brokerage, gts, news

Chart Updates

New Display Options

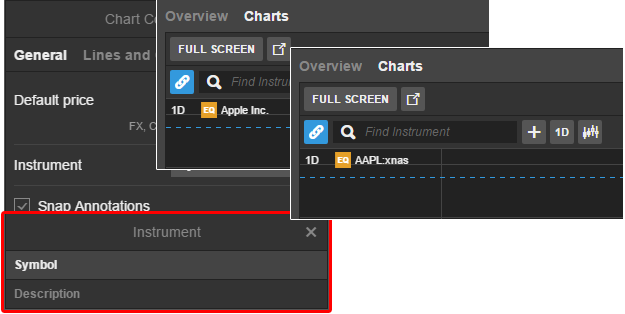

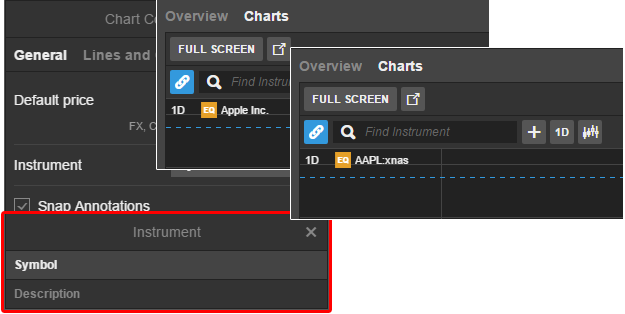

Instrument Symbol/Description

A new option allows you to display instrument names as a symbol (ticker) or description:

Price Label

The last price indicates whether it is an uptick or downtick by red or green background colouring; a blue colouring indicates no price activity for 3 seconds.

The price for FX charts also emphasizes the pips in alignment with the rest of the platform.

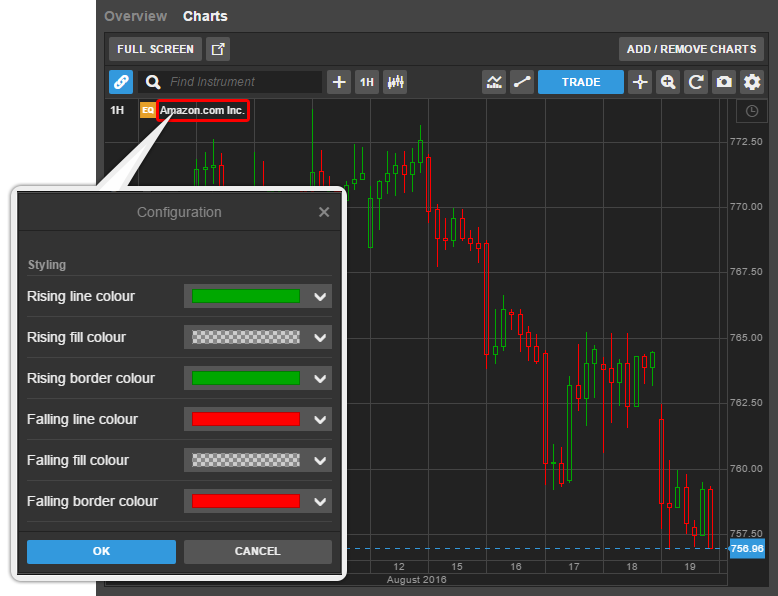

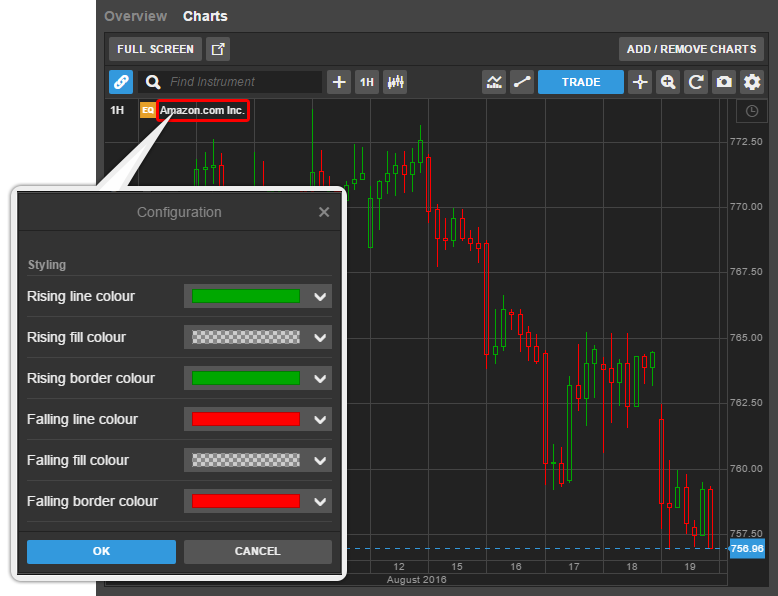

Fill colours for candlesticks and studies

We have added new colour options where you can define the line, border and fill colours for candlestick charts and studies such as Bollinger Banks.

