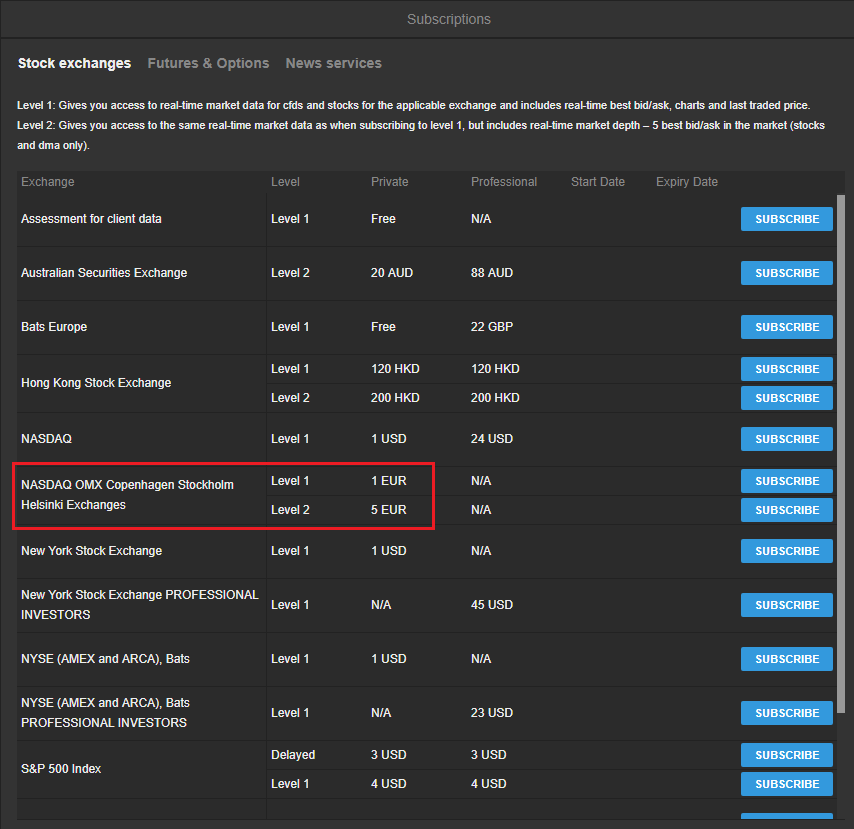

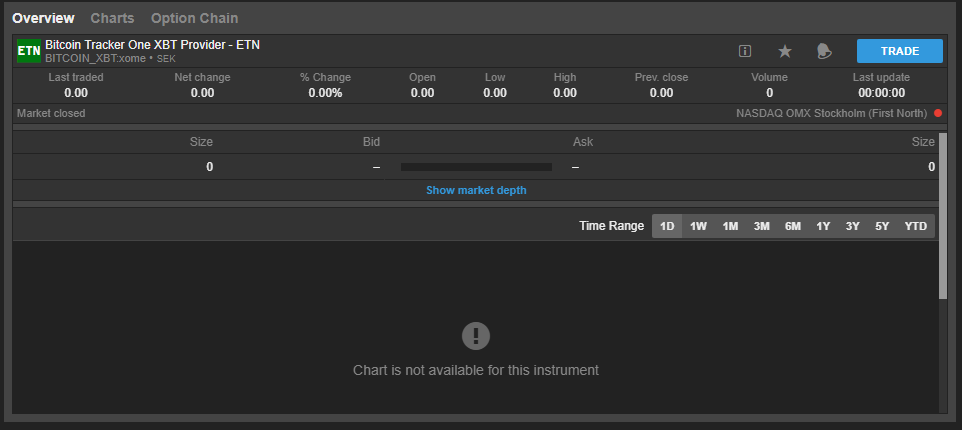

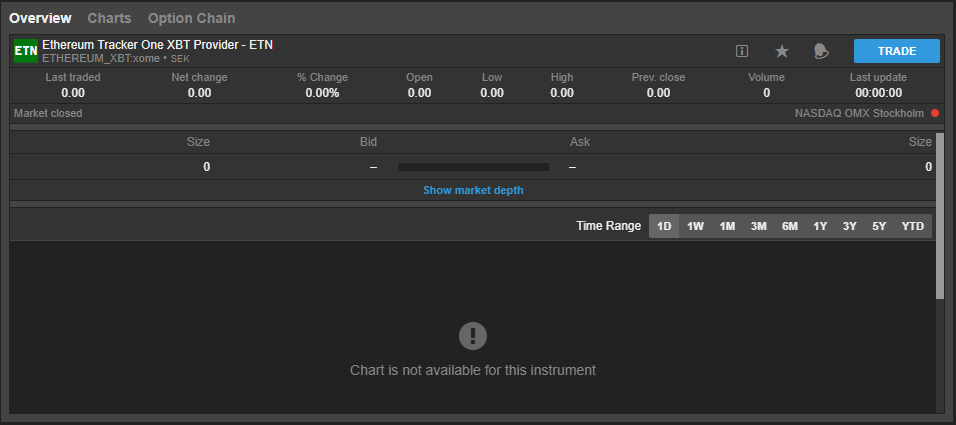

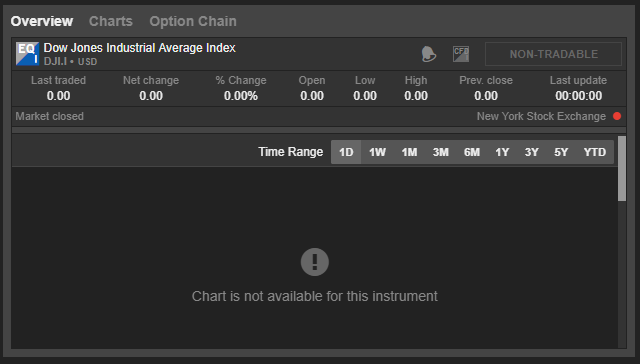

Removal of Non-Professional Subscriptions to Nasdaq OMX Nordic Equities for both live and delayed data

EFFECTIVE: Jan 01st 2019

Please be advised that we are no longer going to be supporting Nasdaq OMX Nordic Equities Subscriptions due to changes in the Nasdaq OMX Nordic Equities exchange licensing policies associated with this subscription. Existing subscriptions will be terminated and the ability for clients to subscribe to this exchange as non-professionals will be removed. Professional subscriptions have been removed on Aug 1st 2018 as previously communicated here.

Subscriptions to be removed

Current view of the instruments

Instruments on OMX that show zero on the price are supposed to be still tradable.

Please contact [email protected] if you have further questions about these changes.

New standard margin rates for CFDs from 2 November 2018

Dear client,

On Friday 2 November 2018 at 08:00 GMT we will be implementing new standard margin rates for CFDs, as a result of the continued uncertainty surrounding the Brexit negotiations.

These margin rates will remain in effect until further notice, as we continue to monitor the geopolitical and market situation closely.

What will the margin rates be?

The following table gives you an overview of the affected instruments on your account.

CFDs

| CFDs | Minimum margin from 2 November |

|---|---|

| UK 100 | 5% |

| EU Stocks 50 | 4% |

| Swiss 20 | 4% |

| France 40 | 4% |

| Netherlands 25 | 4% |

| Germany 30 | 4% |

You can check the upcoming changes to margin rates and collateral requirements for your respective margin profile in the trading platform under ‘Account – Margin and Collateral’ from Friday 19 October 2018 and onwards.

Margin Monitor Feature

From Monday 22 October, a new ‘Margin Monitor’ feature will be available in GTS Web and GTS Pro, to complement the existing Margin and Collateral changes module. This gives you an overview of the positions that are affected by margin changes, and shows the current and simulated margin after all changes have been applied.

Access to the Margin Monitor

The Margin Monitor will be available through an icon on the Account Toolbar (on the Account Summary in GTS Pro). The Margin Monitor is also available in My Account.

How does this impact your trading?

If you have open positions in any of the affected markets, please ensure that you monitor your positions carefully and maintain sufficient funds in your account to meet the increased margin requirements during this period of turmoil.

