Product Updates & Enhancements

GTS Mobile improvements

New navigation

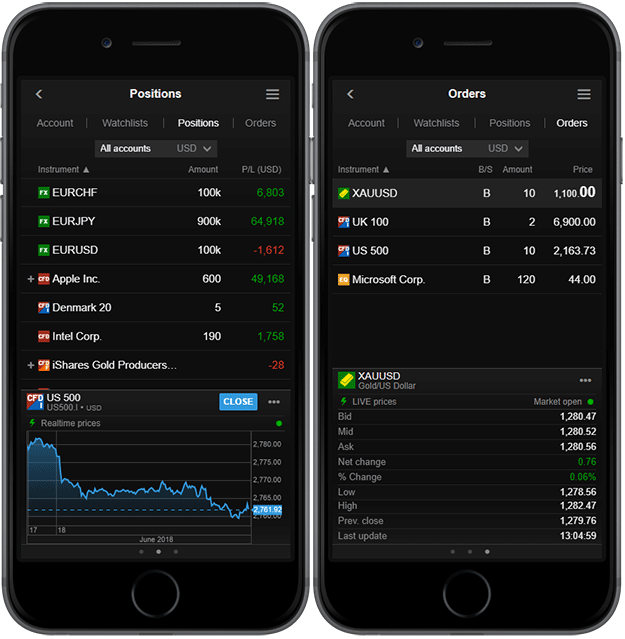

The new navigation makes it fast and easy to access the main components: Account Summary Watchlists, Positions and Orders in a single tap.

Other functions are accessed through the menu icon.

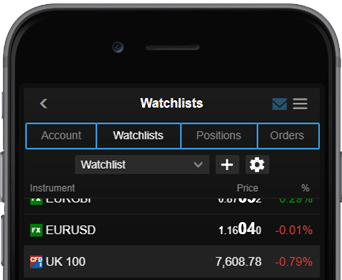

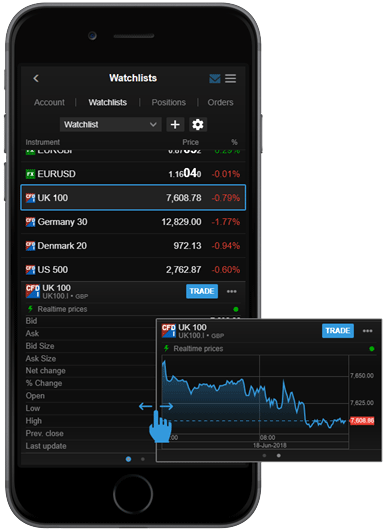

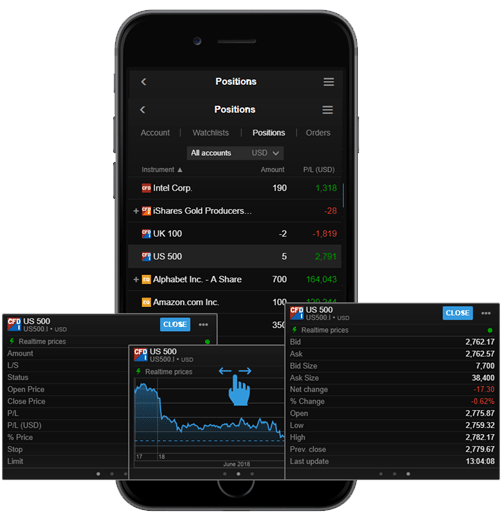

Redesigned Watchlists, Order and Positions

The Watchlist, Positions and Orders sections have been redesigned to offer a simpler layout, with easy access to detailed information through the use of info card which appear when you select an instrument.

The info cards allow you to swipe between key information for the position or order, a chart for the instrument and key market information for the instrument.

Account summary

The Account Summary was also redesigned to give an overview of all accounts and easy access to details on a particular account.

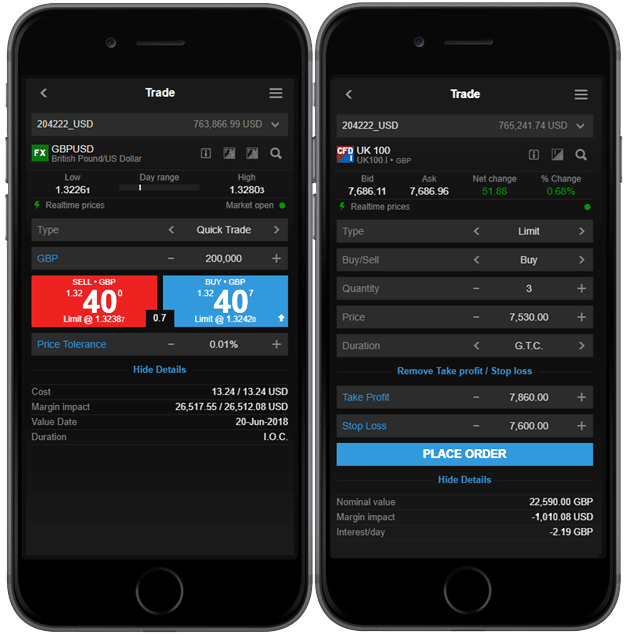

Trade Ticket

The new Trade Ticket has recently been introduced which is optimised for easier navigation and use on mobile devices with more touch-friendly controls.