You can also configure hollow candlesticks by selecting no colour.

Similarly, for studies such as Bollinger bands, you will be able to define or remove the fill colour between the bands.

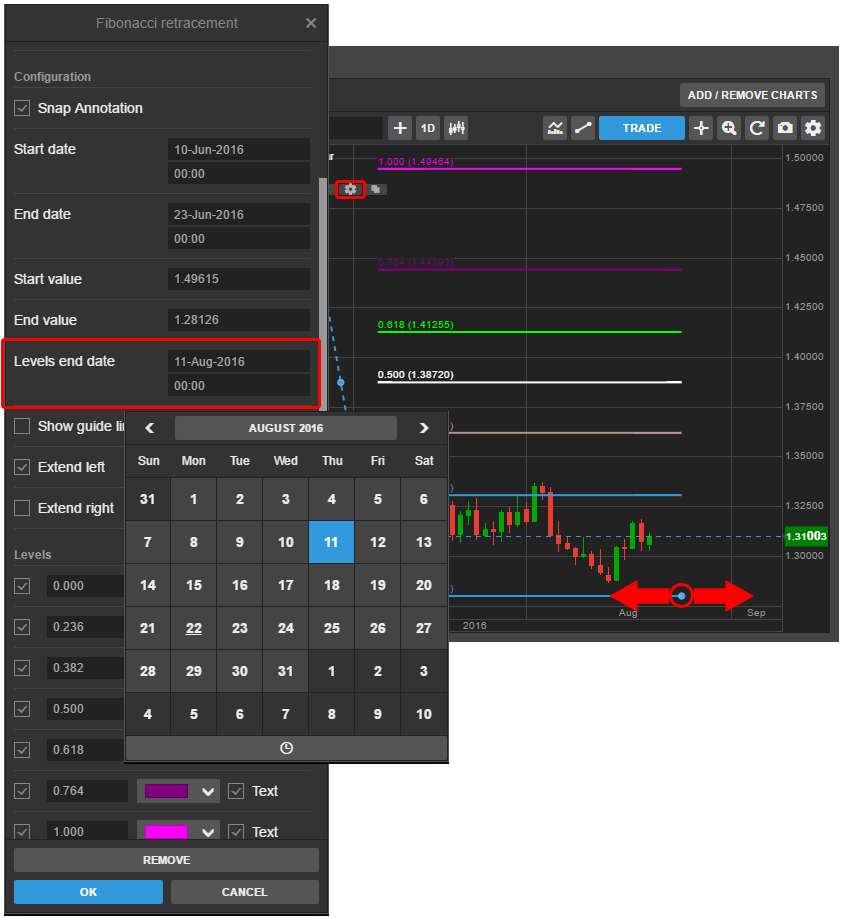

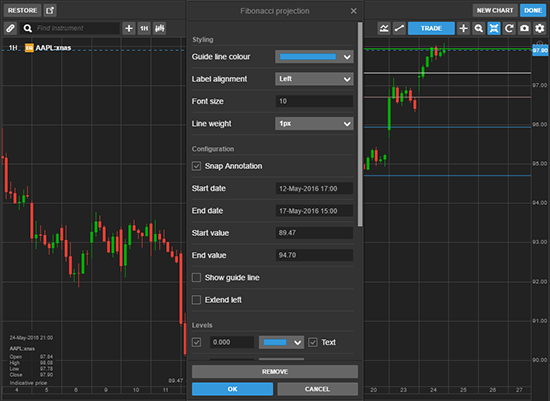

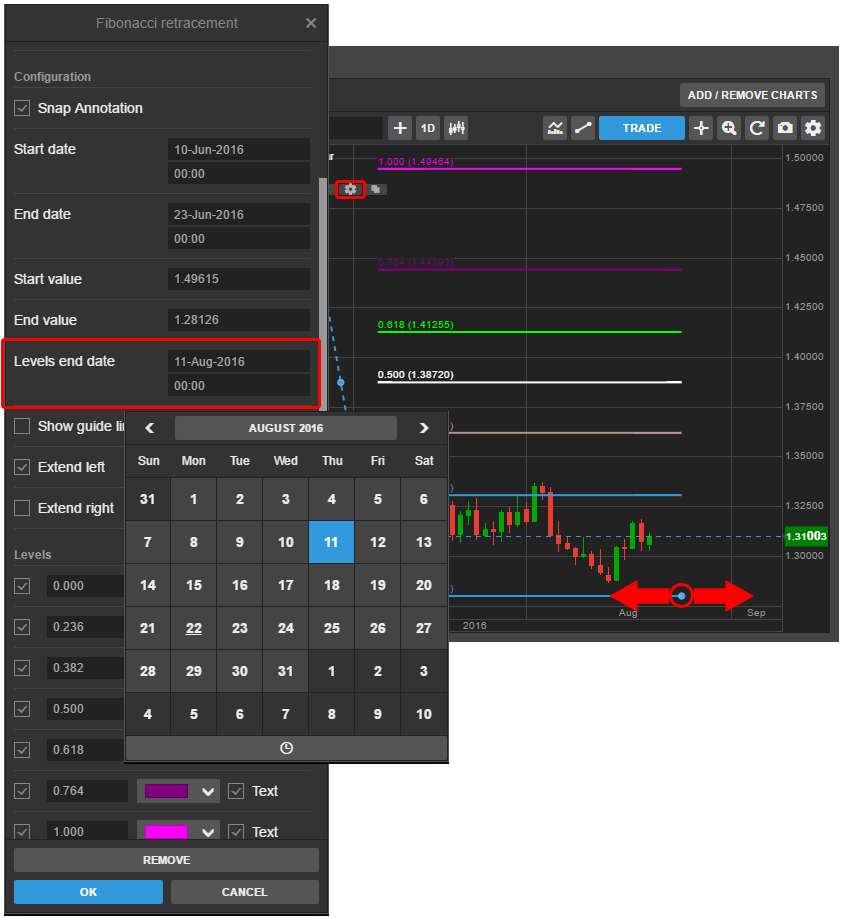

Fibonacci adjustment to the right

The length of the lines on Fibonacci Annotations can now be adjusted left/right. Select the Fibonacci you want to adjust and grab the handle and drag the lines left or right.

In the Settings for the annotation, you can adjust the end time and date or extend them infinitely.

Vertical line extension

It is now possible to extend vertical line annotations through to sub-panels by clicking on the configuration icon and selecting Extend vertical line.

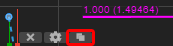

Copy Annotations

You can now copy annotations by clicking the copy icon on the annotation.

Individual snapping

Now you can also select or deselect snapping in each individual annotation in the specific annotation configuration settings.