We recommend you keep the following in mind, especially when trading during periods of potential market volatility:

- Consider placing relevant resting orders in advance. Market liquidity may vary substantially, and trade/quote requests may be unavailable at times as existing resting orders and new market orders are filled as priority

- Market orders are not guaranteed to be filled at any specific price – they will be filled “at best” according to available market price when processed

- Stop Loss orders are converted to Market orders once triggered, so are not guaranteed to be filled at your stop order level – gaps in available liquidity can result in significant slippage on Stop orders

- Using Stop Limit type orders (rather than Stop Market) can be very beneficial as they allow the client to specify the worst acceptable immediate fill rate after triggering, and they will rest in the order book if not able to be filled immediately

- Buying options (i.e. puts to protect long positions and calls to protect short positions) could be a hedging vehicle suitable for market uncertainty since they offer protection at the fixed Strike price, rather than Stop orders where fills on gapped prices can occur

If you have any questions, please contact [email protected].

October 2018 New Products & Platform Updates

GTS desktop and tablet ticket upgrades

During the month of October, we will be updating the trade and order tickets available in GTS for desktop and tablet, aligning the platforms with the current ticket offerings in GTS Mobile and GTS Pro.

Keyboard controls for GTS and GTS Pro

We now have keyboard controls in grids which have been focused on (i.e. active window in GTS Pro or part of the workspace that has been clicked on with the mouse).

- Cursor up and down will move up and down items in selected grid

- Page up and down will work as expected

- Same for HOME and END keys

- ENTER will trigger primary action in same manner as mouse double click and launch:

- Trade Ticket from Watchlist

- Modify order ticket from Orders blotter

- Close position dialogue from Positions grid

- Trade Ticket from Closed positions grid

September 2018 New Products & Platform Updates

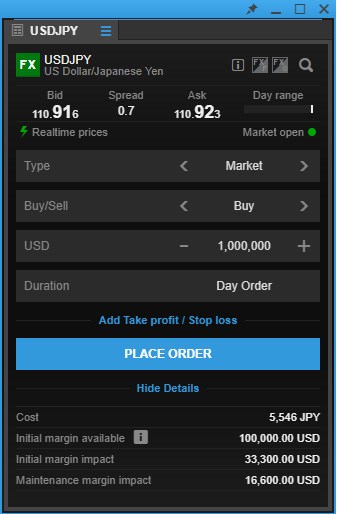

Initial margin now available in trade ticket

For those regions where margin instruments have an initial and maintenance margin configured, initial margin available is now shown in trade tickets in all platforms in addition to the initial and maintenance margin impact. Initial margin available shows the funds available for opening new margin positions.

New trade ticket in GTS

A new trade ticket will be available in GTS from 20 September 2018 — already available in GTS Pro, and GTS Mobile.

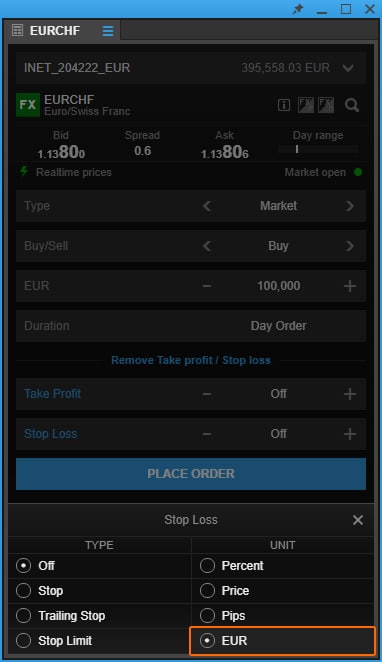

Take profit / stop loss in account currency

Take Profit / Stop Loss in the Account currency in addition to a price, distance in % or distance in Ticks / PIPs.

Keyboard support

GTS Pro now offers basic keyboard support in the trade ticket to improve the efficiency and speed of entering trades and orders.

Keyboard support now includes:

- TAB to move to the next input fields

- SHFT + TAB will go to back a field

- UP/DOWN to increase/decrease the values of a field, e.g. a price or amount

- ENTER to complete current field

- ENTER (or SPACE) to activate a selected link

- CTRL + ENTER takes you to the Place Order button for quick execution

Other features recently added to the new trade ticket

Second currency FX spot trading

Trading using the second currency is now available in GTS and GTS Mobile allowing you to trade in amounts in the second currency.

Persistence of input fields

GTS Pro now saves input values for each instrument when a trade or order has been placed, persisting them the next time the instrument is selected. This includes all order fields including stop loss and take profit order settings (not the order price field).

Market depth in trade ticket

For clients subscribing to level 2 data for an exchange, the market depth is now also shown in the trade ticket for reference.

