Product Updates

Quick trade

Quick trading from the chart

Two new buttons have been added to the chart toolbar giving access to:

-

Instruments where quick trading is available, quick trading as either a market or limit order with price tolerance

- Placing orders on the chart

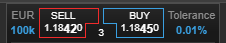

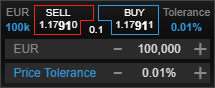

The ![]() button gives access to quick trade the instrument as a market order or limit order with price tolerance.

button gives access to quick trade the instrument as a market order or limit order with price tolerance.

Click the amount to the left of the buy/sell quick trade buttons to select the trade amount. Click the Tolerance to the right of the buy/sell buttons to edit price maximum tolerance you are willing to accept.

To close the edit amount and tolerance clicking the fields again

Placing orders

Placing orders in the chart is now available using the order button ![]()

Position summary

A position summary is now also available in the chart that shows your current net position on an account, the current P/L on the account and the number of open orders.

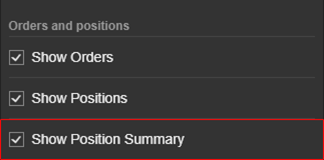

To enable/disable position summary

The position summary can be enabled/disabled using the Show Position Summary checkbox in the chart settings.

New Chart Types

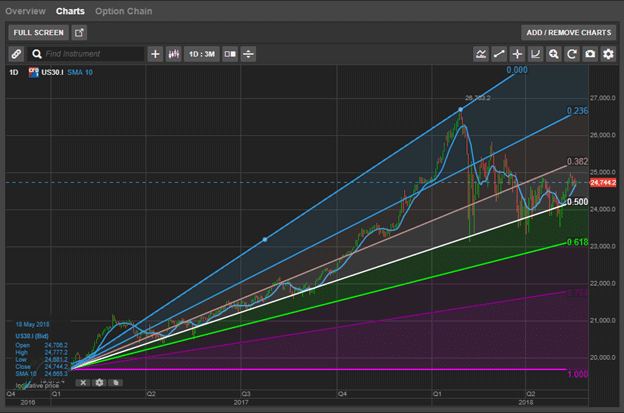

Fibonacci fan

A new indicator, Fibonacci fan, is now available from the Annotations menu.

Fibonacci fans can be both rising or falling trend lines based on Fibonacci retracement levels. Fibonacci fan lines and can be used to estimate support and/or resistance levels in the financial markets.

The default Fibonacci ratios are the same as used in the other Fibonacci annotations available in the charts.

Weighted Close (WTC) indicator

Two new Indicators are now available from the Indicator menu. Weighted Close (WTC) and Kaufman’s Adaptive Moving Average (KAMA).

The Weighted Close indicator is now available from the indicators menu and is another way of looking at the price data of exchange-traded instruments. The weighted close price is an average of the price for the chart period, placing a greater emphasis on the closing price rather than the high and low. The Weighted Close indicator is calculated by multiplying the close by two, adding the high and the low to this product, and the result dividing by four. As there is only one price for Weighted Close it is shown as a line.

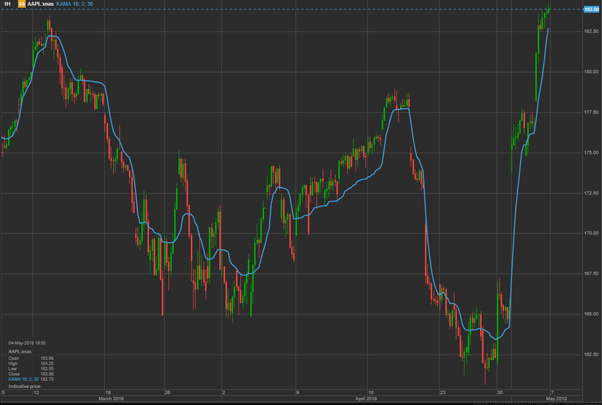

As you can see from the Apple chart below, the ‘normal’ close and the weighted close differ most of the time.

Kaufman’s Adaptive Moving Average (KAMA)

Kaufman’s Adaptive Moving Average (KAMA) was developed by Perry Kaufman and is a moving average, trend-following indicator that can be used to identify price turning points. It is designed to take market noise and volatility into account so that if volatility is high, the KAMA will be farther away from the current price confirming the trend and when a trend may be coming an end, the KAMA value will be closer to the market price.

The KAMA indicator differs from other moving averages such as Exponential Moving Averages which uses a weight variable, by using a constant called the ‘efficiency ratio’ to measure the strength of a trend.

Product Enhancements

Improved auto-logout time for mobile GTS-web

By popular request, the automatic logout time for mobile GTS-Web has been extended from 10 to 30 minutes.

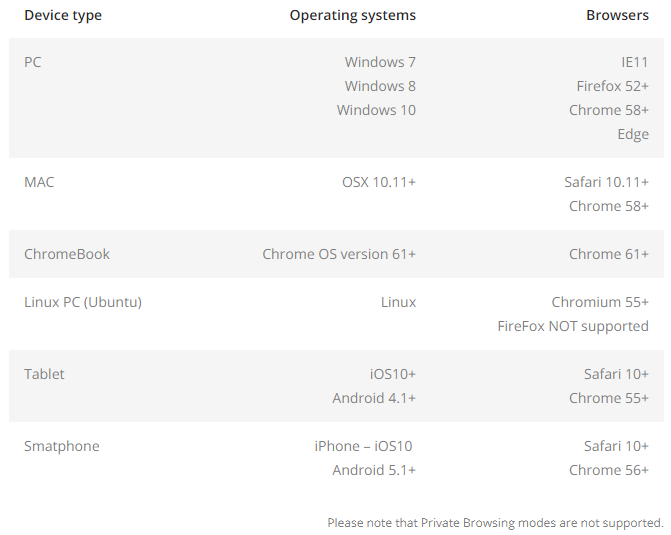

Minimum browser requirements for GTS-Web

Operational Changes

Subscription Changes

Hang Seng Indices subscription fee change

From 1 July 2018, Hang Seng Indices Level 1 subscriptions will be raised from HKD 45 to 54 for both private and professional clients.