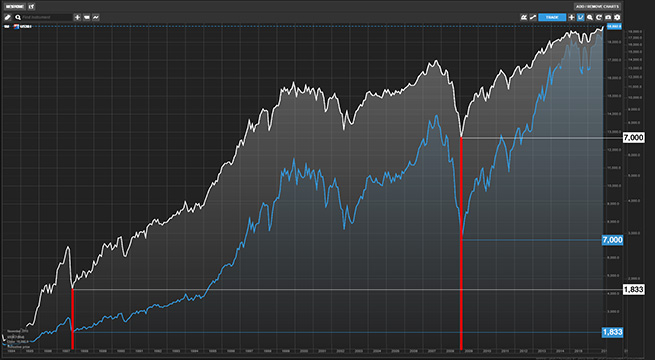

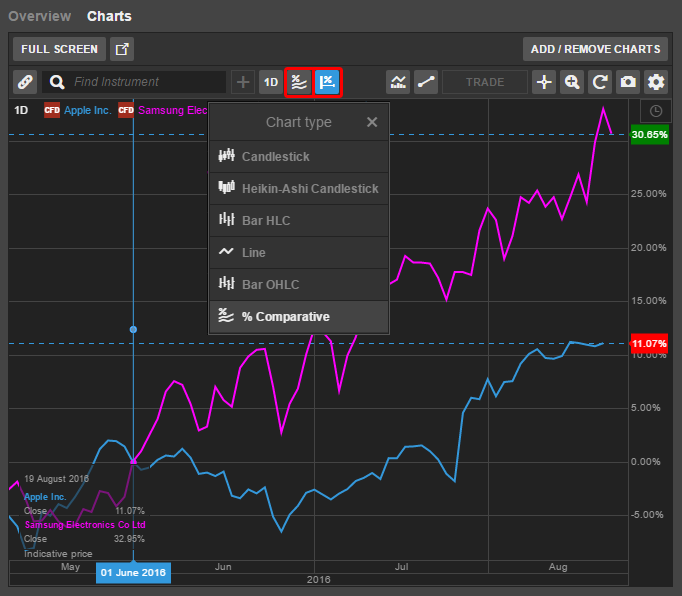

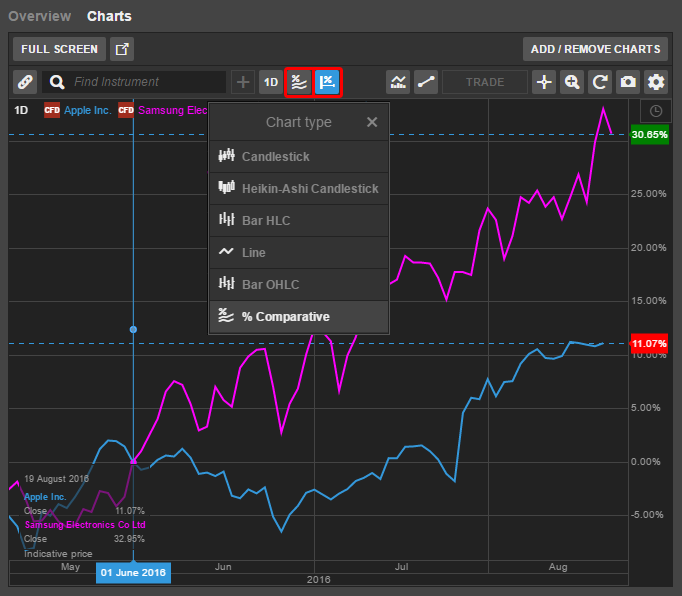

Percentage Comparative Chart

A new % Comparative chart type is now available allowing you to compare the relative performance of two instruments.

To use the Comparative chart, add the second instrument, click the + button next to the instrument finder, then search for the second instrument, then select % Comparative as the Chart type.

The % Comparative chart shows values relative to the reference point bar. You can drag the reference bar to move the reference point on the x-axis. To use the left of the chart as the reference point, deselect the ruler on the toolbar – note that if you zoom, scroll or manipulate the x-axis, the reference point will change to the new left-hand side of the chart.

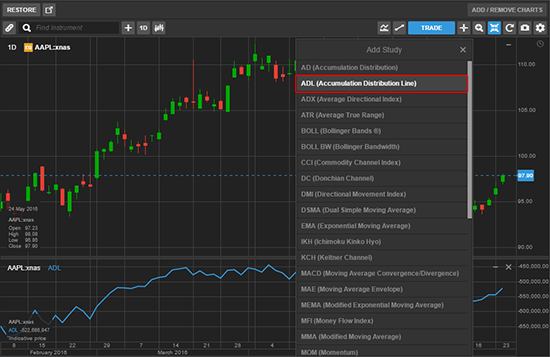

New Studies

(Chaikin) Accumulation Distribution Oscillator

Chaikin Accumulation Distribution Oscillator (ADO) is a momentum indicator which is similar to the previously released Chaikin Accumulation Distribution Line (ADL) but using the exponential moving average formulas used by MACD.

ADO is essentially the difference between 3 and 10 periods Exponential Moving Averages. For example, for a daily chart it would be the difference between the EMAs for 3 days and 10 days.

ADO is used to detect directional changes in ADL by measuring the momentum of the movements – the first signal for a change of a trend. ADO generates a signal when the line crosses below or above the zero line.

ADO can also indicate bearish or bullish divergence:

- If the price is rising and AD is falling (negative divergence) can indicate a bearish market

- If the price is falling and AD is rising (positive divergence) can indicate a bullish market

Williams Alligator Indicator

Developed by Bill Williams, the Alligator Indicator is a trend following and trend change indicator. It uses three different Smoothed Simple Moving Averages (SSMAs) which slow the turn of the indicator and uses 5, 8 and 13 periods as default – you can change the calculation method from SSMA to SMA (Simple Moving Average) or EMA (Exponential Moving Average) in the configuration dialog.