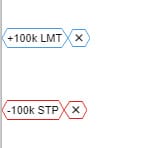

New position and order indicators in charts

We have recently released a number of improvements to the position and order indicators in the charts.

Positions, orders and order/position price lines can be shown or hidden in the chart settings

Position indicators

Open positions are shown as:

- A triangle on the chart at the price and time the position was opened

- An indicator on the left side of the chart showing the size of position

These are coloured blue for long position red for short positions.

Hovering over the indicator on the left:

- The triangle is highlighted

- A horizontal line appears to better show the price at which the position was opened

- A tool tip with detailed info about the position is shown

You can close the position by clicking on the X. That opens a prepopulated trade ticket.

- The order indicators are outlines and are coloured blue for buy orders and red for short orders

- Hovering over the indicator shows a tool tip with the order details and a horizontal line showing the price

- The indicator also shows the order type LMT(Limit) or STP (Stop)

To edit an order

Click on the amount.

To cancel the order

Click on the X.

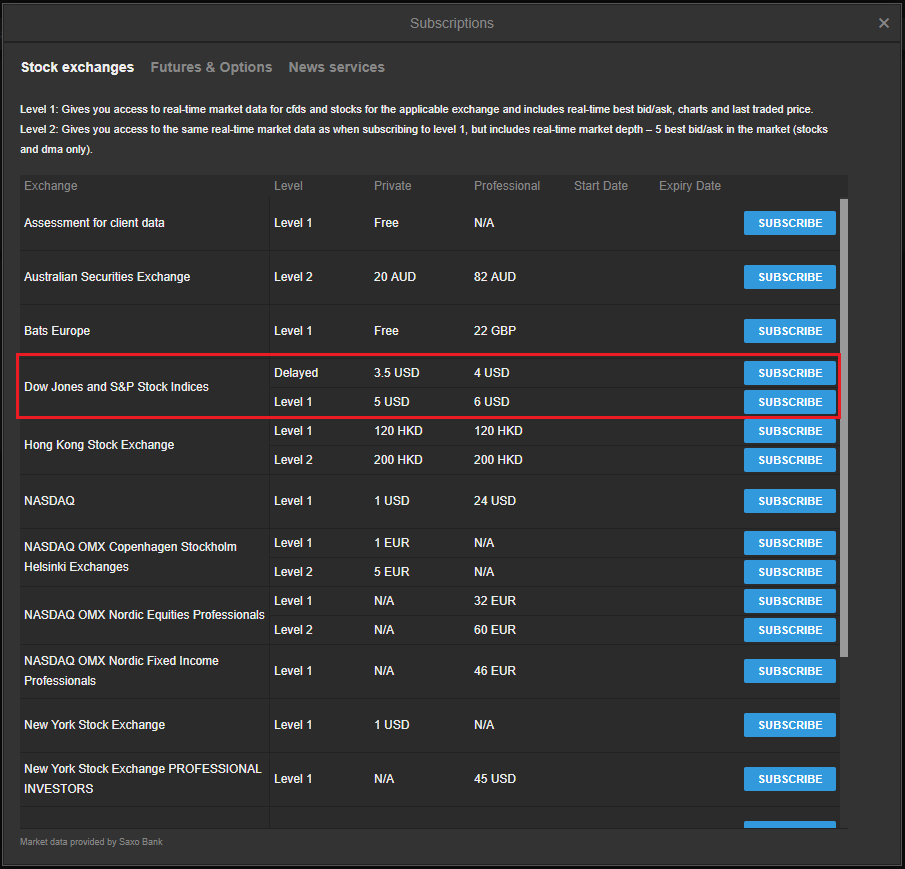

Removal of Dow Jones and S&P stock indices subscription after June 30th 2018

EFFECTIVE: Jul 01st 2018

Please be advised that we are no longer going to be supporting Dow Jones and S&P stock indices subscription due to substantial increases in pricing associated with offering this subscription.

IMPORTANT: These are just the non-tradable stock indices, not exchanges. All US equities and derivatives and the DJIA and S&P Index derivatives, such as options on these indices currently offered in the platform will still be tradable.

Subscription to be removed

Current view of the instruments

Please contact trading support ([email protected]) if you have any further questions about these changes.

|

|