Many other new features are coming to the GTS Mobile soon.

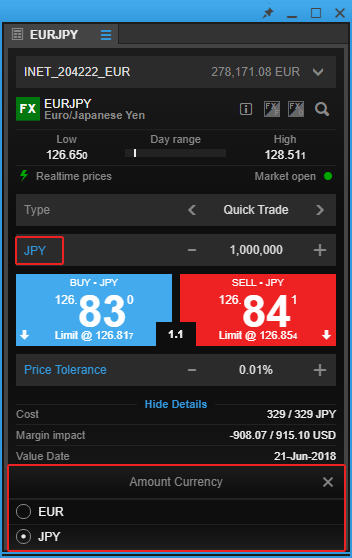

Second currency FX spot trading

Trading in a second currency is now available in the GTS Web.

FX Quick Trades in the GTS Web now have a currency toggle on the amount selector, allowing you to select a second currency and set trade amounts in a second currency (the quote currency).

In this example, the Amount would normally be placed in EUR but you can now select to place the trade in JPY which will be converted to the EUR amount when you place the trade.

Please note that this is for convenience in converting trade amounts from the quote currency. The trade amount will always be placed in the base currency (EUR for EURJPY in this example).

Futures and futures options initial margin

Effective Monday, 9 July 2018 Global Trading LTD will improve the order checking of futures and options orders, so that the initial margin is used for the entire portfolio. The change only relates to pre-check of futures and futures options so clients without positions in these instruments are not affected.

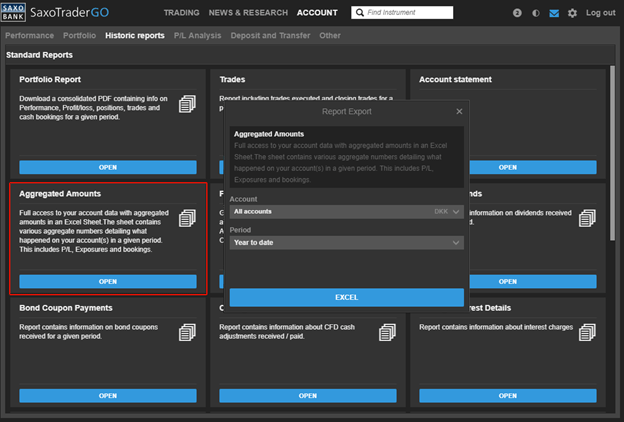

Aggregated amounts tool

A new Aggregated Amounts tool is now available which exports aggregated amounts for your holdings into an Excel sheet. These include daily exposures, position values, P/Ls, costs and bookings and allows you to filter and process these amounts based on your own use cases.

The exported Excel sheet includes sections for:

- Aggregated Amounts – a full list of relevant amounts affecting your accounts in the period

- PL – The total P/L (realised +unrealised) per instrument per day

- Cash movements –amounts that were booked on your account per day

Aggregated amount is available under Account > Historic reports > Aggregated amounts in the platforms.

Please note that this is for convenience in converting trade amounts from the quote currency. The trade amount will always be placed in the base currency (EUR for EURJPY in this example).

Chart improvements

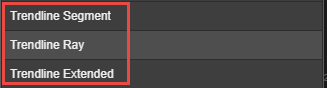

Trendline annotations

Improved trendline annotations are now available in the charts in all platforms.

A number of changes have recently been made to the trendline annotation, available from the Annotations menu in the chart.

Trendline segment (Trendline)

The Trendline annotation has changed name to Trendline Segment which still draws a line between the two points on the chart.

Trendline ray (Infinite trendline)

Infinite trendline has changed name to Trendline Ray and still extends in one direction (forwards).

Trendline extended (new)

A new trend line named Trendline Extended is now available which extends to both the left and right.

Trendlines can be edited in the configuration settings for the trendline configuration settings  where you can edit:

where you can edit:

- Line colour weight and type

- Start and end points

- Line extensions

- Add parallel trend lines

Chart improvements from May 2018

See also: New chart features from June 2018

Trade Ticket margin impact changes

From late July 2018, we will be changing the methodology used to calculate margin impact values shown in Trade Tickets in all platforms:

- Currently, the margin impact of a trade is based on the change in Margin available

- From July 2018, the margin impact of a trade will be based on the change in Reserved for margin positions = Reserved for margin positions after trade – Reserved for margin positions before the trade

This change separates the margin impact from impact of costs and option premiums.

Operational Changes

Subscription Changes

Australian Securities Exchange subscription fee change

From 1 August 2018, Australian Securities Exchange Level 2 subscriptions will be raised from AUD 82 to 88 for professional clients.