The three Smoothed Moving Averages comprise the Jaw, Teeth and Lips of the Alligator where:

- Jaw (blue line) – starts with the 13-bar/candle SSMA and is smoothed by 8 bars/candles on subsequent values

- Teeth (red line) – starts with the 8-bar/candle SSMA and is smoothed by 5 bars/candles on subsequent values

- Lips (green line) – starts with the 5-bar/candle SSMA and smoothed by three bars/candles on subsequent values

The Alligator Indicator helps you to determine trends and trend changes and direction of the trend where:

- Uptrend: Jaw at bottom, Teeth in the middle, Lips at the top

- Downtrend: Jaw at top, Teeth in the middle, Lips at the bottom

When the above rules are not in place – when the lines are not in any of the above orders and intertwined – the Alligator “sleeps” with its mouth closed. When it wakes up and is hungry, it opens its mouth in the correct order above, and that is when a trend starts. When the Alligator is no longer hungry and the three lines intertwine again, that signals the end of a trend.

Using the Alligator Indicator, you should not take a position when the Alligator is sleeping as the market is indecisive without a clear trend.

Awesome Oscillator

Awesome Oscillator (AO) was developed by Avrum Suodack and Gene Quong. It uses both volume and price to measure buying and selling pressure in an instrument. The output values ranges from 0 to 100 and works like an RSI – the Awesome Oscillator is also known as volume-weighted RSI.

Investors use the Awesome Oscillator to look for divergence when the MFI moves in the opposite direction of the price.

Correlation

Now you can analyze the correlation between two instruments using the Correlation study in the Indicator selector and add it when you have two instruments.

Spread

The Spread study is used with comparable instruments that are trading with a spread between them such as:

- A and B share for the same company

- 2 equities in the same industry sector

- 2 commodities futures

The spread can widen and narrow and can be used for Spread Trading where the trader sells one instrument and buys the other when the spread is wider than historical norms for example.

Ratio

The Ratio (RTO) Indicator shows the current and the historic price ratio between two instruments. Ratio is similar to the spread but shows the price difference as a ratio between the two instruments – the first divided by the second.

