Operational and margin changes

Product Updates

Greeks and implied volatility on US stock options now available

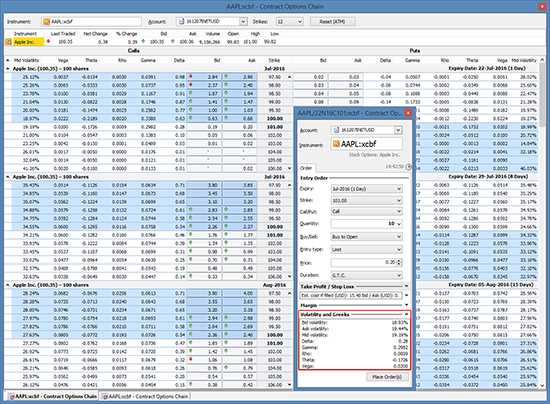

Greeks and Implied Volatility are now available on US stock options in the GTS Pro platform in the Option Chain and Trade Tickets.

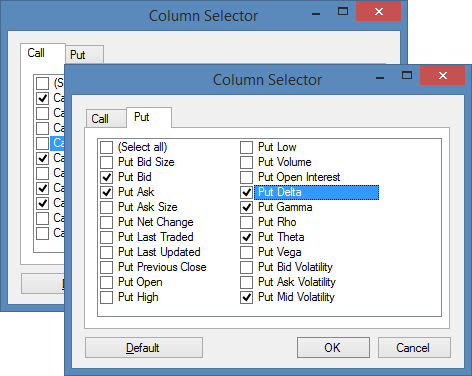

To add Greeks and Implied Volatility to the Option Chain:

Right click on the table header, select Column Selector, then add the Greeks/Volatility columns in the Call and Put tabs.

Operational and margin changes

New equity rating model

In a string of improvements within the area of Market Risk Management, Global Trading will now introduce a new model for equity rating.

The model

The new equity rating model provides continuous daily assessment (and potential re-ratings) for up to 11,000 unique shares. The model is relatively simple and straightforward, building on the following factors:

- Market Capitalisation (Large, Mid or Small)

- Volatility (Low, Moderate, High or Extreme)

- Credit Rating (Excellent, Good, Regular or Poor)

- Gap tendency (Negligible, Marginal, Critical or Catastrophic)

- Liquidity (High, Medium or Low)

In order to transition to this new model, Global Trading will make two overall changes:

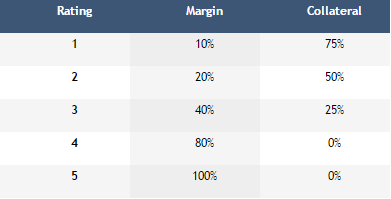

1) Limit the number of “risk buckets” to five

2) Re-rate all instruments to suit the new limited number of risk buckets

Global Trading’s new standard will be as follows:

Next steps:

Please observe the below deadlines and roll-out dates:

- The re-rating will be taking effect as of 12 September, 2016.