If you have long and short positions they will net out at the end of the trading day – but only if the long and short positions are on the same account and none of them have any related orders as related orders prevent the netting of positions.

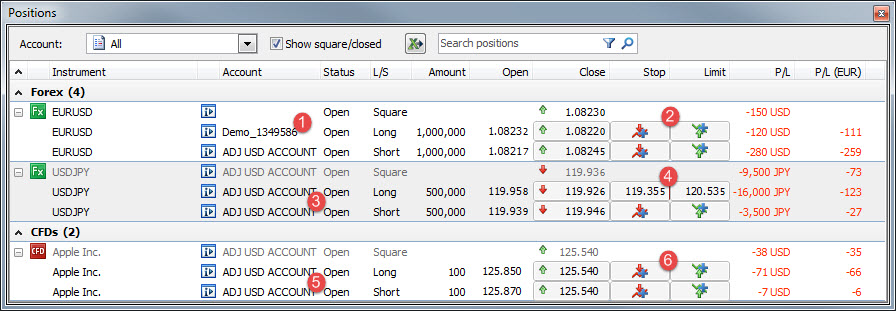

In this example, notice that the client is viewing “All”-accounts (see “1” in the image), and is “Square” on EURUSD, USDJPY and Apple (See “2”, “3” and “4” in the image).

Looking at the 3 positions in more detail in the below image, you will notice:

- The 2 EURUSD positions (long and short 1,000,000) are placed on 2 different accounts – so even though the client is square, the 2 positions will not net out (See “1” and “2” in the below image)

- The 2 USDJPY positions (long and short 500,000) are placed on the same account – but the long position has related orders. This means that the positions will not net out at the end of the day. (See “3” and “4” in the below image)

- The 2 Apple positions (long and short 100 Apple shares) are on the same account, and none of the positions have any related orders – so they will net out at the end of the day. (See “5” and “6” in the below image)

In the 3 examples above the long and short positions are for the same amount. It should be noted that the netting also applies if the long and short positions are for different amounts – if you have a long EURUSD position for 1.000.000 and a short for 750.000 on the same account with no related orders, they will net to a single long position of 250.000 at the end of the trading day.

First-In-First-Out (FIFO)

When netting the open positions, we use FIFO rules, which means the first position you open is the first position to be closed. Example: You are trading EURUSD opening the following positions:

- Buy 1M EURUSD

- Buy 1M EURUSD

- Sell 1M EURUSD

- Sell 2M EURUSD

Total = Sell 1M EURUSD

The first long position (1.) will net out with the first short position (3.), the second long position (2.) will net out with half of the second short position (4.), leaving only one short position of 1M EURUSD at the end of the day.