EFFECTIVE: Nov 24 2016 – GTS Pro, at 8:00 CET, GTS (web) at 13:00 CET

In our dedicated effort to provide the best available solutions for online trading, we are implementing an Order Driven Model in GTS. This will allow greater control over trade execution through user defined “Price Tolerance.”

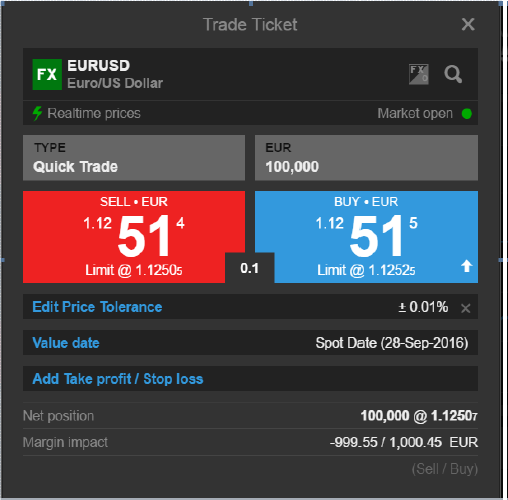

Sell/Buy Prices

Click Buy or Sell to place a Limit Order with a pre-defined Price Tolerance.

Adding Price Tolerance ensures that your order is only executed within a range that you are comfortable accepting (see Edit Price Tolerance).

The minimum price (when selling) and maximum price (when buying) are displayed on the Trade Ticket below the Spot Price i.e. ‘Limit @ x.xxxx’

Type

Select the order type that you wish to use to enter a position:

- Quick Trade orders for immediate execution, with or without a pre-defined Price Tolerance.

- Resting Limit, Market and Stop orders for longer durations i.e Day Order, Good Til. Cancelled etc)

Edit Price Tolerance

Edit Price Tolerance (cross (x)-icon). Allows you to remove the option of adding Price Tolerance. This changes the Quick Trade order from a Limit Order to a Market Order.

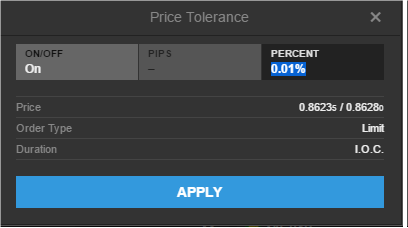

Price tolerance enables you to define the minimum price (when selling) or maximum price (when buying) that you are comfortable accepting (i.e. a Limit Order) when entering a position.

Price tolerance can be specified in pip (i.e. 0.1 pips) or percentage terms (i.e. 0.01%).

The default is set to 0.01% of the Spot Price for all currency pairs, but is configurable on an individual currency pair level.

- Pips: Set your tolerance in pip terms, in increments of 0.1 pip (1/10th of a pip)

- Percent: Set your tolerance in percentage terms, in increments of 0.01 percent (1/100th of 1 percent or 1 basis point)