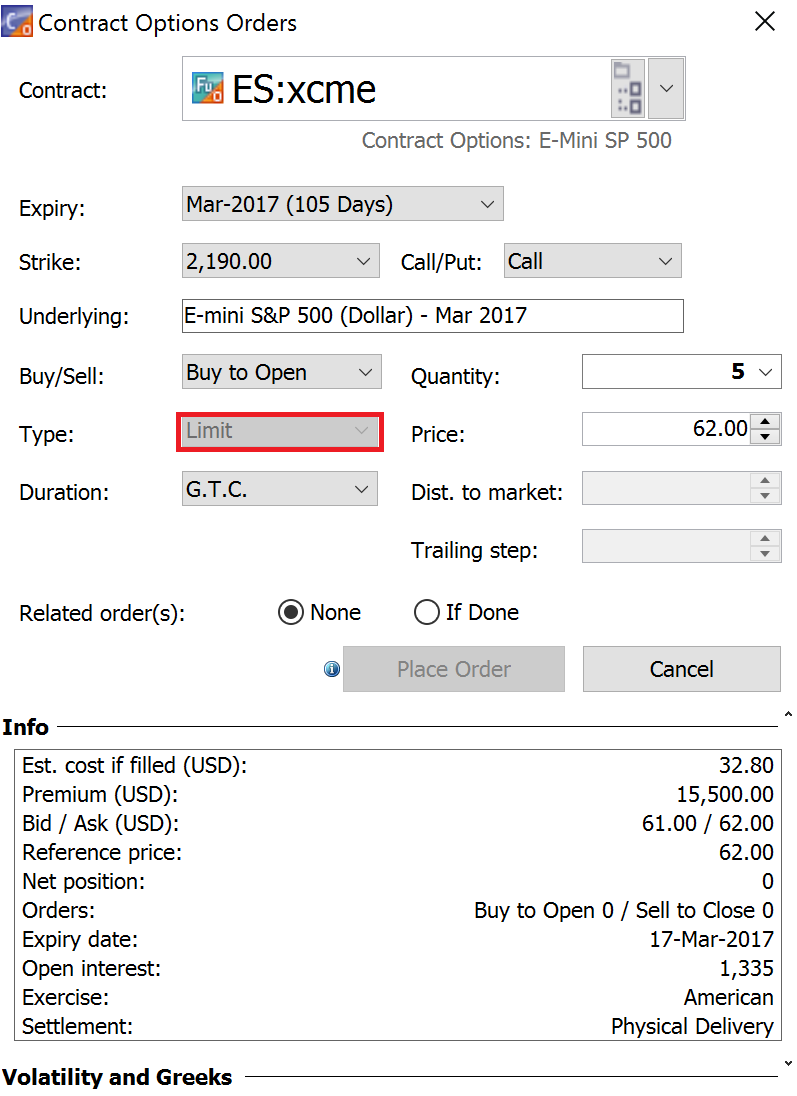

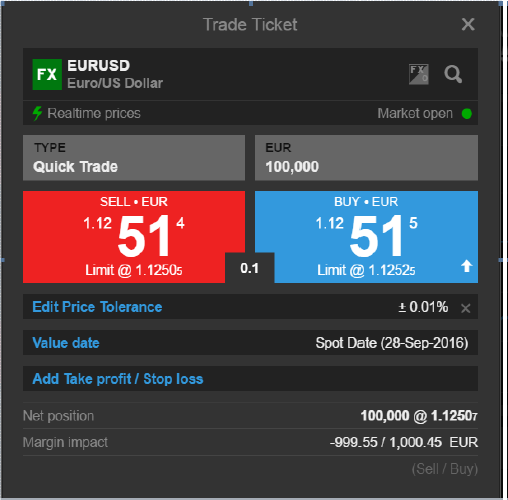

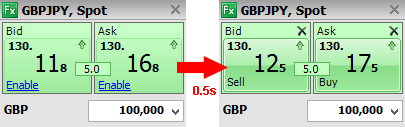

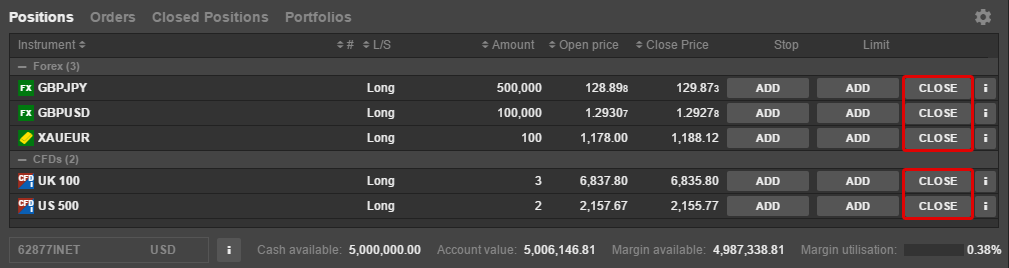

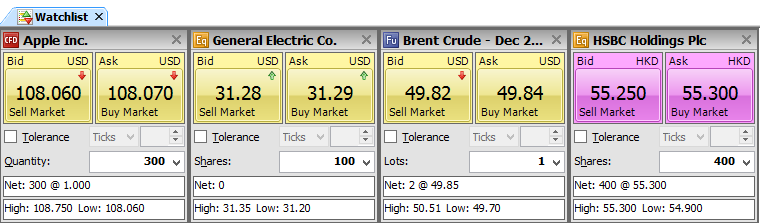

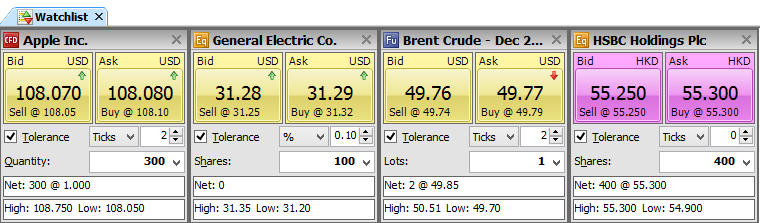

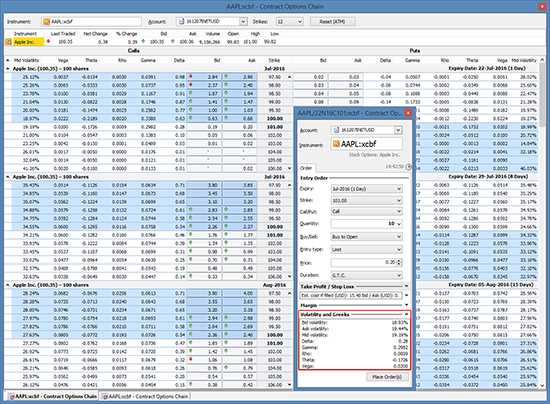

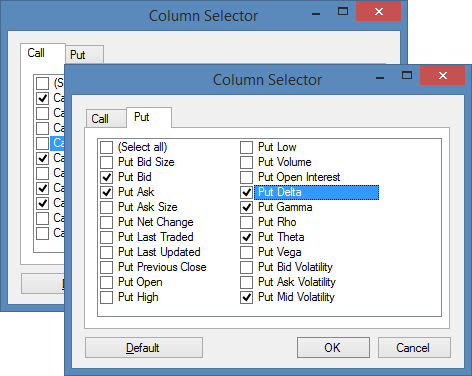

Trade all Instruments from Trade Board

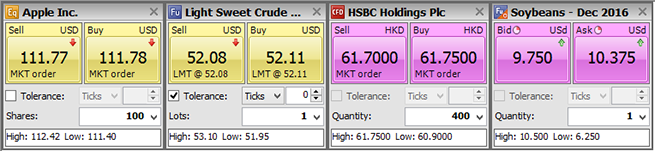

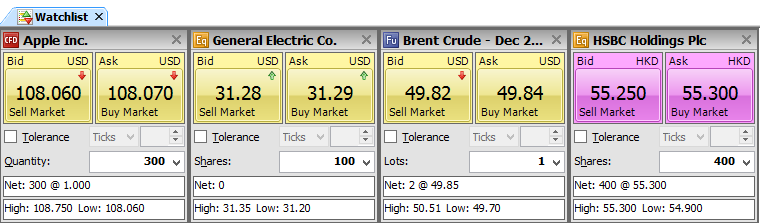

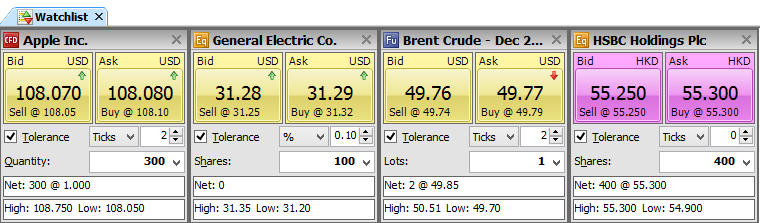

Stocks, CFDs and Futures through the Trade Board

SaxoTrader now allows you to trade exchange-traded instruments through the Trade Board, including Stocks, CFDs (all CFDs), Futures and ETOs. Previously, only instruments FX and CFD indices (on green prices) were tradable through the Trade Board.

To trade an instrument from the Trade Board, you must be subscribed to live prices for the instrument from the exchange – instruments on delayed prices cannot be traded through the Trade Board and the trade buttons will launch a Trade Ticket instead.

Trading as Market Orders

If you do not specify a tolerance for the instrument, the trade buttons will place a Market order for the instrument, to be filled at the price available on the Market.

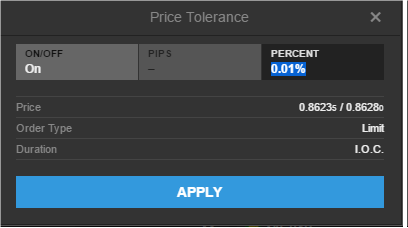

Trading as Limit Orders

If you specify a price tolerance, the trade buttons will place a limit order instead, ensuring you are not filled at more than your price tolerance from the market price.

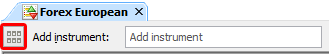

Access to the Trade Board

The Trade Board is part of the Watchlist and is accessed by clicking the Trade Board icon in the Watchlist.

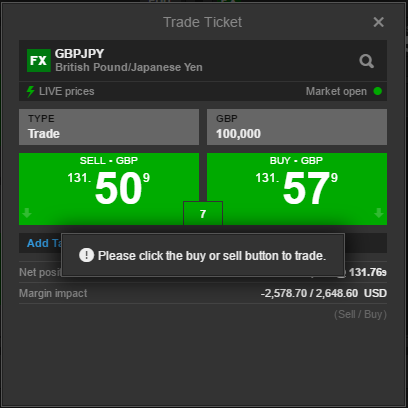

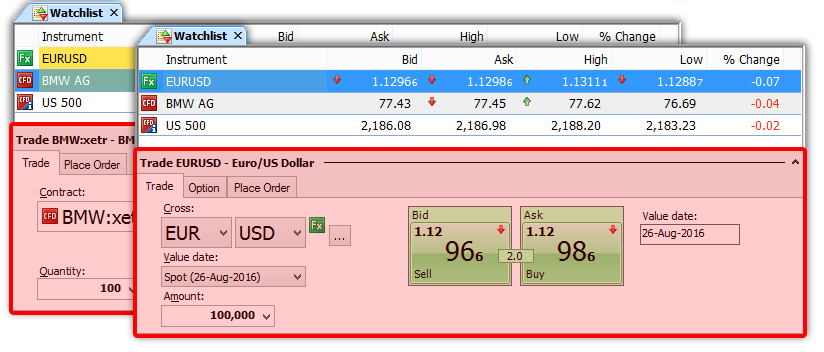

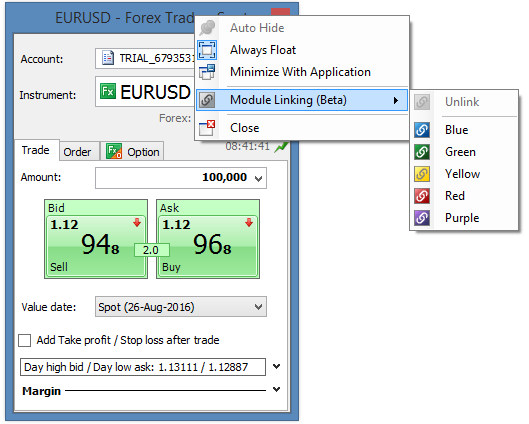

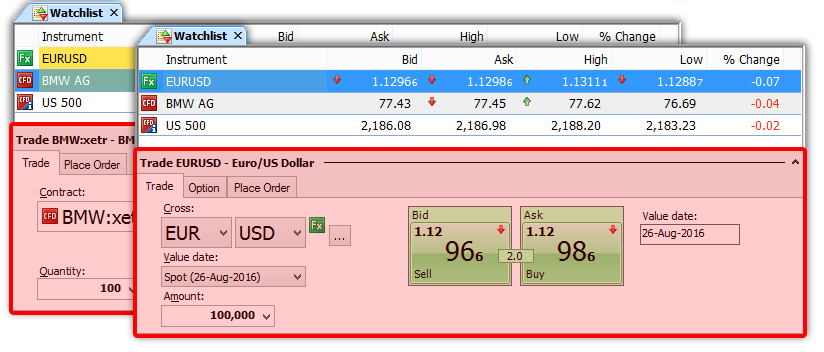

Trade Panel Removed

As part of a usability clean-up, the Trade Panel at the bottom of the Watchlist has been retired due to low usage.

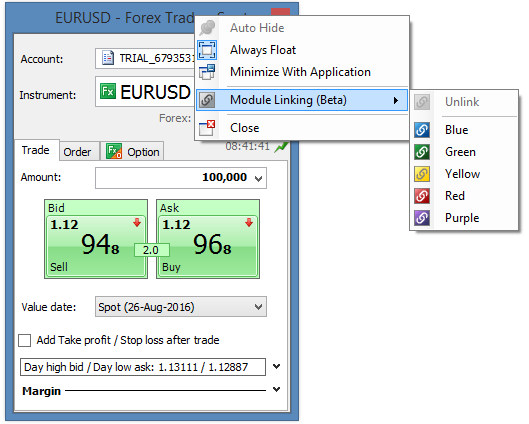

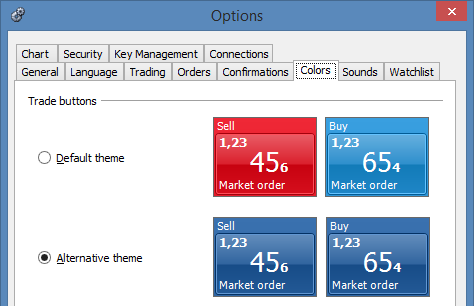

If you miss this functionality, we recommend that you open a Trade Ticket in you view and link it to your Watchlist – the instrument in the Trade Ticket will update with selected instruments in the Watchlist in the same way as the Trade Panel.